Bitcoin: A potential +38% rally for ‘bleeding’ BTC could be in play if…

Bitcoin [BTC], the king coin has gone below the $20,000 level, losing its much-respected price milestone. The United States Federal Reserve’s comments on the inflation outlook saw Bitcoin witnessing the brunt of a sell-off. At press time, the world’s flagship crypto was changing hands at $19,227 on CoinMarketCap.

Sentiment hits dead low

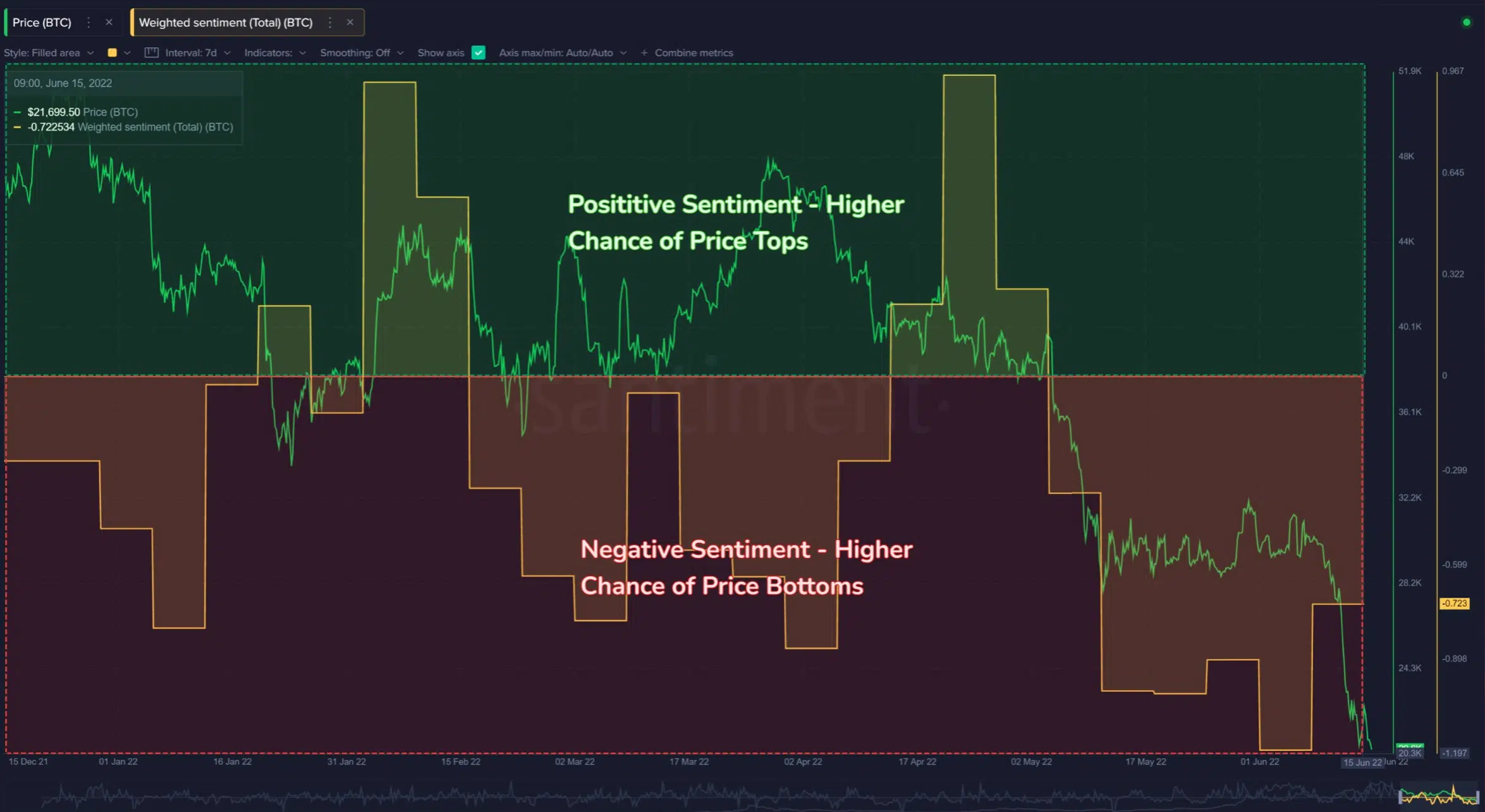

At press time, the Fear and Greed Index recorded an ‘extreme fear’ sentiment on their indicator which doesn’t come as a surprise. To add to this, the weighted sentiment likewise responded by hitting a low- the sentiment towards Bitcoin remained expectedly negative following the -30% price freefall over the past 30 days.

