Cardano [ADA]: Risk-averse traders can lock gains at this level

![Cardano [ADA]: Risk-averse traders can lock gains at this level](https://ambcrypto.com/wp-content/uploads/2022/12/kanchanara-999WKOMULPQ-unsplash-scaled.jpg.webp)

Disclaimer: The information presented does not constitute financial, investment, trading, or other types of advice and is solely the writer’s opinion

- ADA was in a price rally and could retest the previous support-turned-resistance at $0.2531.

- A drop below $0.2397 would invalidate the bullish forecast.

Cardano [ADA] traded within a range in late November 2022 before a downtrend in December 2022. However, ADA bulls found stable support at $0.2441 and used it to initiate a rally.

At press time, ADA was trading at $0.2472, up 1.9% in the last 24 hours. If the bulls maintained the momentum, ADA could retest or surpass the previous support level of $0.2472.

Read Cardano’s [ADA] Price Prediction 2023-24

Cardano resistance at $0.2531: Can the bulls retest it?

ADA’s decline from its mid-December trading range between $0.2531 and $0.2652 was held in check by support at $0.2441. If the bullish momentum strengthens, the rally could reach or retest the previous lower boundary and support at $0.2531.

The Relative Strength Index (RSI) retreated from oversold territory, indicating increased buying pressure. In addition, the Money Flow Index (MFI) showed an uptick, indicating a massive accumulation of ADA coins given its discounted prices.

The Chaikin Money Flow (CMF) recovered from the zero line and climbed above the zero mark. This showed that buyers had an increasing influence on the market.

If buying pressure increases, ADA could rise and retest the $0.2531 level. Risk-averse investors can take profits at this point. A move above the previous trading range could depend on a strongly bullish Bitcoin [BTC].

However, a break below $0.2397 would negate the above bullish forecast. Such a downtrend could see ADA settle at $0.2298.

How much ADA can you get for $1?

ADA saw improved demand in the derivatives market

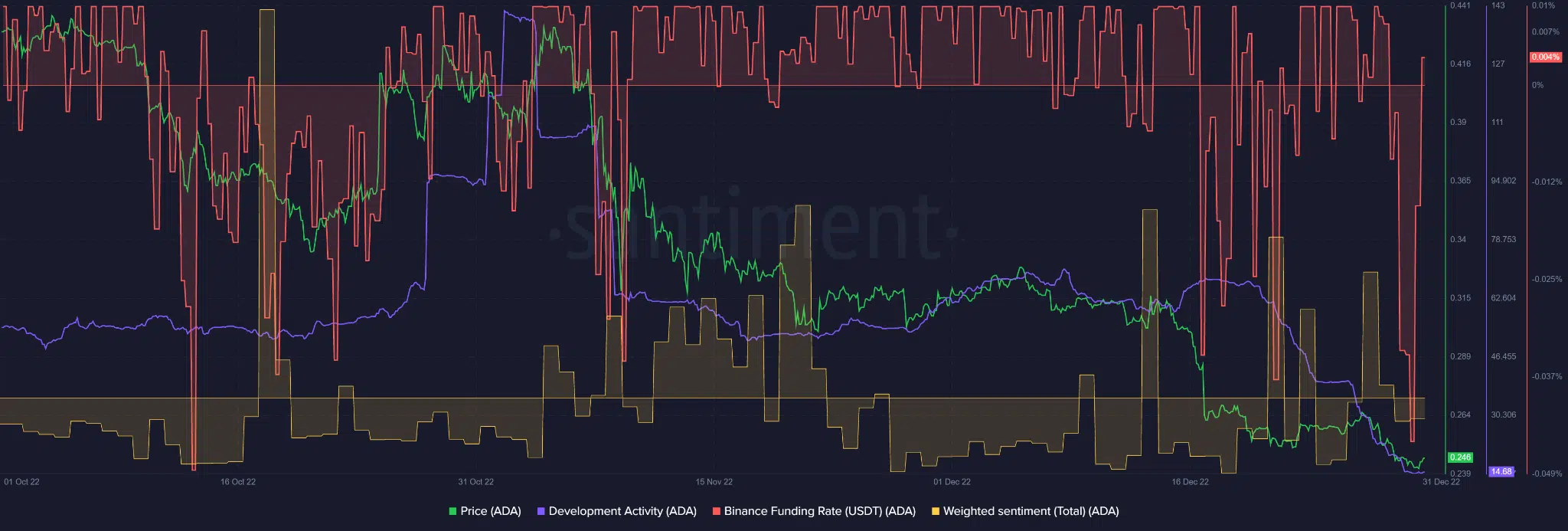

According to Santiment, demand for ADA on the futures market declined in mid-October, early November, and mid-December 2022.

At press time, demand improved as Binance Funding Rates retreated from negative territory and jumped into positive territory.

There was also a slight improvement in weighted sentiment, suggesting that investors’ outlook for the asset has improved. Could demand in the derivatives market and improved investor sentiment drive the upward trend?

Nonetheless, investors should maintain sight of BTC’s price performance to assess ADA’s movement.