Why Arbitrum’s TVL’s growth may have set up an ‘OpenSea’ of opportunities

Arbitrum has witnessed significant growth over the past month. The blockchain also has an increasing number of users and growing number collaborations. But what has led to the L2 chain witnessing an influx of these positive developments?

Let’s talk facts

Arbitrum has witnessed consistent growth in its total value locked (TVL) since July. From a TVL at $601.72 million, Arbitrum has managed to progress all the way till 935.29 million at press time.

Furthermore, Arbitrum showcased growth all across the board. The number of unique addresses present on the Arbitrum have increased significantly over the past year. Since January, the blockchain gained 957,324 new unique addresses. The total number of unique addresses stood at 129 million at the time of writing and the number is only projected to grow further.

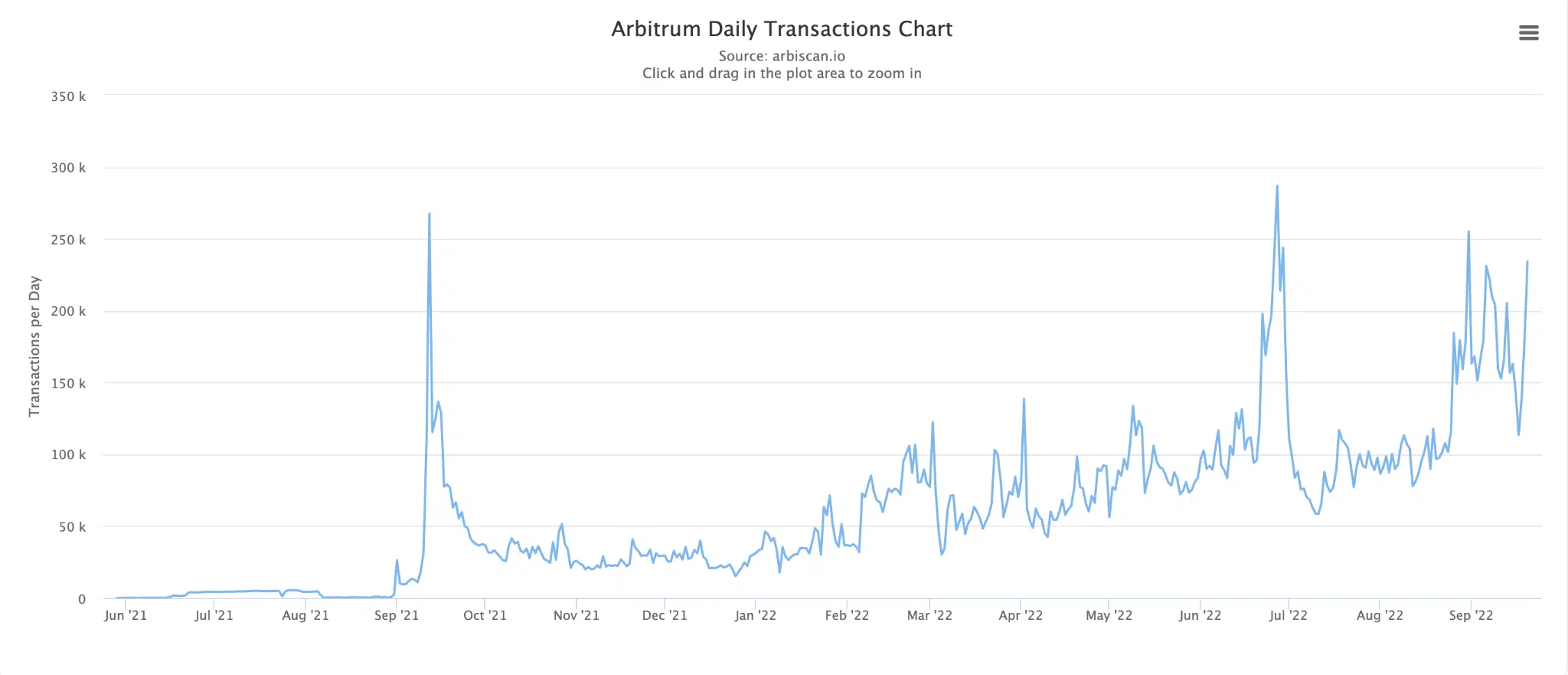

However, the daily transactions on the Arbitrum network witnessed some volatility over a few months. As depicted in the image below, the number of transactions on the Arbitrum network have been growing rapidly. This has been the case since the beginning of the year. However, there was a dip in the number of transactions in August.

