SingularityNet [AGIX] follows BTC’s lead, traders can look for gains here

![SingularityNet [AGIX] follows BTC’s lead, traders can look for gains here](https://ambcrypto.com/wp-content/uploads/2023/03/michael-dziedzic-qDG7XKJLKbs-unsplash-scaled-e1678016272126.jpg)

Disclaimer: The information presented does not constitute financial, investment, trading, or other types of advice and is solely the writer’s opinion

- AGIX outperformed BTC in the past seven days.

- AGIX’s open interest rate surged but quickly followed BTC’s price action.

SingularityNet [AGIX] outperformed Bitcoin [BTC] in the past seven days. It appreciated by 17.5%, while BTC declined by 3.5%, thanks to the current AI hype.

At the time of writing, BTC oscillated between $22.25 – $22.44K after a sharp decline on 2 March following the Silvergate bank’s fallout with major crypto clients.

Read SingularityNet [AGIX] Price Prediction 2023-24

However, AGIX recovered swiftly and posted a 10% hike in the past 24 hours, as per CoinMarketCap. Nevertheless, it slowly took BTC’s lead and could trade sideways if the king coin’s consolidation persists.

AGIX was stuck within the 38.2% – 50% Fib levels range

On the six-hour chart, the RSI (Relative Strength Index) fluctuated above the equilibrium level after recovering from the lower range.

It shows the uptrend was limited, and the sideways structure could continue. In addition, the OBV (On Balance Volume) fluctuated too, further increasing the probability of sideways structure.

Therefore, AGIX could continue oscillating between 38.2% Fib level ($0.47538) and 50% Fib level ($0.49162) in the next few hours/days. Investors could target the range’s highs ($0.49162) and lows ($0.47538) to look for profits.

A breach of the consolidation range would invalidate the above-neutral thesis. An upside breakout could tip bulls to target the Fib levels of 61.8% ($0.50786), 78.6% ($0.53097), or the overhead resistance of $0.56042.

However, bulls could only make moves if AGIX closes above the red area (a bearish order block area on the three-hour chart).

On the other hand, bears could seek shorting opportunities at the 23.6% ($0.45530) Fib level or 0% Fib level ($0.42282) if AGIX closes below and retest the range low of 38.2% Fib level ($0.47538).

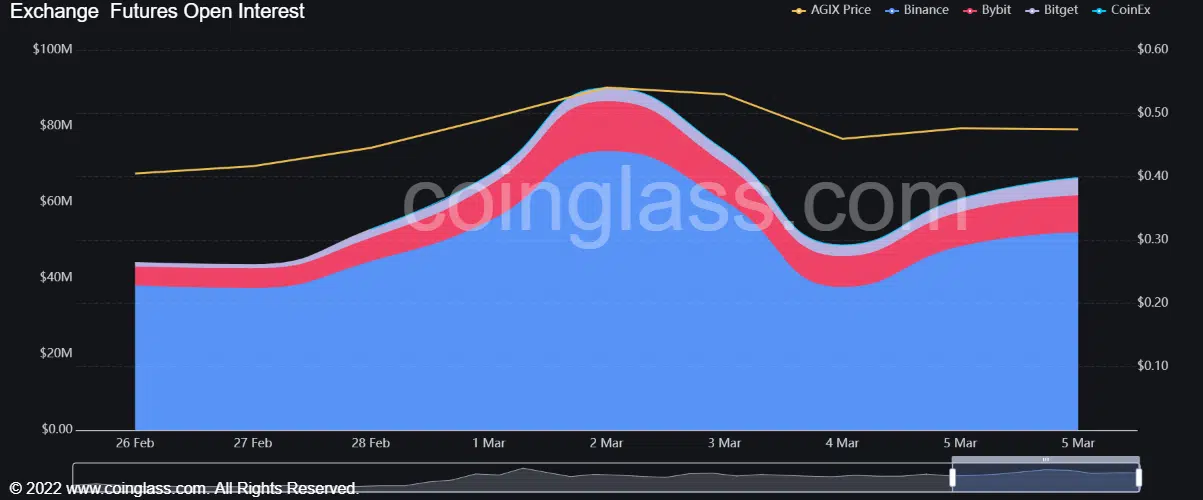

AGIX’s open interest (OI) increased

According to Coinglass, AGIX’s OI declined on 2 March but rebounded on 4 March. It underlies a bullish sentiment on the AI-centric asset in the futures market. An increase in OI and price above $0.50 could boost the bullish momentum and tip bulls to target upper resistance levels.

Is your portfolio green? Check the AGIX Profit Calculator

In addition, more than $500K worth of short-positions has been liquidated in the past 24 hours, according to Coinalyze. In contrast, only $300K of long positions were liquidated in the same period, reinforcing a mild bullish sentiment at the time of writing.

![Kusama [KSM] explodes 119% in one day - How DOT helped](https://ambcrypto.com/wp-content/uploads/2024/11/Michael-KSM-400x240.webp)