Dogecoin [DOGE] HODLers may see light at the end of the tunnel after this…

Disclaimer: The findings of the following analysis are the sole opinions of the writer and should not be considered investment advice.

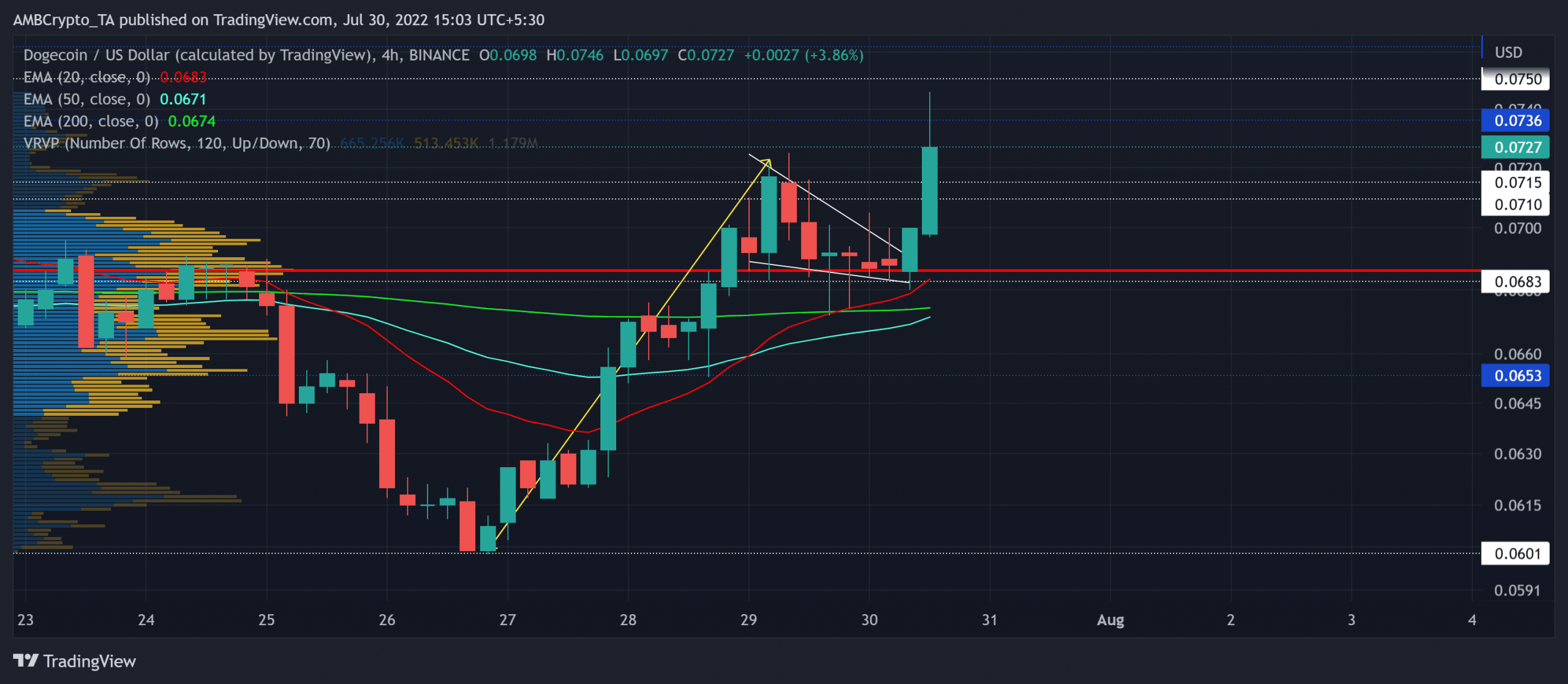

Over the last three days, Dogecoin [DOGE] bulls provoked an impressive buying comeback from the $0.06 support. As a result, it saw a revival above the Point of Control (POC, red). In its endeavor to sustain the bullish volatile break, DOGE bulls could continue propelling near-term gains.

With the formation of a bullish pattern in the four-hour timeframe, sellers were on the back foot. At press time, DOGE was trading at $0.0727, up by 3.61% in the last 24 hours.

DOGE 4-hour Chart

After flipping from the $0.075-resistance, DOGE lost over 21% of its value and matched its weekly lows on 26 July. After seeing a tussle between the buyers and sellers near the Point of Control (POC, red), the price action saw a reversal from the long-term $0.06 zone support.

