Uniswap: What UNI’s latest metrics suggest for its near future

As the month of May came to an end yesterday, it bought relief to a lot of investors who had been suffering under the weight of the bears for months now.

Among the ones that found relief was Uniswap holders, as well as Uniswap itself, whose peak in the DeFi market might open doors towards a new direction.

Uniswap in the DEX market

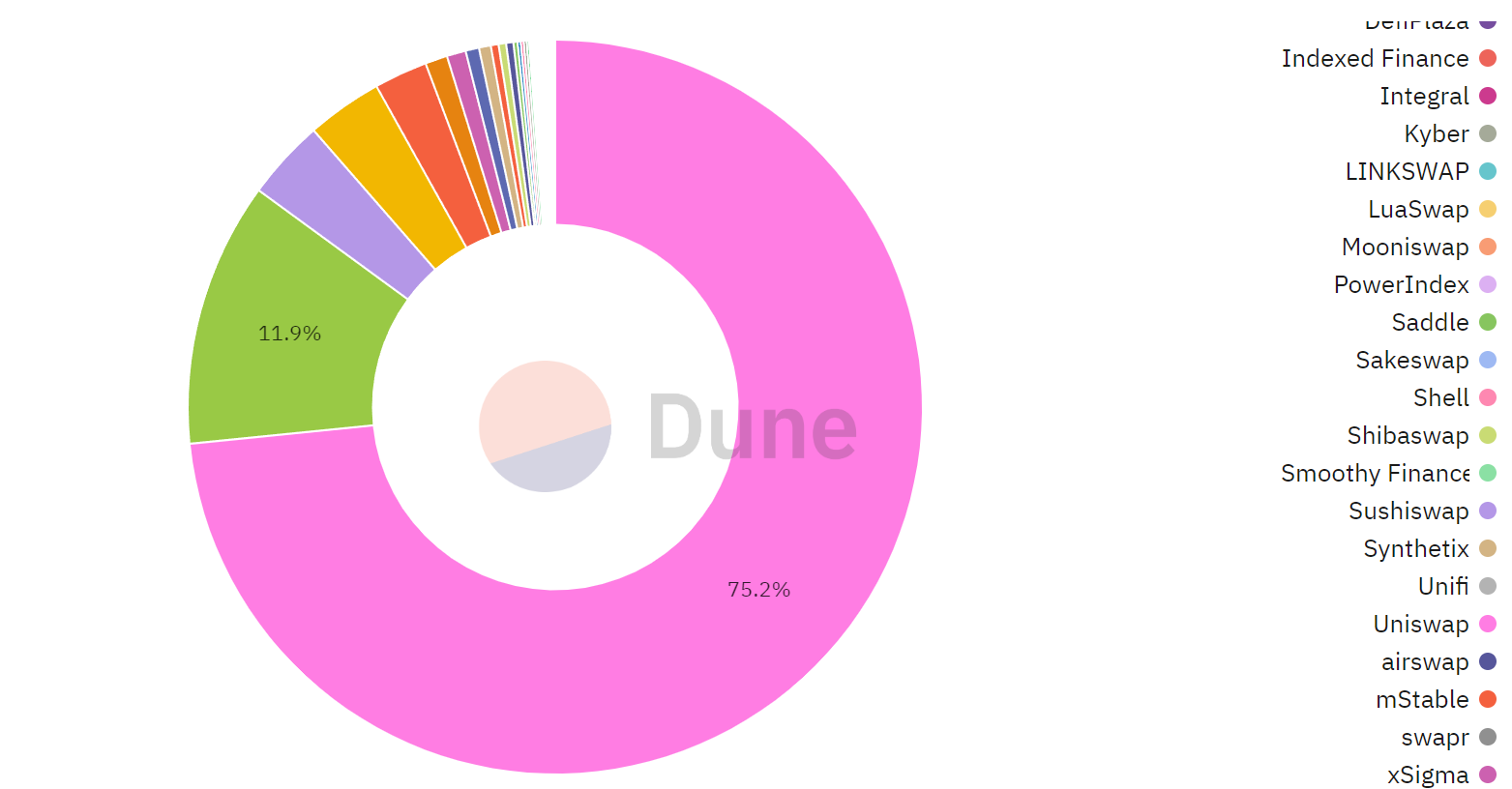

Known to be the biggest Decentralized Exchange, Uniswap has a 75% domination in the DEX space, with Curve and SushiSwap taking up another 15%.

