Can Ethereum 2.0 encourage $350 million worth of institutional investment

June is important for two reasons for the crypto market. Firstly it marks the end of the second quarter, and secondly, the end of June will also mark the arrival of the Merge. The highly anticipated event is expected to be a turning point for Ethereum [ETH] and maybe for the ones investing in the token as well.

It’s up and up for ETH

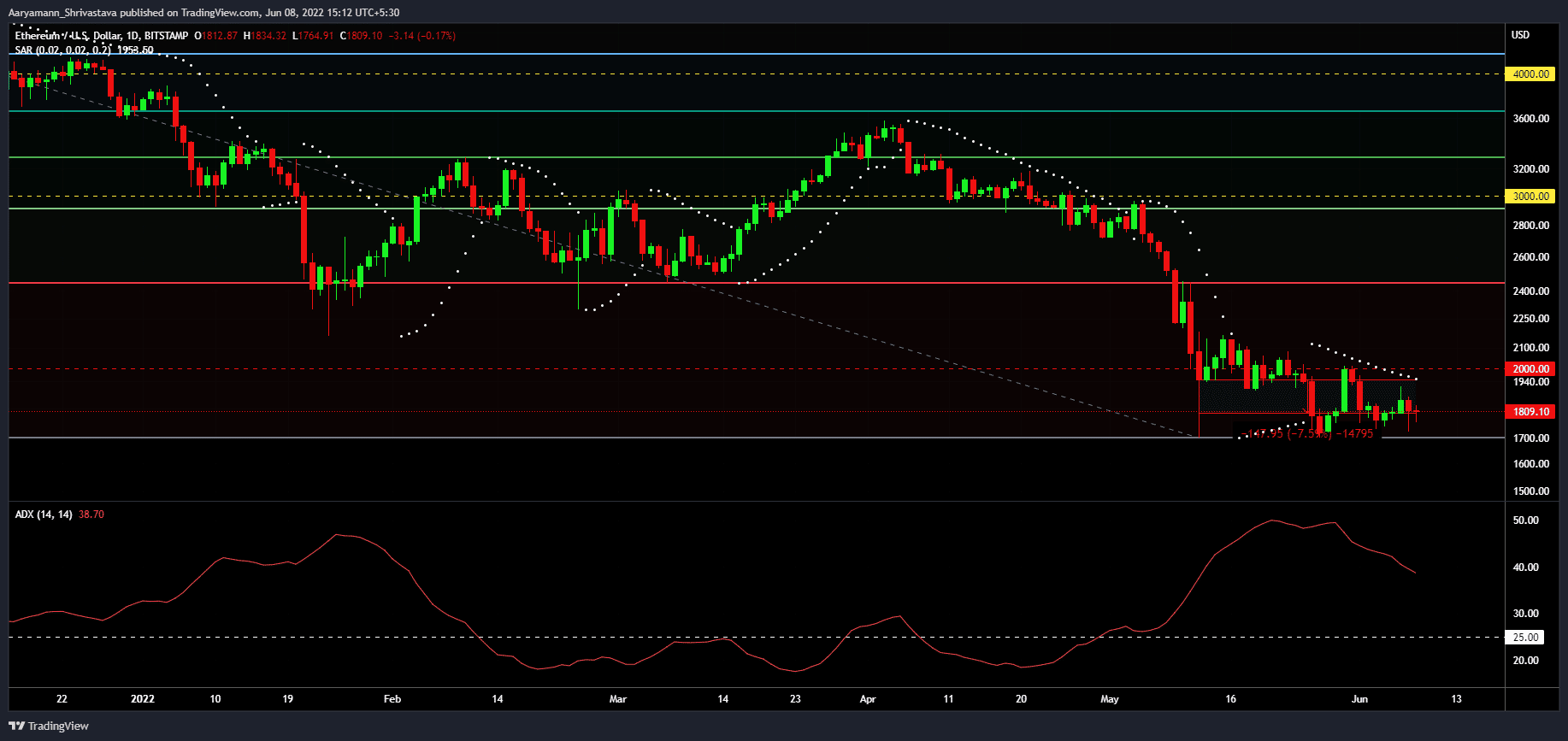

Probably not, but the transition to Proof-of-Stake (PoS) is definitely expected to help Ethereum recover from its recent losses. Apart from what ETH witnessed during the crash of 9 May, the altcoin’s king has been on a committed decline since, having lost almost 7.6%.

Ethereum price action | Source: TradingView – AMBCrypto

But, the losses aren’t just limited to the price action. Investors’ behavior has been a contributing factor as well.

As per institutional flows, Ethereum has been the worst-performing asset, registering year-to-date outflows worth $357 million. For the week ending 3 June, Ethereum once again noted institutions pulling money out of the asset to the tune of $32 million.

Coinshares netflows report | Source: CoinShares

This is despite the fact that the overall netflows have been positive, exceeding $100 million, led by Bitcoin. A part of the reason behind these consistent outflows is the delays Ethereum experiences pertaining to the aforementioned Merge.

