LUNA, LUNC investors may experience some distress due to this update

A piece of proposed legislation in the House of Representatives would put a two-year moratorium on creating algorithmic stablecoins. According to Bloomberg’s latest version of the legislation, it would be illegal to create or issue new “endogenously collateralized stablecoins.”

With the cat out of the bag, how are the two infamous stablecoins holding up? Let’s find out…

LUNC, how do you feel?

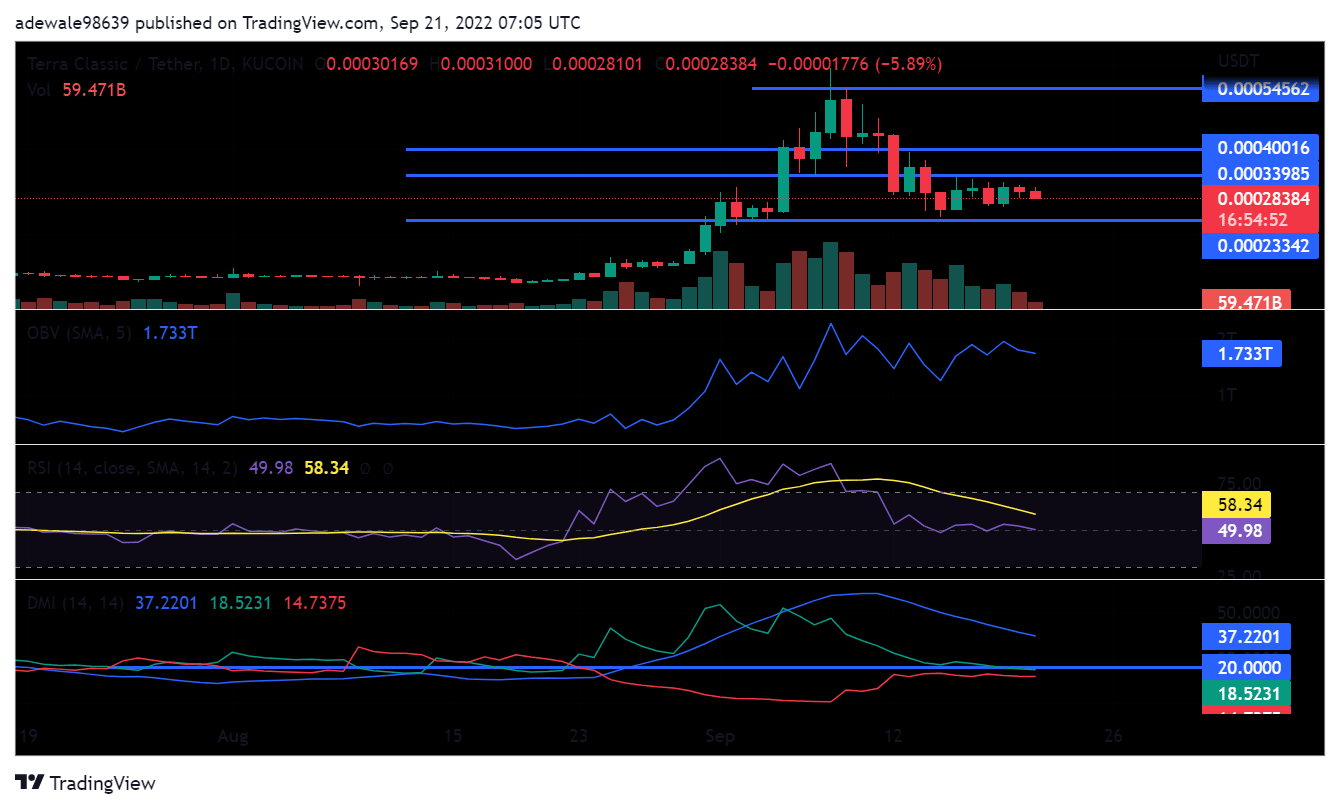

As of 20 September, Terra Classic [LUNC] opened at $0.000311 and closed at $0.000301, experiencing a loss of 3.12%. In the same trading period, it experienced a high of $0.000314 and a low of $0.000283. The support had been holding well at $0.000233. Furthermore, volume showed minimal activities in trade, but witnessed a drop to 153 billion from 239 billion at the end of trading on 20 September.

Coinmarketcap showed an over 20% drop in volume in the past 24 hours. The On-Balance Volume (OBV)’s movement was largely sideways, indicating low activity from LUNC.

The Relative Strength Index (RSI) displayed a move along the neutral line. The Directional Movement Index (DMI) depicted the signal line above 20. However, the plus DI line stayed slightly below and the minus DI line moved close to the 20 trend line. Looking at the DMI and RSI indicator, a waning bullish trend was seen with the likelihood of a bearish one setting in soon.

