Here’s why Tron [TRX] rallied before encountering resistance in its triangle pattern

Tron’s native cryptocurrency TRX is off to a strong bullish start this month having already delivered an impressive 45% rally in the first five days. It is currently one of the best performers in the list of top cryptocurrencies by market cap.

A close look at TRX’s historic performance reveals that it is still trading within its triangle pattern. The price remains constrained within the ascending support and descending resistance lines.

In fact, TRX’s price has been hovering near its support line since mid-April but it shot up sharply after concluding the month. It traded as low as $0.061 on 1 May and peaked at $0.075 earlier on 5 May after rallying close to its descending resistance line.

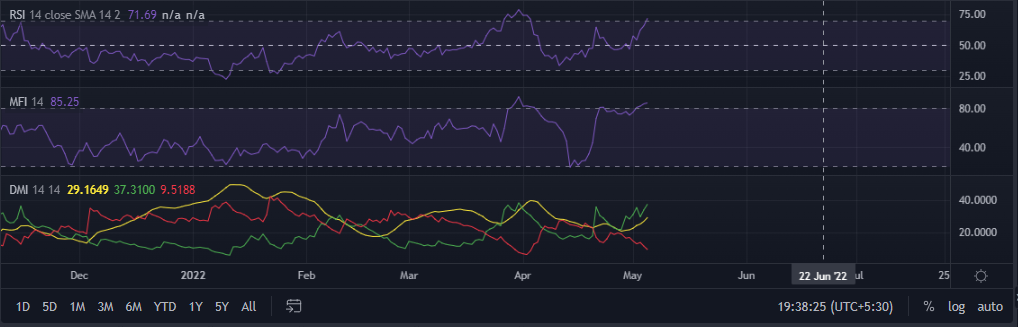

TRX traded at $0.083 after a significant pullback from its 24-hour high. It pulled back after almost coming into contact with its resistance line, likely due to profit-taking. This is further supported by the fact that the rally pushed TRX into overbought conditions according to the RSI.

TRX’s Money Flow Indicator registered heavy inflows in the last five days. It is now above 80, which is the zone where heavy selling or distribution starts to take place, paving the way for a cool down during a bull run. TRX is still heavily bullish according to the Directional Movement Indicator.

Metrics align with the catalyst?

Tron Dao announced towards the end of April that there were plans to roll out a new stablecoin called USDD. The algorithmic stablecoin would be based on the Tron network, which means that its supply mechanism would be tied to TRX. As a consequence, the demand for TRX would increase due to the utility tied to the USDD stablecoin.

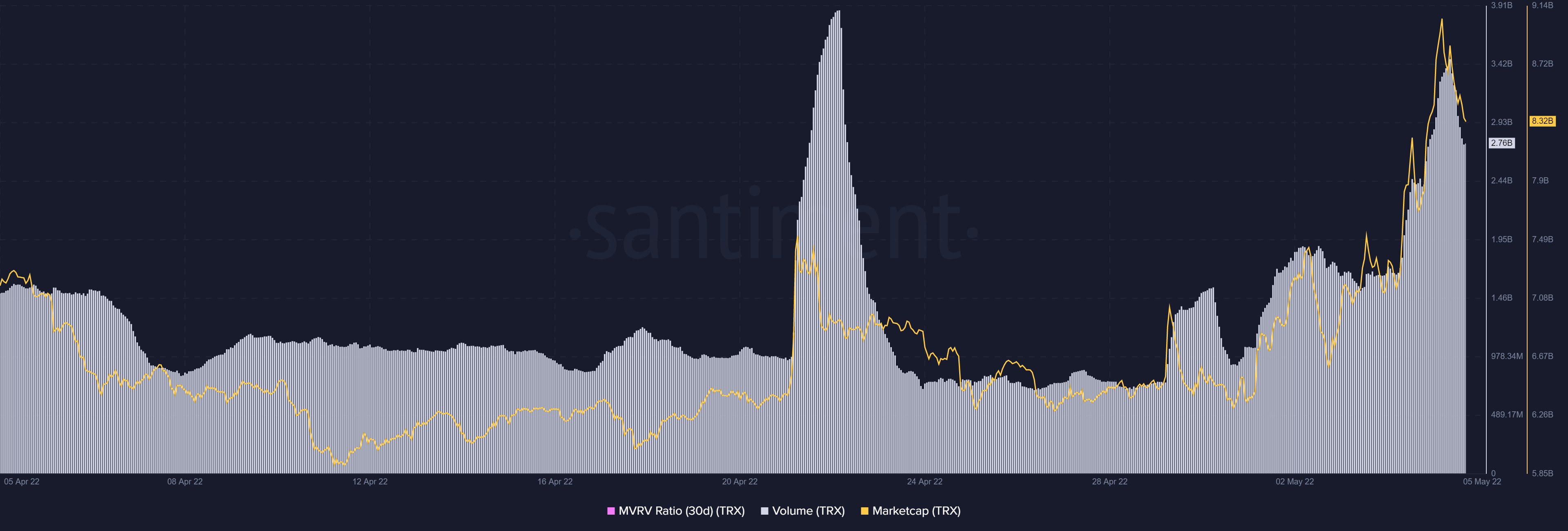

The anticipated demand for TRX triggered the wave of heavy volumes in the last few days ahead of the stablecoin launch on 5 May. TRX’s market cap metric registered a solid uptick in the last five days, reflecting the heavy inflows registered by the MFI. Also, its volume metric registered a strong volume uptick during the same period.

The rally appears to be a case of ‘buy the rumor, sell the news’ given that it rallied days ahead of the USDD stablecoin’s launch.

![dogwifhat's [WIF] 3-day rally has eyes glued, yet a hidden risk lurks](https://ambcrypto.com/wp-content/uploads/2025/04/Gladys-8-400x240.jpg)