The number of transactions also seemed to have recovered since August and the growth was relatively positive at press time. Even though Arbitrum performed well in terms of TVL and gained new users, some areas showed uncertainty.

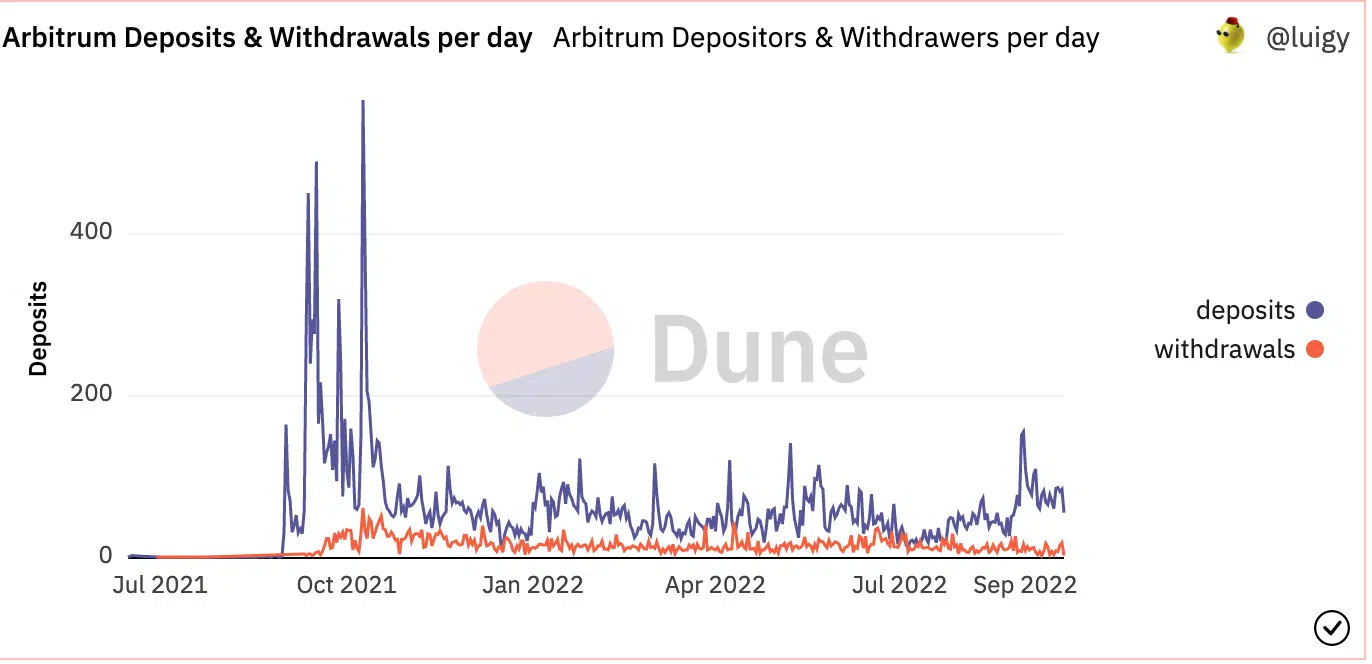

Arbitrum’s daily number of depositors and withdrawers went on a steep decline since its peak during 2021. Furthermore, the number of active depositors and withdrawers were relatively flat throughout the year. However there was a spike in the number of deposits that occurred in September. Thus, this could be seen as a positive sign for the chain.

Another indicator of Arbitum’s growth could be the increasing number of collaborations and partnerships.

Plenty of fish in the ‘OpenSea’

On 20 September, OpenSea, leading Web3 marketplace, announced or rather lent support to Arbitrum. A huge range of NFTs, such as dopex, smolverse, and Gmex blueberry club would be available for OpenSea users. With this development, Arbitrum would get exposed to a large user base that OpenSea possessed. Ergo, helping with Arbitrum’s growth.

Apart from the NFT space, Arbitrum also managed to make strides in the DeFi department. Risk finance, a DeFi platform, will also launch on Arbitrum, strengthening its position in the DeFi market.