Axie Infinity reopens Ronin Bridge after audits but here’s the problem

Axie Infinity has announced the official re-launch of the Ronin Bridge, enabling the transfer of funds to and from the Ronin network. This is the same bridge that makes it possible for users to fund their Axie Infinity accounts.

The Ronin bridge was temporarily suspended after an exploit by hackers, which resulted in a huge loss worth over $600 million. The official announcement revealed that the Ronin bridge was restored after undergoing three audits (One internal audit and two external audits).

Some of the notable changes include backing funds at a 1:1 ratio, and adding a circuit breaker feature. The latter was designed to provide a backup plan and increase security in case large suspicious withdrawals are detected.

Water under the bridge then?

Axie Infinity users have surely not forgotten about the exploit considering that it led to one of the biggest crypto losses of 2022. However, the relaunch of the bridge and the new changes should provide a much-required reassurance for users with regards to the safety of their funds. The announcement, however, is not expected to have a direct impact on AXS price action.

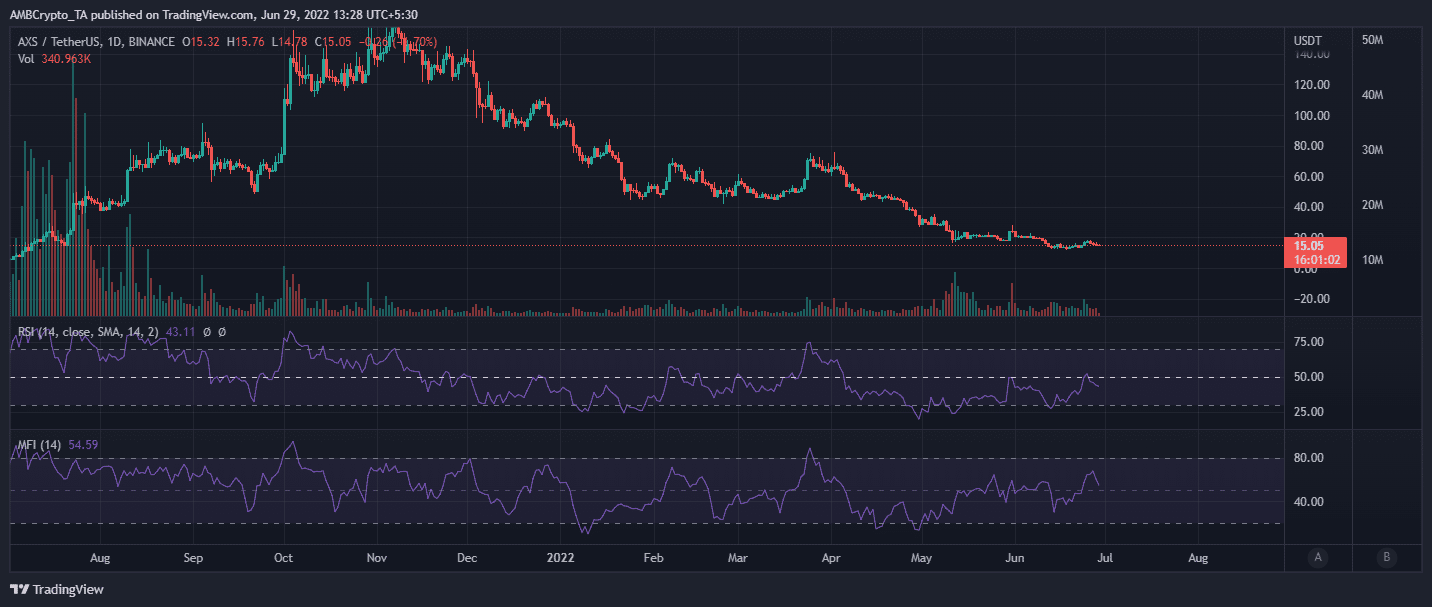

AXS trading volumes increased significantly in the last two months, as investors sold off their holdings due to the market crash. The coin dropped as low as $11.82 on 18 June.

The last time that it traded around the same price was at the start of its July bull run in 2021. Furthermore, AXS traded at $15.05 at press time after dropping from a weekly high of $18.53.

