TRX continues to trend upward, here’s what buyers can look forward to

Disclaimer: The information presented does not constitute financial, investment, trading, or other types of advice and is solely the writer’s opinion.

- The higher timeframe structure remained bullish.

- A dip to the support level at $0.065 could offer a buying opportunity.

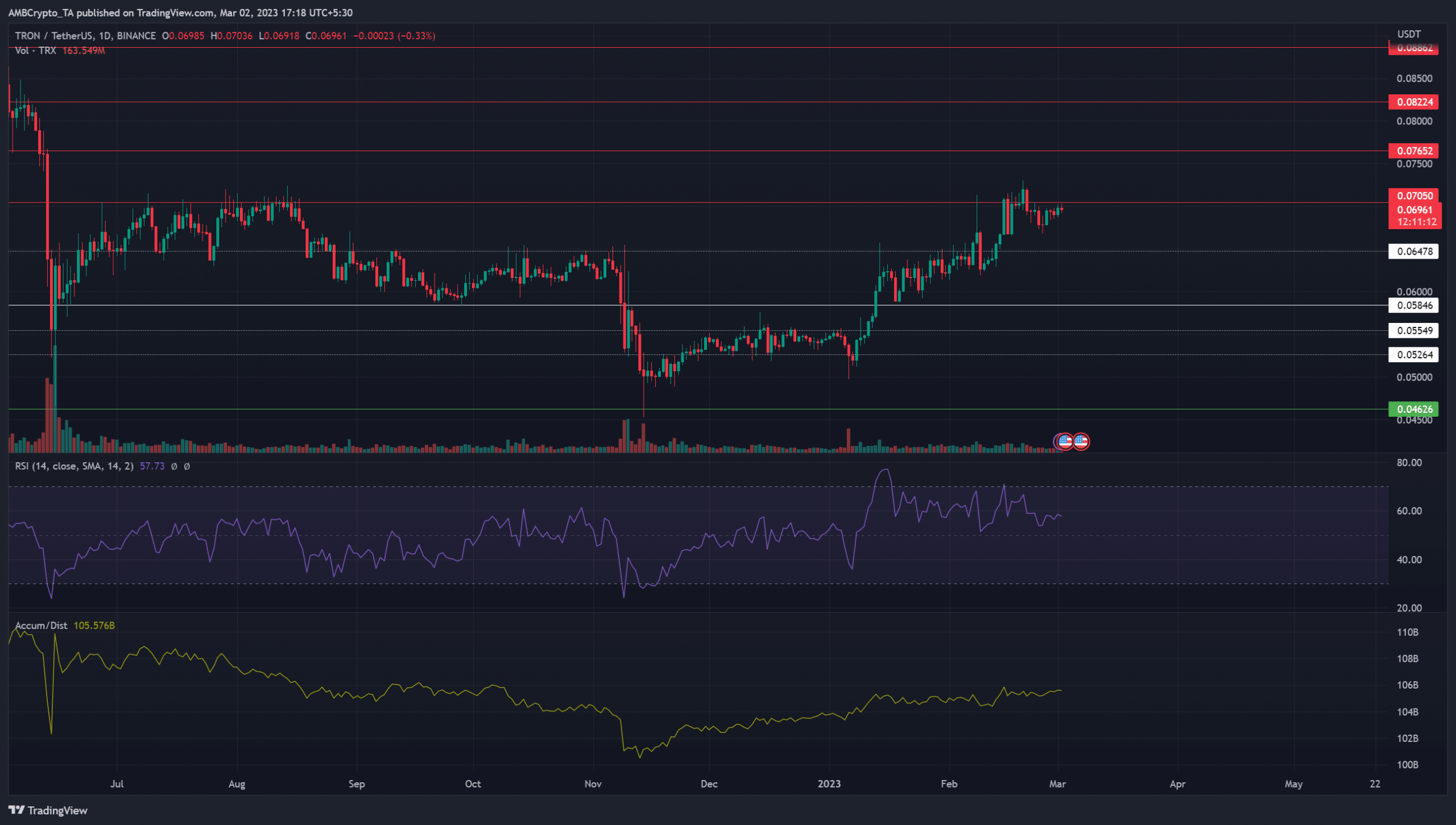

The price action of TRON [TRX] had strong bullishness behind it. The rally that began in January has not yet stopped on the higher timeframes, as TRX continued to make higher highs and higher lows.

Read TRON’s [TRX] Price Prediction 2023-24

A retest of a zone of demand to the south could offer a buying opportunity. Even though Bitcoin [BTC] saw some losses recently, TRX has performed well overall. This could be a sign of strength from the token.

Another phase of consolidation beneath resistance could see another move higher

TRON was in a clear uptrend after the breakout past $0.055 in mid-January. Even when Bitcoin faced rejection at $25.2k and fell by close to 7%, TRX saw only a 5% decline and has already ground its way upward.

An imminent level of resistance the price faced was at $0.07. It could be similar to the resistance at $0.064 that TRX consolidated beneath for close to a week. It was followed by a strong upward move on 7 February, a retest of $0.06 as support and a continuation in the uptrend.

