BUSD faces depegging scare: What’s going on, Binance?

- BUSD under FUD because of reports showing insufficient backing.

- Until the time of writing, the stablecoin was able to maintain its peg.

The stablecoin of trading platform Binance [BUSD] is in the spotlight now. Even though it is the largest cryptocurrency exchange, Binance has been repeatedly criticized. A recent report has now expressed concerns about the integrity and longevity of the the stablecoin’s peg.

Are your BUSD holdings flashing green? Check the BUSD Profit Calculator

How the stablecoin peg works

Given that Binance’s stablecoin is pegged to the dollar, the exchange must have a stockpile of U.S. dollars in a bank account. With the reserve of U.S. dollars on hand, it can guarantee that one BUSD will always be worth one USD.

Regular updates are released by the Binance exchange detailing the overall quantity of BUSD in circulation and the equivalent number of U.S. dollars kept in reserve. This is done so that users can see that there is a sufficient amount of U.S. dollars in reserve to back the whole value of BUSD in circulation and so that the system is transparent.

Unfortunately, subsequent revelations have cast doubt on the process. On 10 January, Binance disclosed that bugs in its system had resulted in at least $1 billion in under collateralization of its Binance Smart Chain BUSD supply, which was supposed to be backed one-to-one by the U.S. dollar. According to experts, the problem has already resulted in three significant deviations from its peg.

Paxos, a New York-based financial technology startup, guarantees the full collateralization of BUSD on the Ethereum blockchain in U.S. dollars. But BUSD on Binance Smart Chain is not similarly governed by an external, audited company. Binance’s USD held on its blockchains is known as Binance-Peg USD. This was according to a recent report.

The blockchain analytics firm ChainArgos, led by Jonathan Reiter and Patrick Tan, discovered that the Binance-Peg wallet on Ethereum, which was supposed to hold the stablecoins required to back all Binance-Peg BUSD, routinely held a lower balance than the amount of Binance-Peg BUSD circulating on Binance Smart Chain.

Fears about the stablecoin are warranted in light of the recent demise of Terra and FTT. However, the Binance team has yet to respond to the current reports directly.

BUSD maintains its peg amidst growing inflow

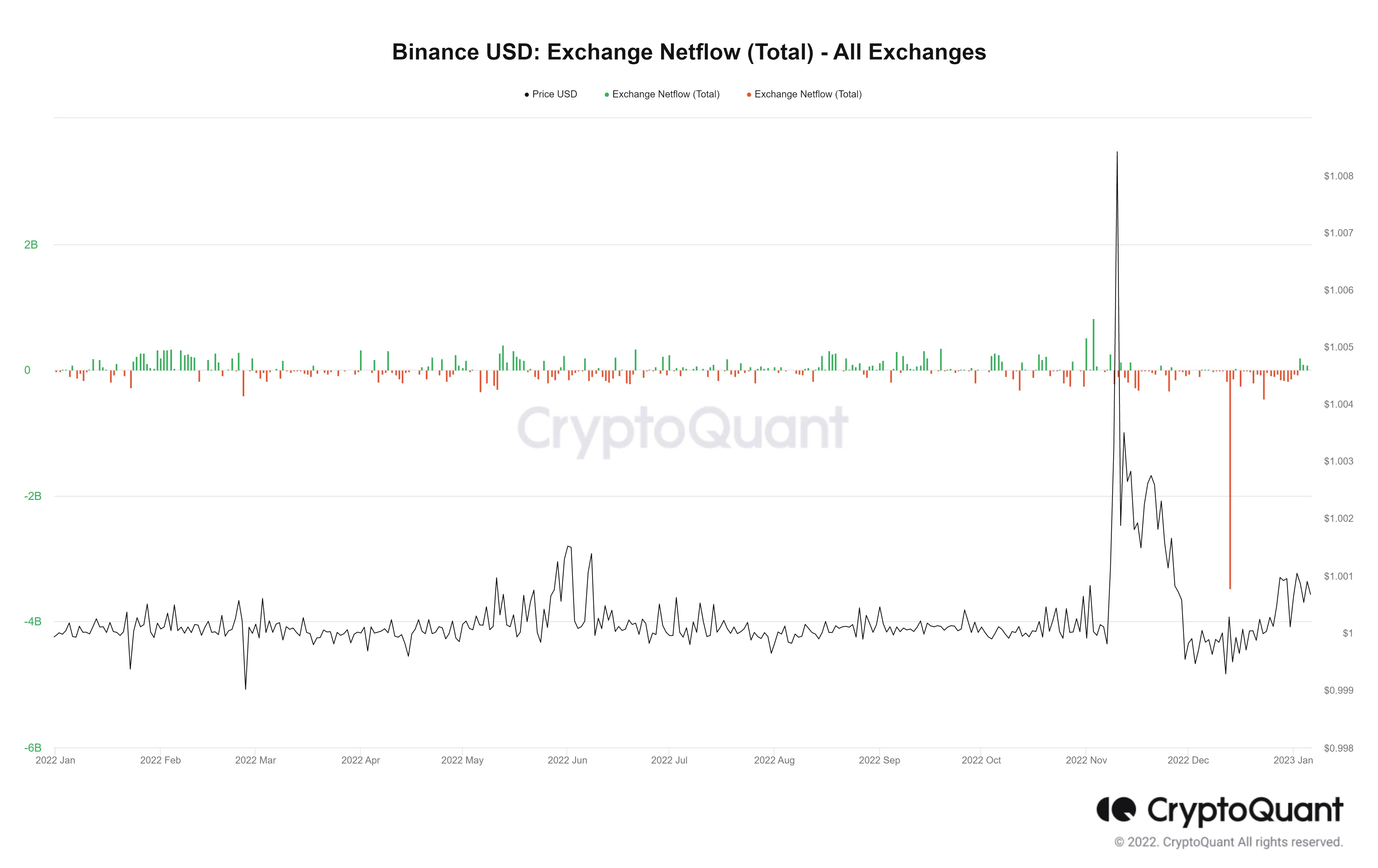

According to the Netflow metric provided by CryptoQuant, the stablecoin has suffered a slight deviation from its $1 peg, but is currently maintaining its stability. Additionally, there was a greater outflow in recent weeks. However, the trend as of late has been toward more inflow, albeit with no significant surges.