Should XRP investors be disturbed amid the news of this…

- Ripple investors failed to pump funds into the blockchain investments despite asset flow hitting highest point in months

- XRP registered a 25% decline from the past week but was rarely impacted by the dormancy; seems to be recovering

According to the 14 November Coinshares digital assets flow report, Ripple [XRP] could not improve from its previous week’s performance. In the information publicized by James Butterfill, XRP investors held back on funding at least $1 million into the payment platform investment products.

Surprisingly, this occurred after digital assets investment products recorded $42 million in inflows. Blockchain equities also registered $32 million, making the past week’s outflow the most significant recorded since May 2022.

Read XRP’s price prediction 2023-2024

Better safe than sorry

The actions by the investors might align with the impression that they were being careful, considering the terrible events that led to crypto price crashes. Nonetheless, XRP seemed to care less about the hesitation.

According to CoinMarketCap, the payment token increased by 1.17% in the last 24 hours, exchanging hands at $0.355 at press time. A noteworthy fact was also its volume which increased by 107.81%.

XRP’s 24-hour trading volume was $1.839 billion as of this writing. This implied that XRP investors participated in an astounding number of transactions within the said period.

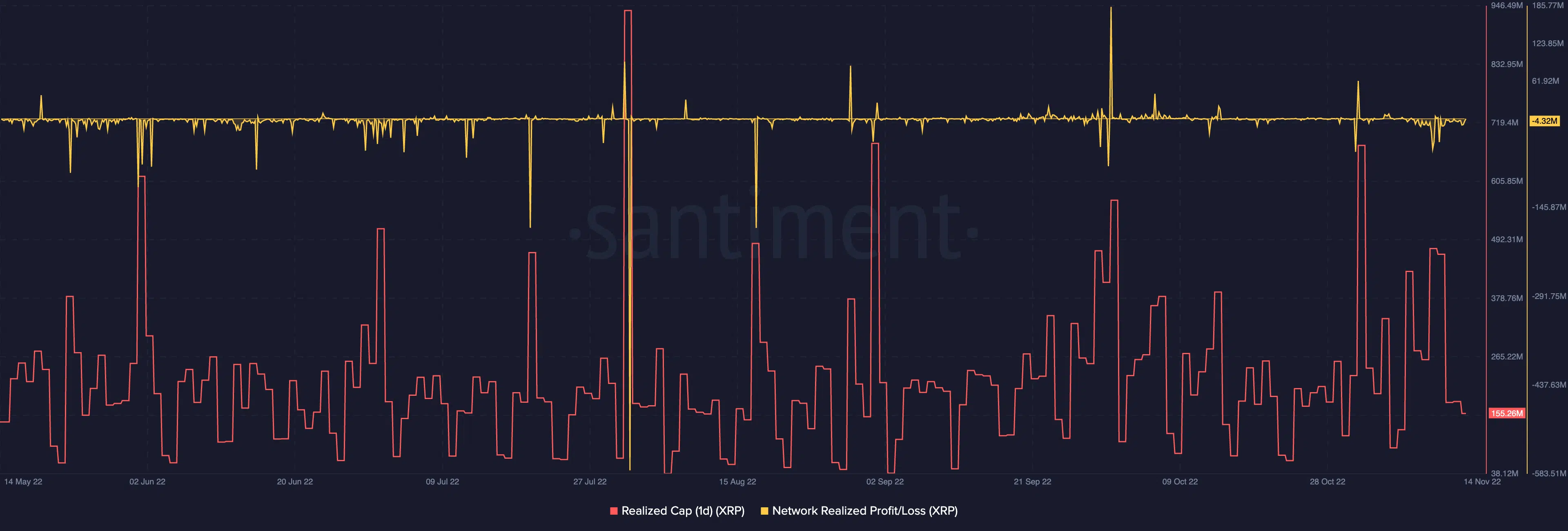

Per the network’s realized profit and loss, XRP was -4.32 million, according to Santiment. At this state, it inferred that XRP tokens involved in transactions were more in losses than gains. Similarly, network profitability was down, and the overall market sentiment was negative.

As for the realized cap, it was 155.26 million. This position meant that XRP investors spent much less to acquire the recently accumulated tokens. Hence, this could somewhat be a balance for the losses incurred recently.

Vanquished but not out of the game

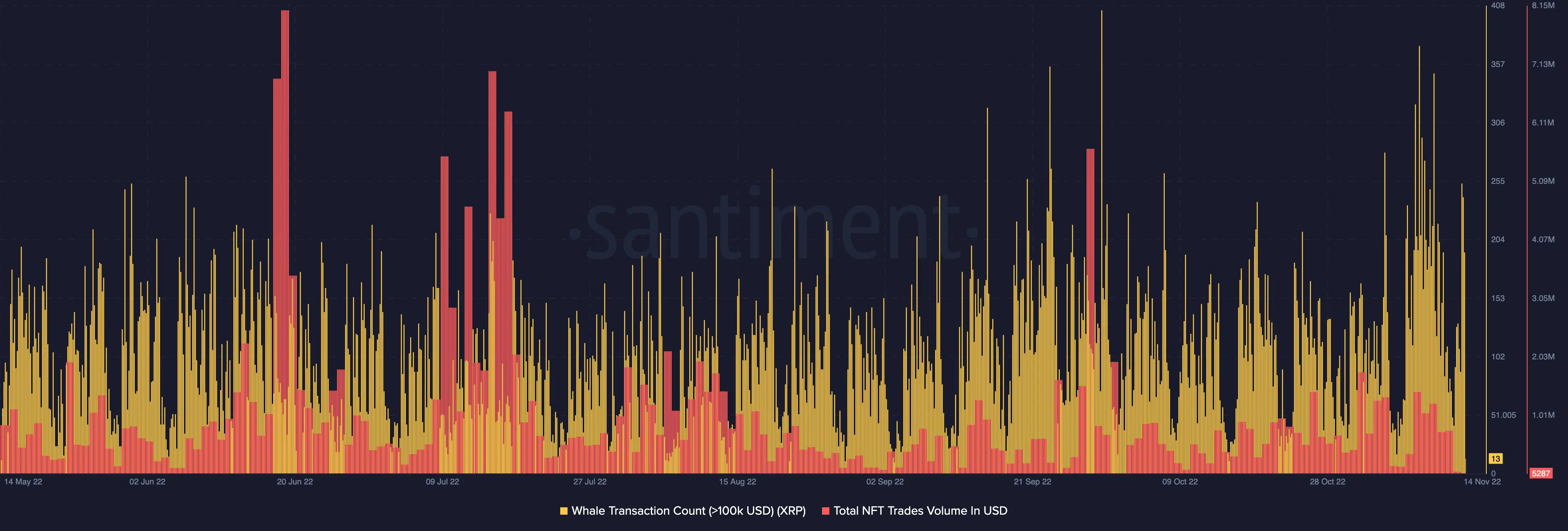

In addition, the inability of investors to add to Ripple’s investment could be linked to the recent SEC-LBRY triumph. Despite the defeat, XRP was able to gain attention in other regards. According to Santiment, whale transactions that spanned $100,000 and above were 13 at press time.

In fact, the transactions were about 249 on the same 14 November before these sharks slowed the momentum. This implied that the SEC loss had not left deep-pocket traders shaken. For the NFT trade volume, it held steady at 5,287. Although far from the records on 1 November, the state indicated that XRP found it more challenging to sustain interest.

However, other parts of the Coinshares revealed that some investors found the market collapse an opportunity. The noteworthy one was Bitcoin [BTC] which recorded $19 million in inflows, while its short-term investment products totaled $12.6 million.