Over the last few days, DOGE formed a bullish pennant pattern in the four-hour timeframe. Given the steepness of the flag, the pattern could hold the near-term bullish momentum. The bears would most likely step in the $0.073-$0.076 range to pose hurdles.

In such a case, this bearish reversal could find reliable grounds in the $0.0715-$0.071 range. Any bouncebacks from this range could hint at an entry trigger. In either case, potential targets for the near-term rest in the $0.076-zone.

Also, with the 20 EMA (red) undertaking a bullish crossover with the 50EMA (cyan) and the 200 EMA (green), the bulls would aim to continue their immediate buying spree.

Rationale

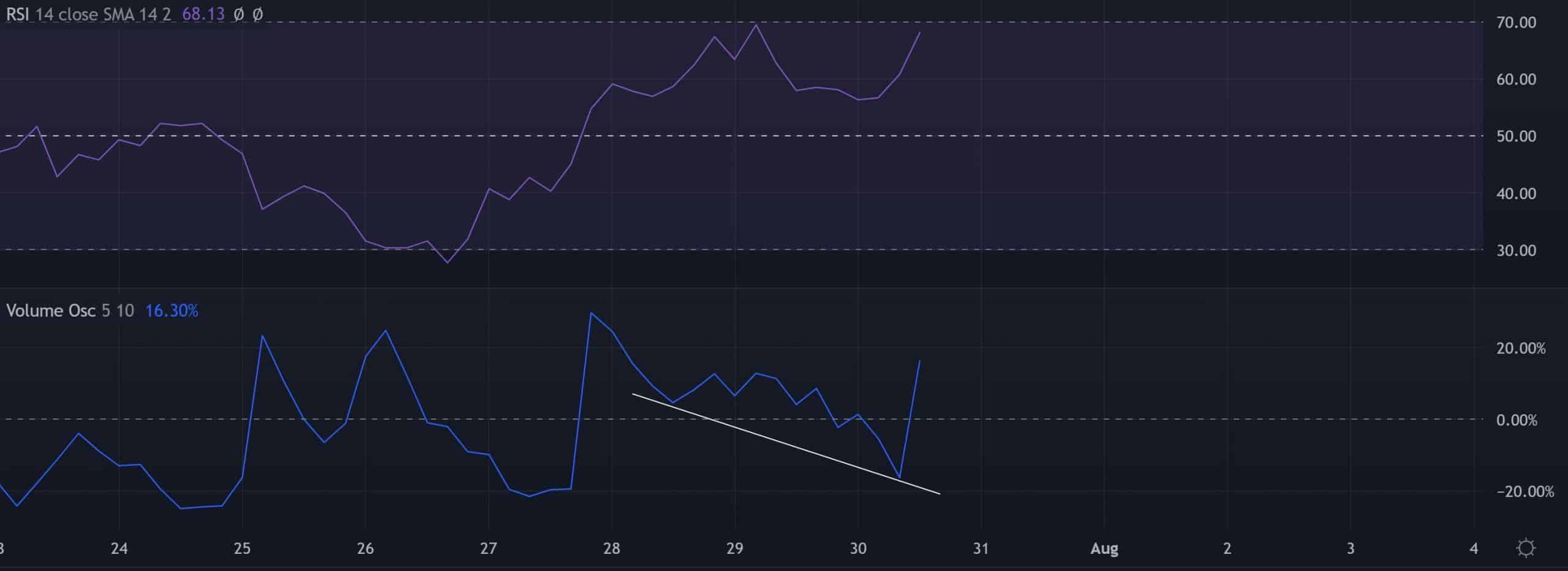

The Relative Strength Index (RSI) approached to retest the overbought mark at press time. A likely reversal from this zone could facilitate near-term ease in buying edge. This reading entailed a possibility of a reversal from the immediate resistance range on the chart.

Also, the Volume Oscillator saw a bullish divergence with price action’s higher troughs in the last few days. Thus, provoking an uptick in buying volumes.

Conclusion

Given the bullish pennant setup breakout, the altcoin could register some more gains until a near-term reversal. In which case, the potential targets would remain the same as discussed.

Finally, the dog-themed coin shares a 57% 30-day correlation with the king coin. Thus, keeping an eye on Bitcoin’s movement would complement these technical factors.

![Three days ago, Uniswap [UNI] attempted a breakout from a parallel channel, surging to hit a local high of $7.6. However, the altcoin faced strong rejection.](https://ambcrypto.com/wp-content/uploads/2025/06/Gladys-83-400x240.jpg)