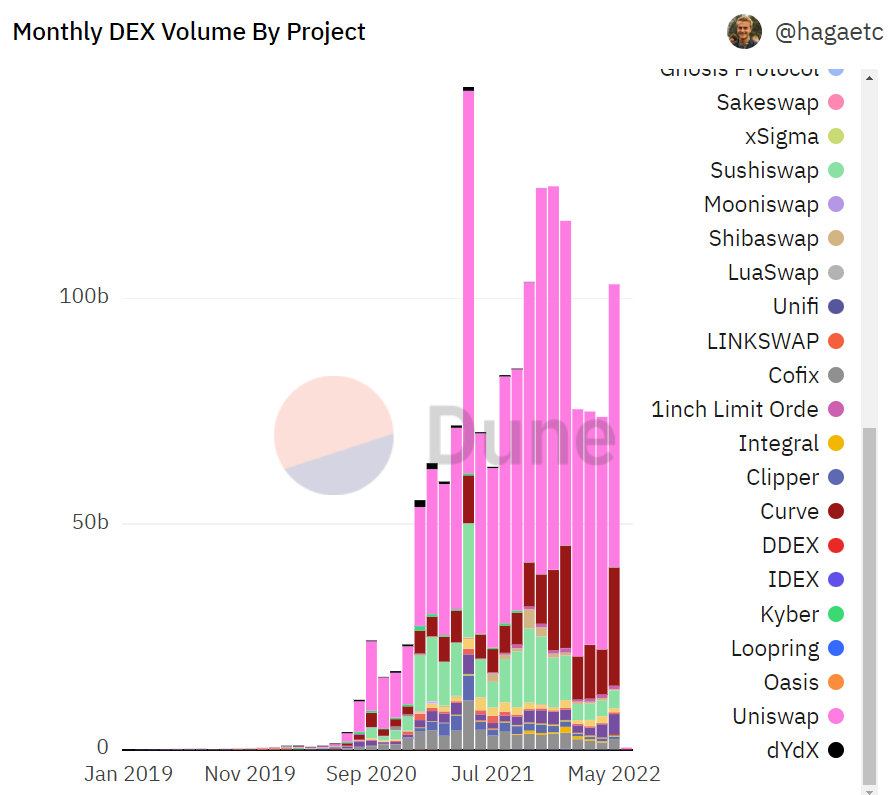

Of late, the DEX market hadn’t been doing well in part because of the broader market bearishness that kept the investors away from participating much in transactions on-chain or on DEXes.

Uniswap DEX domination | Source: Dune – AMBCrypto

As a result, the combined volume generated by these DEXes between February and May averaged $70 billion, with Uniswap alone responsible for more than $50 billion.

However, this month despite the crashes, DEXes generated $100 billion in volume, and Uniswap noted $62 billion.