The A/D line has moved higher and higher since December, and it was possible that the buying pressure could push prices higher. The RSI also continued to stay above neutral 50, which showed an uptrend in progress since January.

The $0.064 level has been an important resistance since September 2022, and the breakout past this level meant bulls were firmly in the driving seat. A drop below $0.058-$0.062 would be required to flip the bias to bearish. After $0.07, the next significant resistance level was at $0.076.

Realistic or not, here’s TRX’s market cap in BTC’s terms

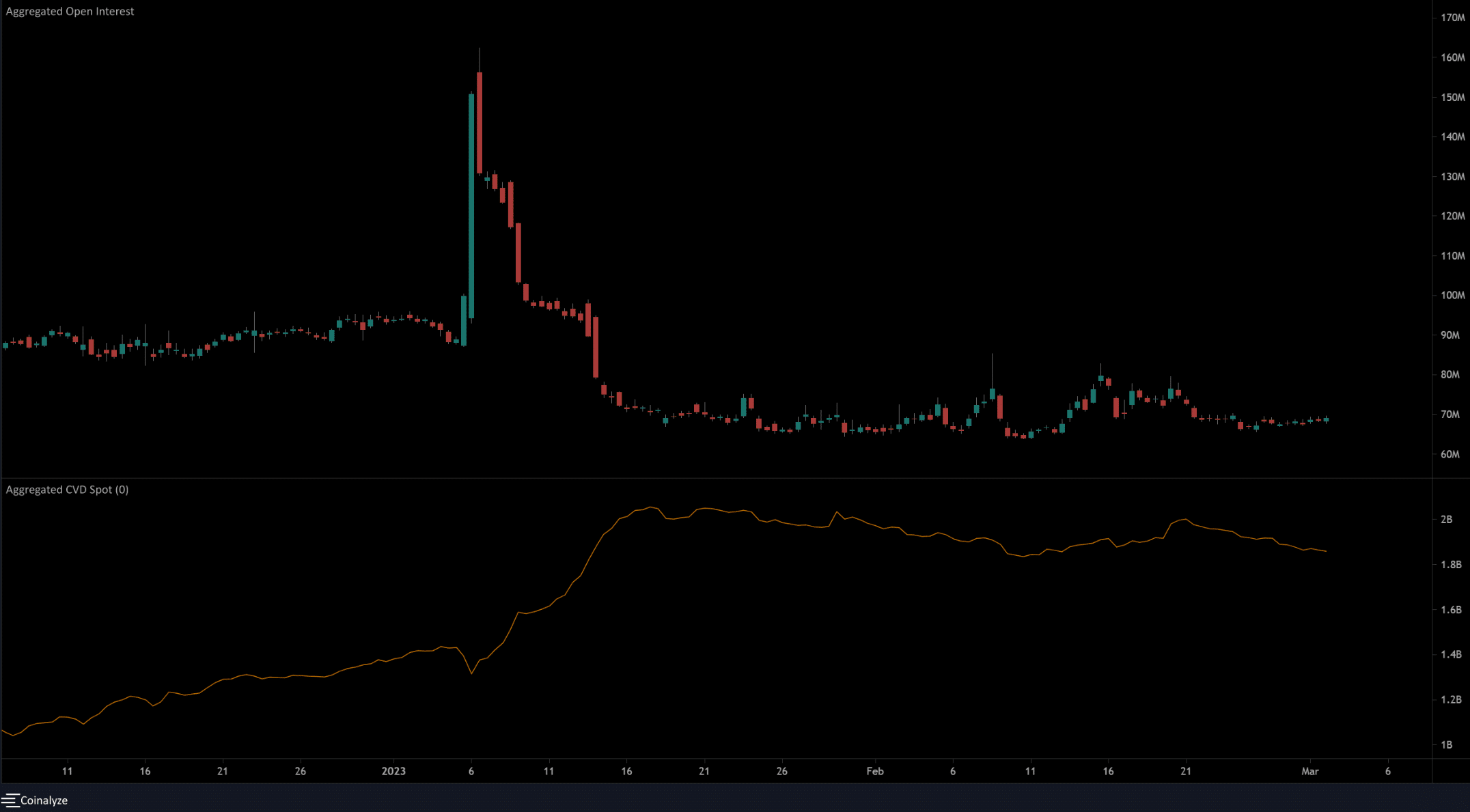

The Open Interest showed bullish sentiment but demand could be in decline

Source: Coinalyze

The moves higher on 8, 13, and 20 February measured 6.1%, 11%, and 3%, respectively. During these spikes in prices, the Open Interest also pushed higher. The retracement of these moves saw a corresponding dip in OI as well. This indicated bullish momentum was in play, and that the market participants were not interested in shorting TRX as much as buying it.

In contrast to the rising A/D line, the spot CVD has gradually declined over the past two months. The decline after 21 February was especially noticeable, which showed selling pressure on the rise.