Chainlink [LINK] poised for a relief rally, buyers can look to book profits at…

Disclaimer: The information presented does not constitute financial, investment, trading, or other types of advice and is solely the writer’s opinion

- Chainlink dived to $5.67 but recovered nearly 5% until press time.

- It showed a good chance of pushing further north to reach $6.8 and $7.5.

Chainlink [LINK] sank to an eight-month low and presented the likelihood of a bullish move. Even though the asset did not possess an overall trend, traders could look to profit from its price movements.

Read Chainlink’s [LINK] Price Prediction 2023-24

Bitcoin [BTC] also sunk to $16.2k on its hunt for liquidity. At the time of writing, its short-term direction had reversed. However, it still faced immense resistance near the $17.6k and $18.2k levels. Moreover, a proper higher timeframe uptrend was nowhere close to being established.

Bulls anticipate some gains for Chainlink in the coming days after revisiting the range lows

Chainlink traded within $9.45 to $5.62 for around eight months, since May. Over the past couple of days, prices descended to the lows of the range. This showed a low-risk, high-reward trade opportunity.

Buyers would likely be interested in the $5.7-$6 region on the charts. Their invalidation lay at $5.3, and their profit targets were the mid-range value at press time. Optimistic bulls could also hope for a retest of the range highs, but that could require Bitcoin [BTC] to break out above the $18.6k mark.

To the north, there was a bearish order block at $6.8. Extending from $6.53 to $7.12, this zone could also be used to take profits. The Relative Strength Index (RSI) stood at 37.8 to show strong bearish momentum. However, the On-Balance Volume (OBV) only shrank by a small margin compared to the gains it posted from 20 November to 1 December.

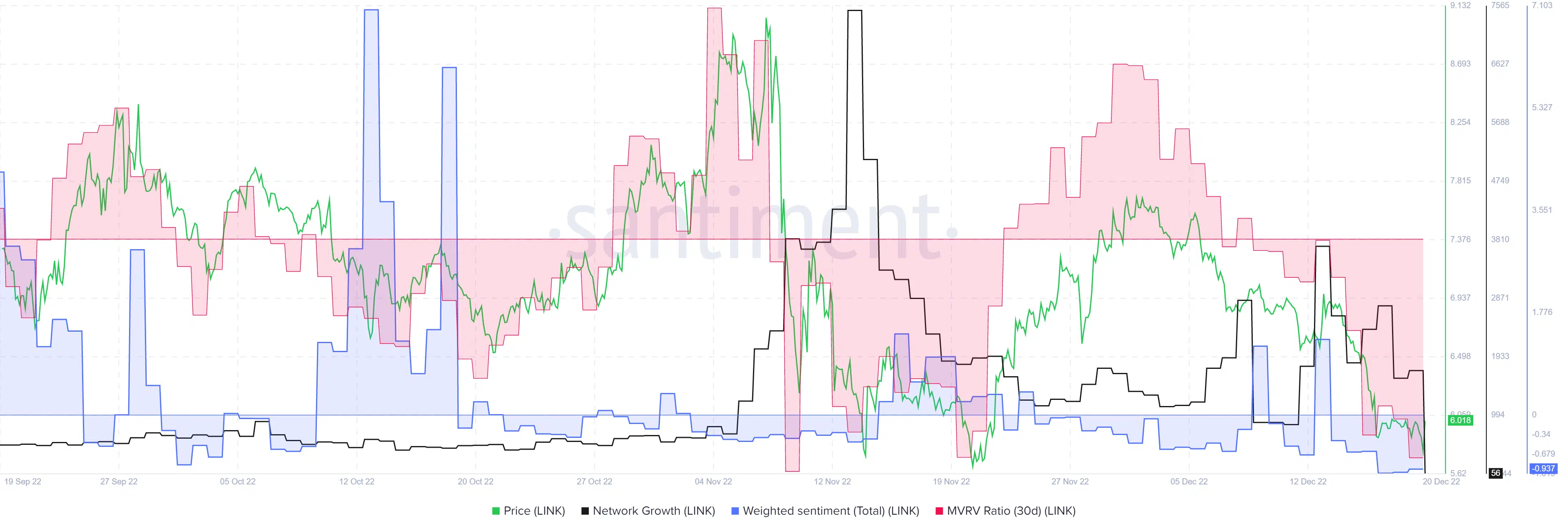

MVRV ratio shows holders at a loss, weighted sentiment was near a 3-month low

Source: Santiment

Chainlink’s weighted sentiment on social media was mildly negative since late November, as evidenced by the downtrend since late November. The Market Value to Realized Value (MVRV) ratio also took a hit and has tumbled a long way since the beginning of December.

Network growth saw a large spike in mid-November, and a couple of weeks later, LINK rallied to $7.7. Over the past week, the network growth saw a spike once again before pulling back at the time of writing.