Assessing if Avalanche [AVAX] could soon reverse its downtrend

The day brought an avalanche of bad news for bulls as Ether fell below the psychological price of $2,000 and was trading at $1,734.01 at press time, after losing around 9.94% of its value in the past day. By press time, Avalanche [AVAX] had fallen to become the #15 biggest crypto by market cap and was trading at $22.45 after losing 16.20% of its value in a day and sliding down by 24.92% in the past week.

Investors snowed in

AVAX’s fall certainly did not go unnoticed, as volumes surged slightly. Presumably, investors were using the opportunity to buy the dip and score some AVAX at discount prices.

Source: Santiment

Moving on to development activity – one of Avalanche’s top-selling points – we can see this metric has been steadily increasing since 2021. From 20 May, however, there was an almost 2x spike in development activity.

However, this was pointed slightly downwards at press time. Even so, the rising metric is a reliable sign of developers’ faith in the project in spite of price falls.

Source: Santiment

All “hail” the market!

The recent changes in the market have been tough on blockchain’s total-value-locked [TVL]. But while some were able to minimize losses, Avalanche lost around 58.62% of its TVL in the past month alone. At press time, the blockchain’s TVL was around $4.09 billion and its ranking was four.

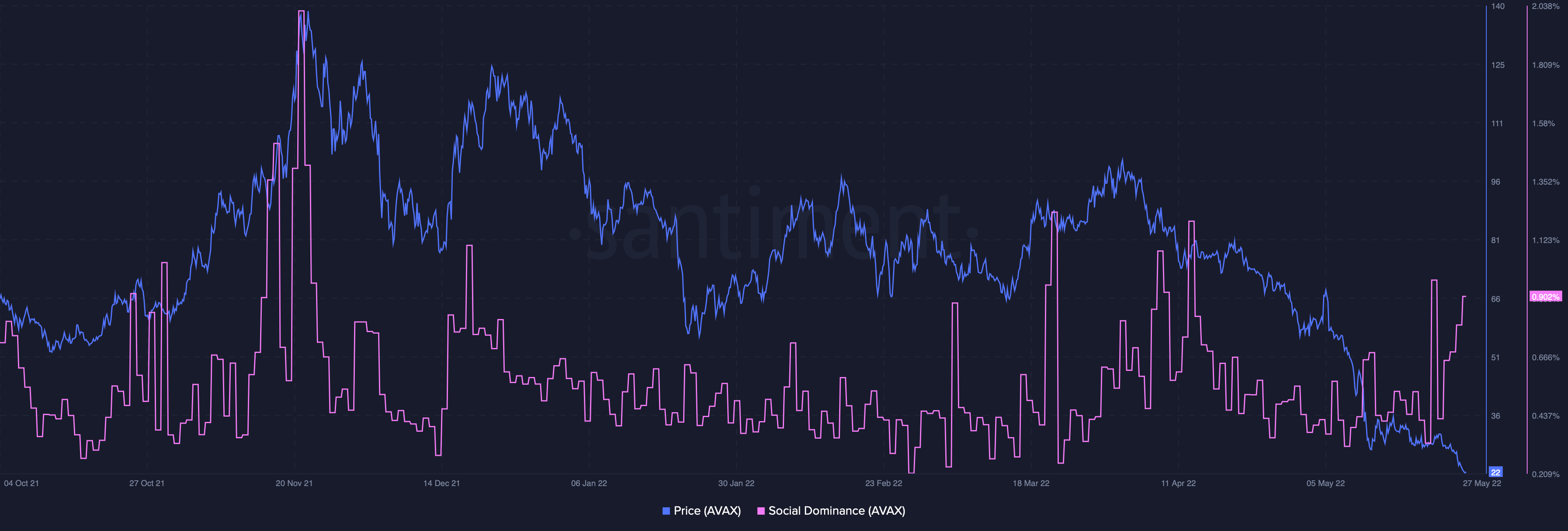

That being said, Avalanche was seeing a dramatic increase in social dominance, suggesting that there is an interested and engaged community paying attention to the project. This is a good sign for future growth. However, press time levels were still below those recorded in April and March 2022.

Source: Santiment

Finally, the Bollinger Bands for AVAX showed that the two bands were narrowing, suggesting that volatility might be less in the future. Adding to that, the red candle was growing closer to the lower band, indicating AVAX could soon be seen as an oversold asset.