AXS kicked off this week on a bearish retracement after last week’s rally. The upside seems to have been curtailed by sell-offs near the 50 RSI level. AXS bulls have been gaining momentum since mid-June, as shown by the MFI. This was courtesy of accumulation after a major crash in the first two weeks of June.

Are on-chain metrics on the same lines?

It remains unclear whether AXS is headed for more downside or whether it is near the bottom. On-chain metrics, like exchange inflows and outflows, confirm that AXS holders shifted their holdings to exchanges.

Exchange inflows peaked at 599,470 in the last 24 hours of 29 June. However, at press time outflows peaked at 295,450. This means inflows exceeded outflows and hinted at sell-pressure.

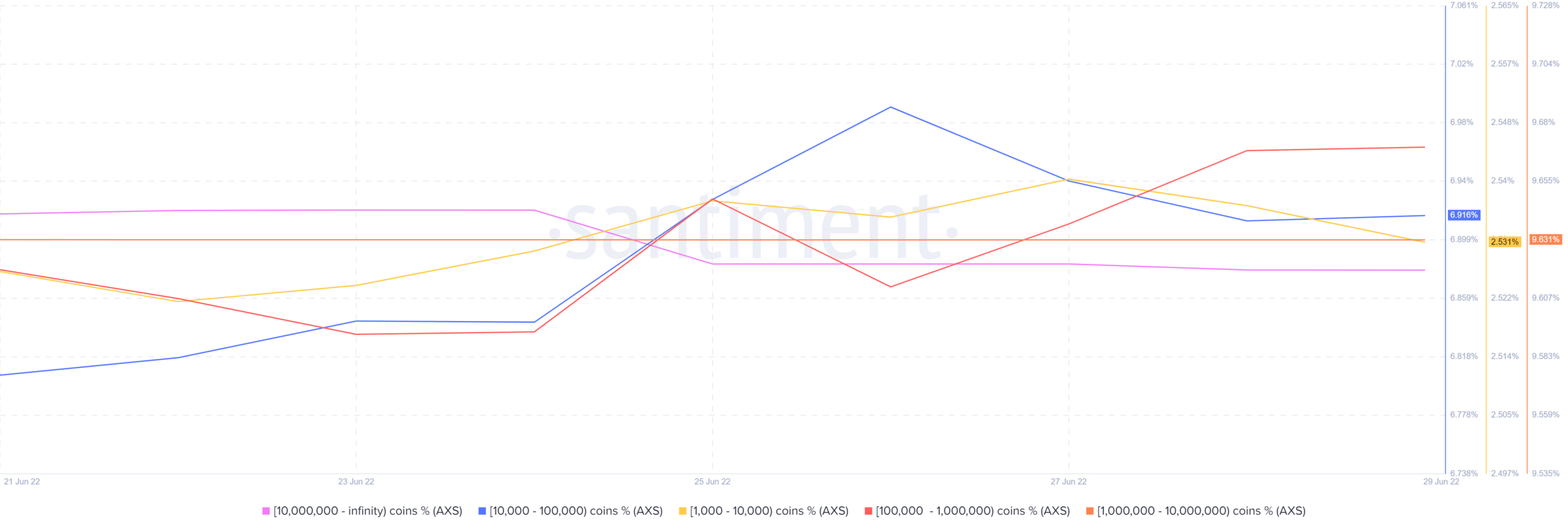

The supply held by whales and supply held by top addresses metrics both highlighted a notable decline. The supply distribution confirms this outcome. It provides a clearer picture of where the buying and selling pressure is coming from.

Addresses holding between 100,000 and one million AXS grew from 9.78% on 26 June to 9.88% on 29 June. This flow provided some bullish pressure.

Addresses holding between one million and 10 million AXS barely saw any changes in the last four days. The balance on addresses holding over 10 million AXS saw a slight marginal drop, contributing to the selling pressure. Addresses holding between 10,000 and 100,000 coins dropped from 6.99% on 26 June to 6.92% by 29 June.

The supply distribution also revealed that the sell-off was tapering off. If this remains to be the case, then AXS bulls may have a chance at taking back control.