LUNA, is that you?

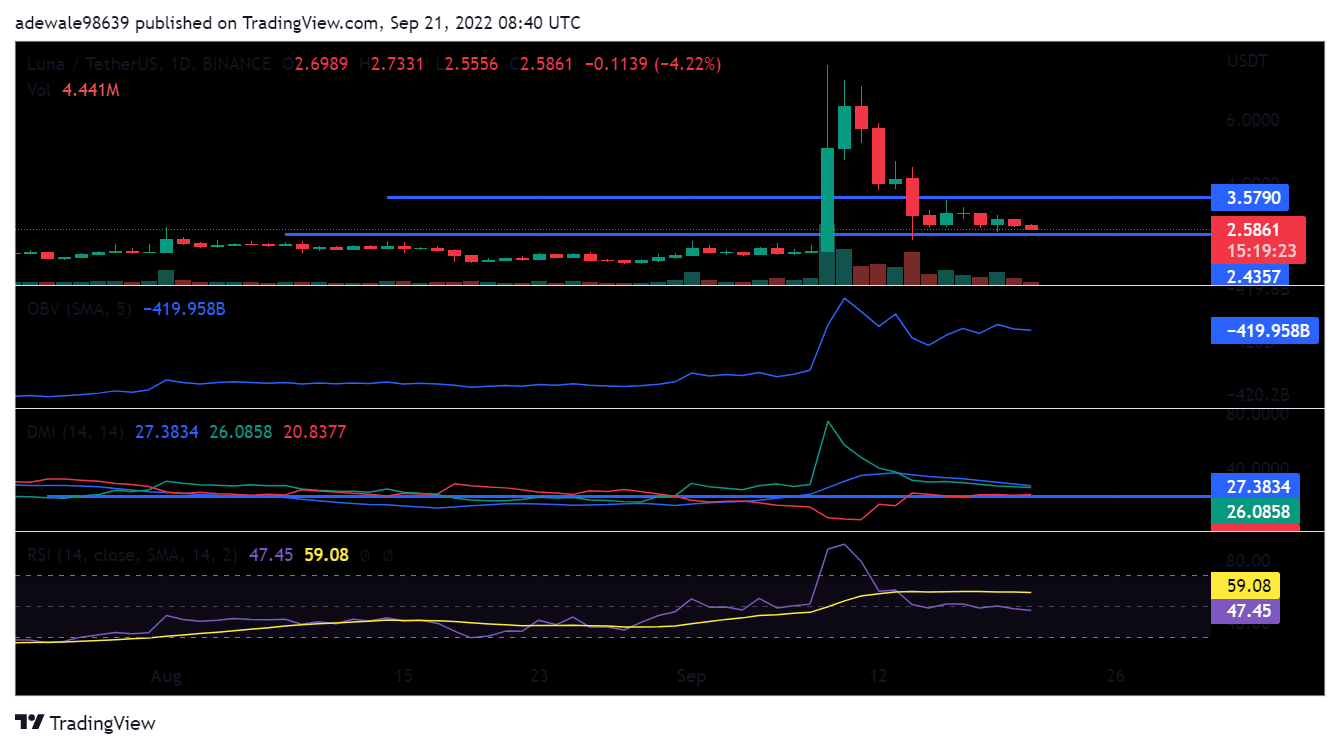

Terra [LUNA] traded as low as %2.6 as of 20 September and could not go higher than $2.7 during the same trading period. Furthermore, on 21 September, the token started trading below $2.7 at $2.69, with over a 3% loss.

The resistance level stood at $3.5 with LUNA struggling against it since it last tested the level on 16 September. The support level at $2.4 held up well, but a highly possibility of it being tested was plausible.

The volume indicated low activities as the drop in volume was from 34 million to 17 million. Per Coinmarketcap, the volume dropped by over 40% in the past 24 hours. The On-Balance Volume (OBV) indicator showed a lack of serious activities with the lines going sideways with no spike noticed.

The Directional Movement Index (DMI) showed the signal line above the 20 line with the minus DI line creeping over the line. Additionally, the plus DI line gradually moved along the same line. This stood indicative of a bearish move.

The bearish sentiment was also confirmed by the Relative Strength Index (RSI) with a move slightly below the neutral line.

Hand in Hand

Both LUNA and LUNAC have been experiencing a downward trend in price movement since the announcement, though LUNA experienced more drops. The indicators also showed a possible strong bearish trend coming for both LUNA and LUNC.

Months have passed since the stablecoin measure was first proposed, and it has been delayed before due to concerns voiced by Treasury Secretary Janet Yellen. Yellen called for stronger regulation of the crypto industry, citing the collapse of TerraUSD as an example.

A vote on the bill could happen as soon as next week.