However, now that Ethereum is on the verge of becoming cheaper, faster, and more economical, institutions are also expected to invest considerably in the asset. This could also help in recovering the outflows.

Institutions’ investment could act as a morale boost for the long-term holders that have been in a bind for more than a month now.

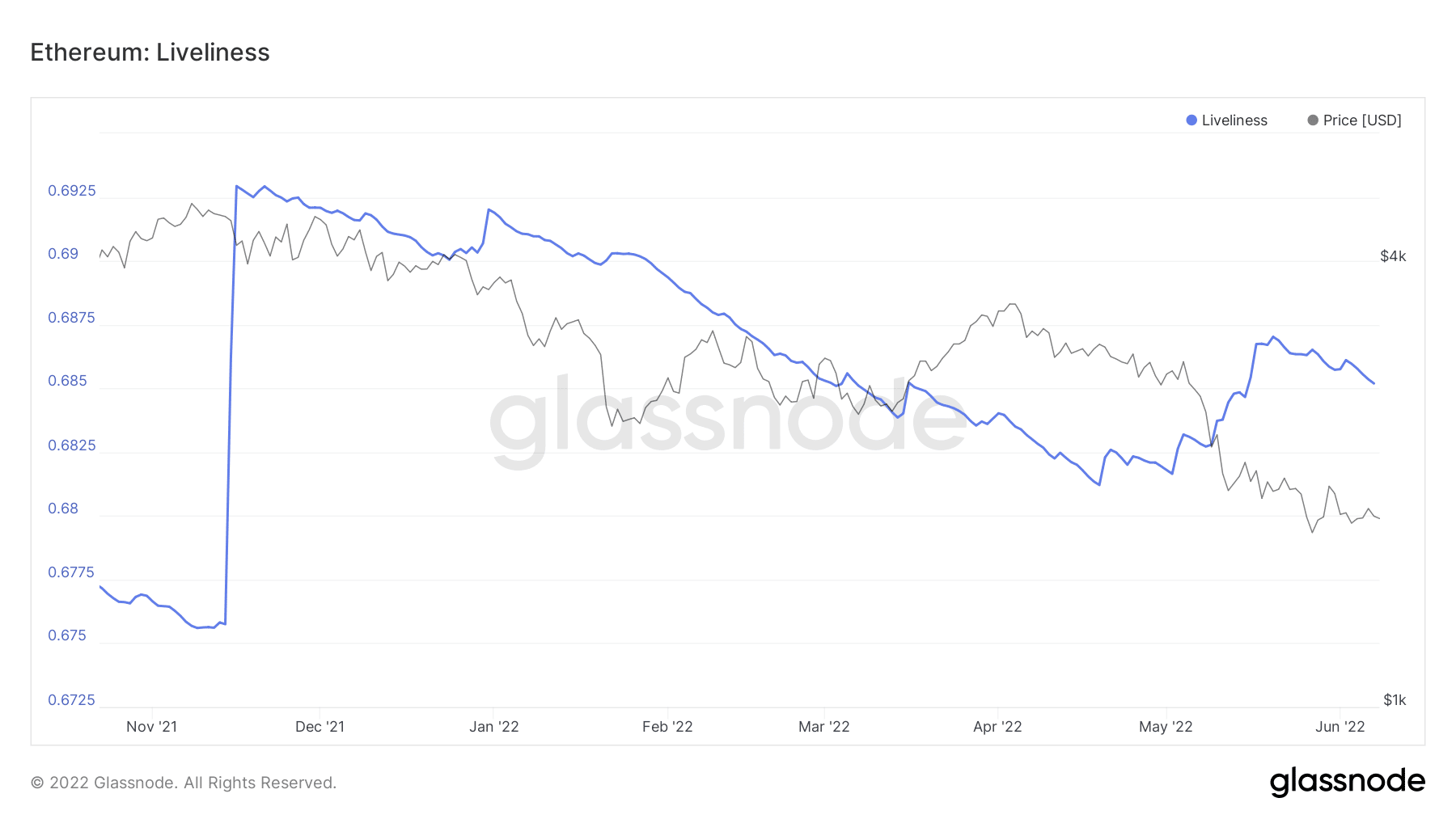

As per Ethereum’s liveliness, investors have been holding on to the idea of accumulation since December 2021, regardless of the decline in prices. But since April, they have been liquidating their positions significantly.

Ethereum liveliness | Source: Glassnode – AMBCrypto

This is also verified by the bouts of selling noted at their end, which on multiple occasions has destroyed as much as 650 million days.

Ethereum coin days destroyed | Source: Glassnode – AMBCrypto

It is essential that LTHs refrain from selling their holdings as the ones holding ETH, from anywhere between six months to seven years, control about 69% of the supply.

The cohort that bought their holdings approximately one to two years ago has the most domination with 28% supply in their possession. Should they begin selling, Ethereum could be in trouble.

Ethereum supply distribution by time | Source: Glassnode – AMBCrypto

Thus, going forward, ETH 2.0 is expected to bring change to encourage LTHs to hold and institutions to invest in Ethereum.