Social sentiment remained ‘extremely negative’ for a fifth straight week here. A similar trend was visible from mid-June to late July of 2021 for a record time of seven weeks in a row. Although, for the latter, Santiment noted, ‘prices jumped +38% following that streak.’

Data from the on-chain analytics tool, Santiment, suggested Bitcoin’s price may see a bottom at current levels and appreciate in the coming weeks. Prices are historically more likely to rise when sentiment reaches low levels.

Carrying the momentum

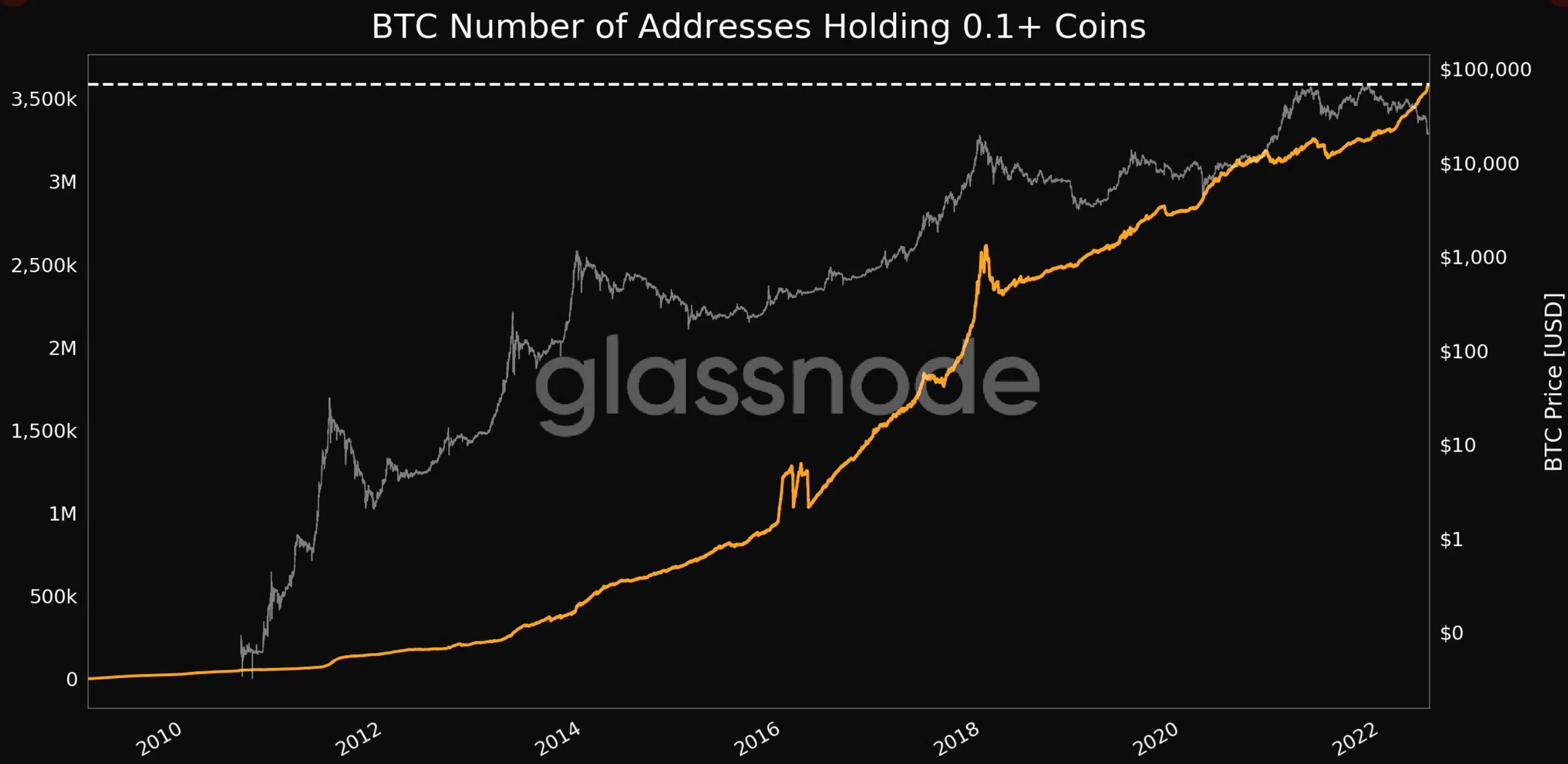

Furthermore, Bitcoin holders, despite the obvious correction, have supported the coin since its inception. For instance, the number of addresses holding 10k+ Bitcoin just saw a significant rise. Even, the addresses holding 0.1+ coins reached an ATH of 3,586,227.