DEX weekly volume | Source: Dune – AMBCrypto

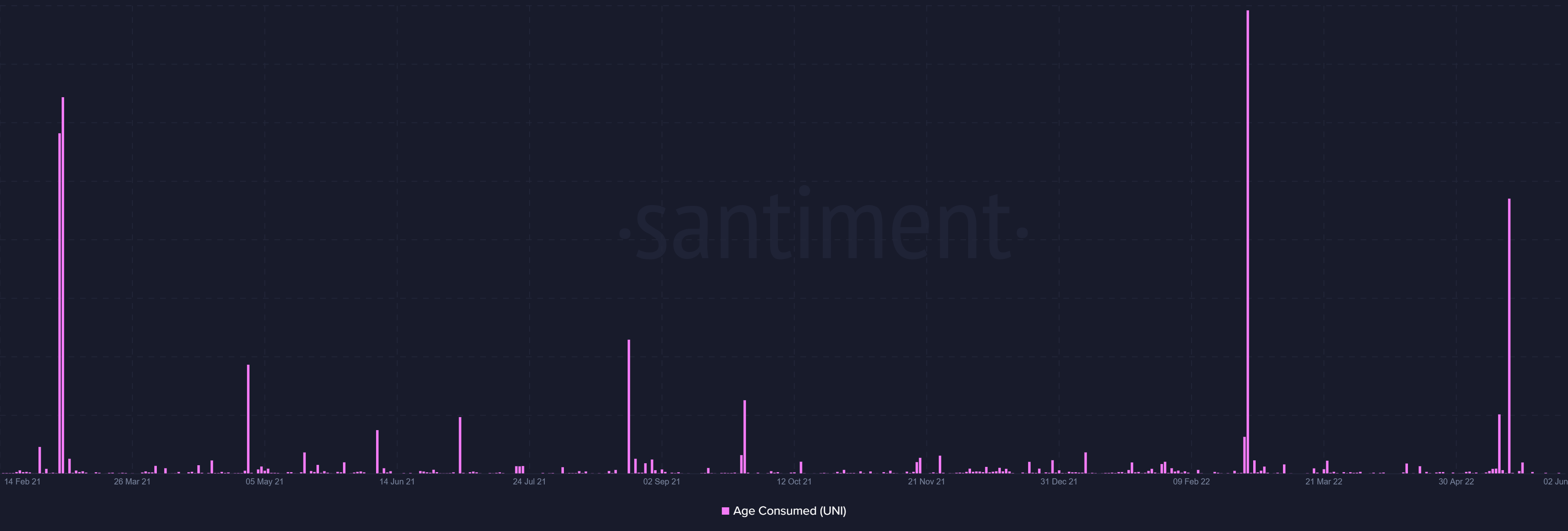

Although most of the investors who used the exchange were keen on selling their holdings, including UNI itself, which even observed selling from its older holders.

This resulted in consumption of 16 billion days in a single day as over $70 million worth of supply fell into losses.

Uniswap LTH selling | Source: Santiment – AMBCrypto

This was only the fourth major movement noted by UNI’s long-term holders in over 16 months. Selling from this cohort is a matter of concern since, usually, LTHs are not known to panic as they are long-term bullish on the asset.

In the case of Uniswap, these holders control 56% of the supply, thus making their activity an important indicator for the community.

