Did SushiSwap’s proposal to offset carbon footprint trigger recovery

Environmental activists have been behind crypto and blockchains for a long time now. They have been citing concerns that come with the use of this technology.

Although for most blockchains, the argument is invalid thanks to their modern approach to conducting transactions. Well, not to forget, the environmental impact of Bitcoin [BTC] and Ethereum [ETH] mining has been huge.

Thus, blockchains and even protocols are now coming up with solutions to put an end to this issue. The latest to address the environmental concern is SushiSwap.

SushiSwap for the nature

The decentralized exchange (DEX) is currently one of the top five DEXs in the market that is conducting transactions worth more than $300 million on average every week.

In June 2022 alone, SushiSwap was responsible for generating more than $1.8 billion in volume.

DEX monthly trading volume | Source: Dune – AMBCrypto

Upon considering the overall volume of exchanges, the DEX market is capable of producing a significant amount of carbon footprint.

SushiSwap is fighting this in its own way by partnering with KlimaDAO, the same DAO which helped Polygon achieve carbon neutrality last month.

However, unlike other chains, SushiSwap plans to adopt a different strategy. The organization plans to allow its users to do good for nature. The DEX is allowing users to pay a small amount for offsetting or reducing their carbon footprint via an opt-in feature.

It’s Sushi time

While the plan is in the works, SushiSwap is looking for other ways as well to make the same happen. The proposal, which was voted for last week, was very well-received among SUSHI holders, with more than 99.3% of the users voting in favor of it.

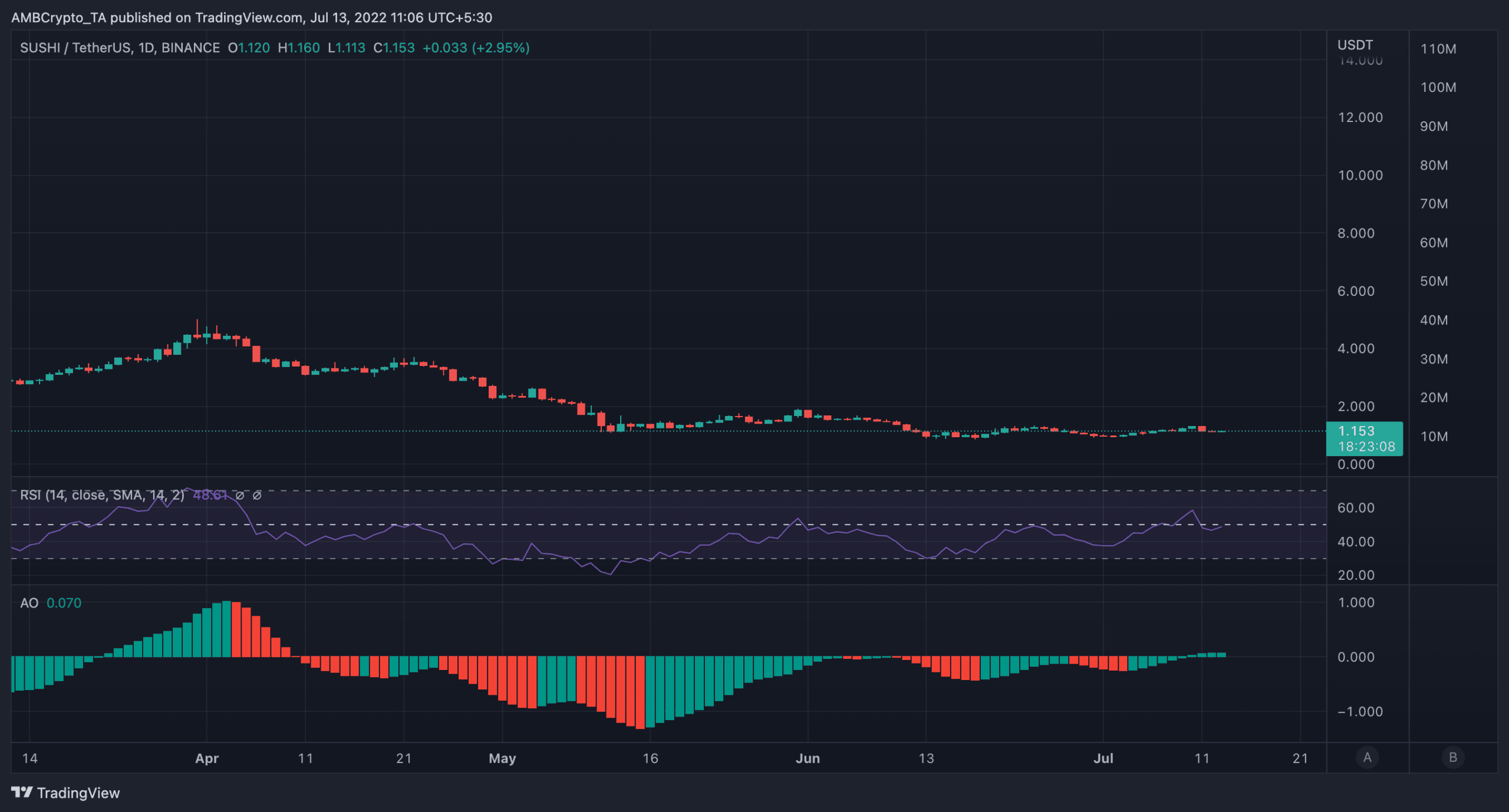

This instance, along with the bullish cues from the broader market, triggered a rally that pushed SUSHI up by 34.67% to trade at $1.153 at press time.

On the contrary, the altcoin’s Relative Strength Index (RSI) did witness a slight drop below the neutral 50 line only to show an inclined trend at the time of writing.

The Awesome Oscillator (AO) was clearly not siding with the bulls. Thus, it is difficult to say if SUSHI’s current movement can actually help the token break out of its range.