Chainlink: Decoding ‘new partnership’ and ‘whale interest’ for LINK holders

- Chainlink announced a new partnership with Blueberry.

- RSI and stochastic were oversold and whale interest increased.

Chainlink [LINK] became a much-talked-about topic in the crypto space of late. Blueberry, which unifies the DeFi experience by aggregating and automating the top strategies (that the space has to offer) announced a partnership with Chainlink.

Blueberry has joined Chainlink BUILD to accelerate the adoption of automated LP strategies on Uniswap v3. With this new partnership, Blueberry will provide network fees and other incentives to Chainlink service providers as part of Chainlink Economics 2.0.

?️ #ChainlinkBUILD ?️@BLBprotocol has joined #Chainlink BUILD to help accelerate the adoption of its automated LP strategies.

Blueberry has committed 3.5% of its total token supply to be used as an economic incentive for Chainlink service providers.https://t.co/SQu5b7I0Ud pic.twitter.com/QBCY0XgHgu

— Chainlink (@chainlink) December 27, 2022

A 111.28x hike on cards if LINK hits Bitcoin’s market cap?

Whale interest increased

Furthermore, whales have recently expressed interest in Chainlink. As per WhalesStats, a popular Twitter account that posts updates related to whale activity, it was revealed that LINK was one of the “top 10 most purchased tokens among the top 100 biggest ETH whales in the last 24 hours.”

JUST IN: $LINK @chainlink now on top 10 purchased tokens among 100 biggest #ETH whales in the last 24hrs ?

Check the top 100 whales here: https://t.co/N5qqsCAH8j

(and hodl $BBW to see data for the top 5000!)#LINK #whalestats #babywhale #BBW pic.twitter.com/MvmbaQBkKN

— WhaleStats (tracking crypto whales) (@WhaleStats) December 28, 2022

Surprisingly, LINK managed to gain significant interest without registering any promising gains over the last week. According to CoinMarketCap, LINK’s price decreased by more than 3% in the last seven days. At press time, it was trading at $5.74 with a market capitalization of over $2.9 billion.

A trend reversal soon?

A look at LINK’s on-chain metrics shed light on why the whales were interested in the token. Some of the metrics suggested a price hike during the last days of the year.

CryptoQuant’s data revealed that LINK’s Relative Strength Index (RSI) and stochastic were in oversold positions, which is pretty bullish. Furthermore, LINK’s net deposits on exchanges were low compared to the 7-day average, suggesting less selling pressure.

How many LINKs can you get for $1?

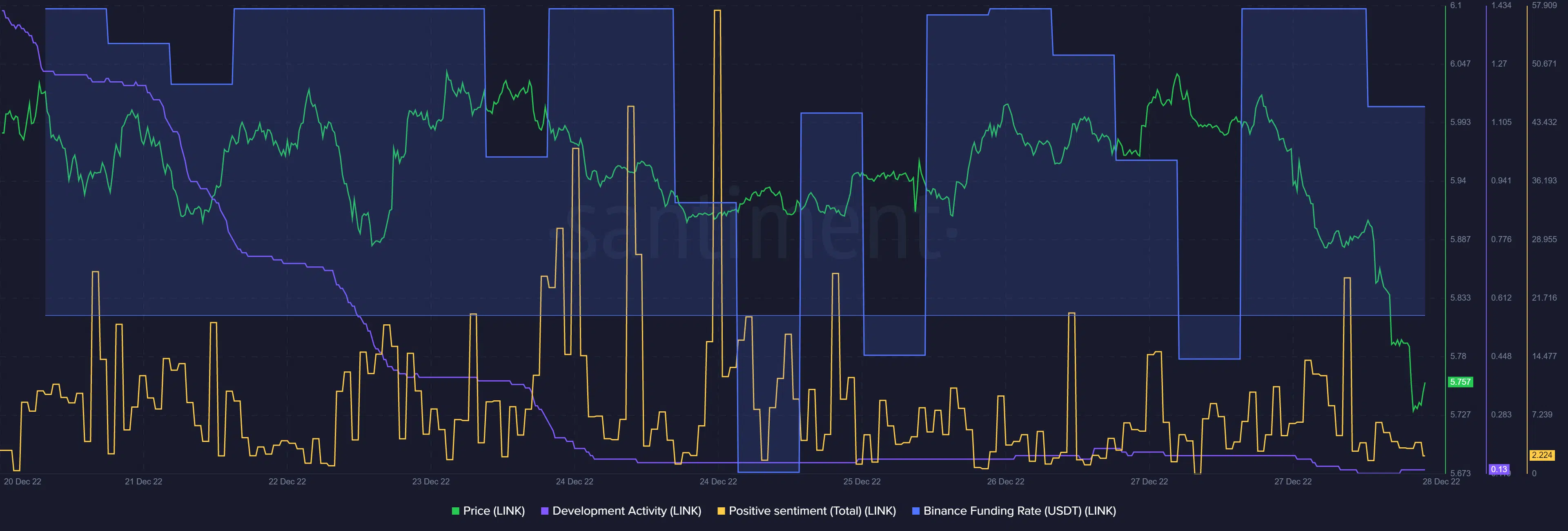

Santiment’s chart also pointed out that a few more things were working in LINK’s favor, which might have played a role in garnering whale interest.

For instance, positive sentiments regarding LINK registered an increase over the last week. Additionally, LINK’s Binance funding rate also remained relatively high, indicating high interest from the derivatives market. Nonetheless, LINK’s development activity decreased substantially, which was somewhat of a negative signal for the network.