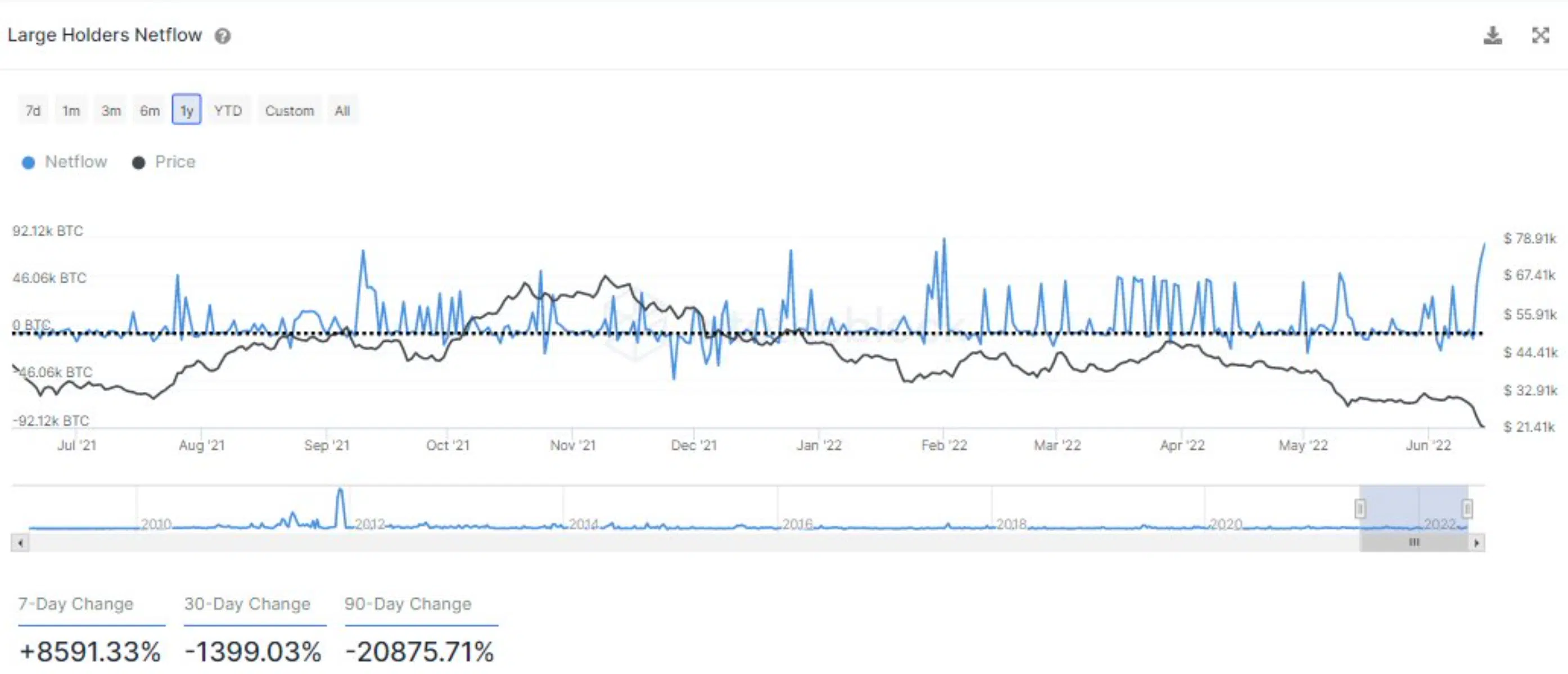

Investors are clamping down to buy more Bitcoin at a much ‘discounted’ price given the aforementioned scenarios. Following this narrative, dominant buyers or whales are on a move. Large holders’ inflow tracks the funds going into addresses belonging to whales. And, it seems to be on the rise at press time.

In fact, large holders netflow noticed the largest inflow since February with 116k BTC. This pointed to a potential bottom in price as these addresses tend to buy in size following significant correction.

Rising concerns?

Bitcoin’s hashrate is at its lowest point since October, 2020, could this be a warning sign? Well, with energy costs rising and BTC prices falling, hashrate is growing much more slowly this year than most anticipated.

Source: Hashrate Index

Since hitting an all-time high of 234 EH/s on 12 June, Bitcoin’s seven-day average hashrate has fallen 9% to 212 EH/s. When the value of the indicator trends down, it means miners are leaving the network. Thus, this may lead to a worsening performance of the coin coupled with lower security of the Bitcoin chain.