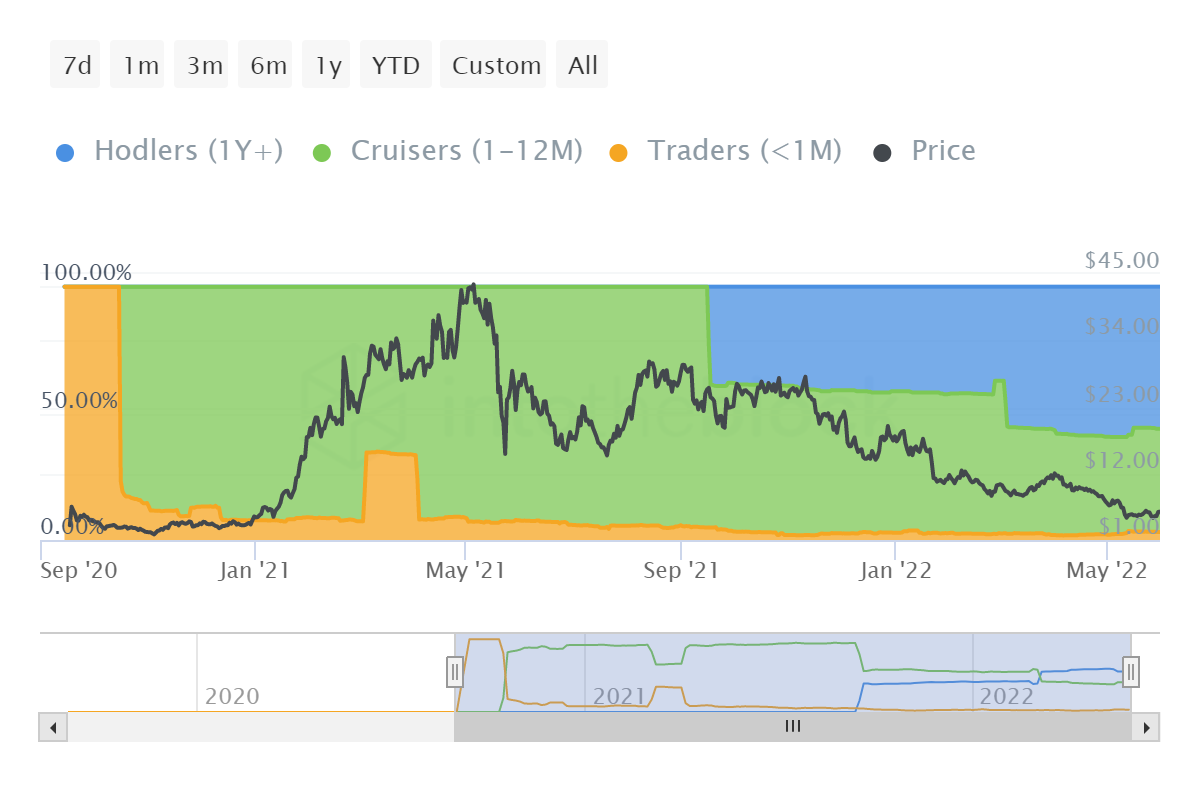

Uniswap balance distribution | Source: Intotheblock – AMBCrypto

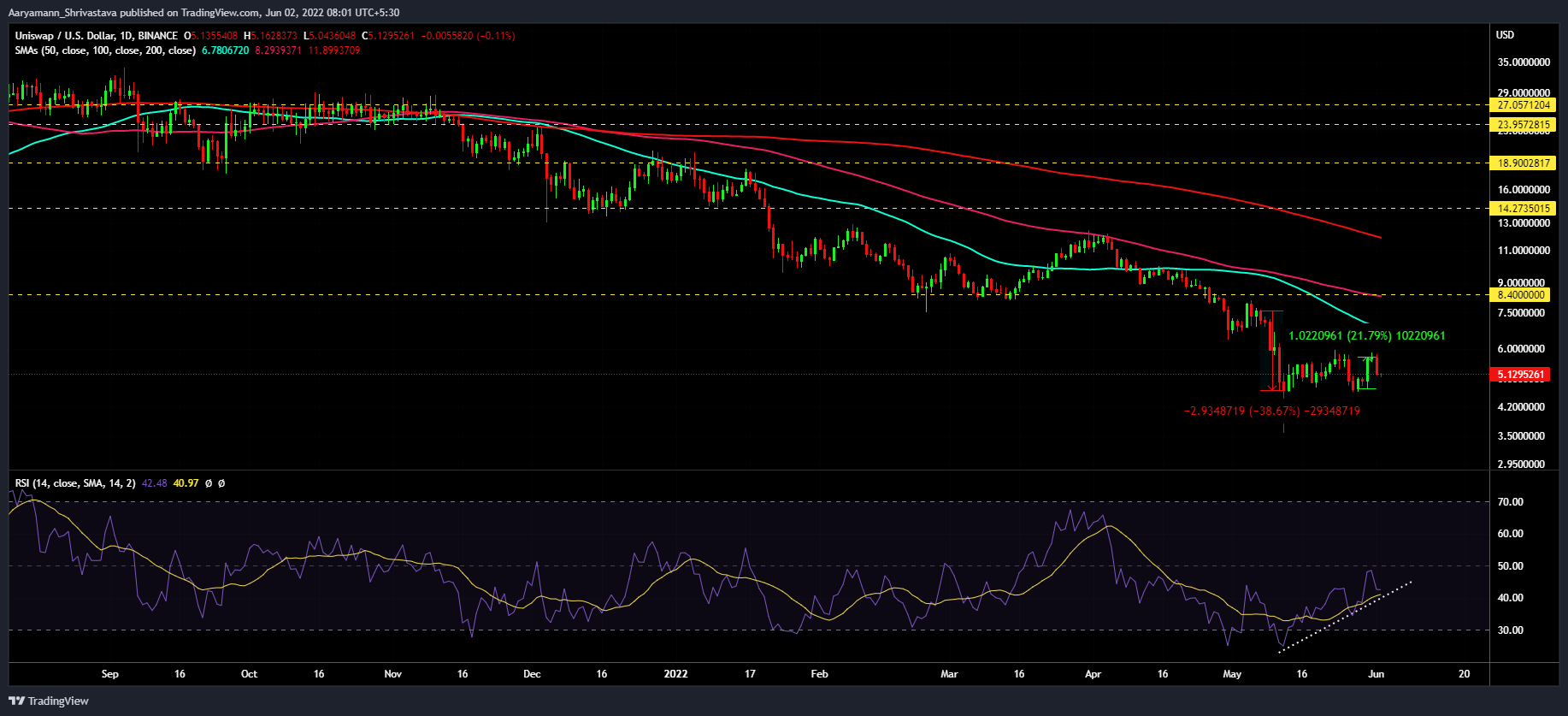

However so, UNI is on the brink of rallying further since the Relative Strength Index (RIS) is evidence indicating a gradual incline into the bullish zone by the end of the first week of June.

Although the price dipped by 9.77% yesterday after a 21.79% rise from the days before, it will continue rising in the longer timeframe.

Uniswap price action | Source: TradingView – AMBCrypto

Put simply, the end of bearishness seems to be in sight, and it will only be a bit longer before it becomes apparent in both the spot and DeFi market.