Cosmos [ATOM] shrinks to $10.58 support, here are key levels to consider

![Cosmos [ATOM] shrinks to $10.58 support, here are key levels to consider](https://ambcrypto.com/wp-content/uploads/2023/04/image-1200x900-2-1.png.webp)

Disclaimer: The information presented does not constitute financial, investment, trading, or other types of advice and is solely the writer’s opinion

- ATOM’s daily structure was bearish at press time.

- Funding rates fluctuated, offering sellers slight leverage.

Cosmos [ATOM] has dropped to a key support level of $10.58. The current level could offer an ideal buying opportunity if ATOM bulls defend the support. Notably, ATOM corrected by 18% after facing price rejection at $12.94, as sellers dominated the market.

Read Cosmos [ATOM] Price Prediction 2023-24

Meanwhile, Bitcoin’s [BTC] sharp correction has unnerved altcoin holders as most gains made in the first half of April have been erased. For example, ATOM rallied 12%, hitting $13, only to drop to its March swing lows of $10.6 after BTC’s correction.

Will $10.58 hold again?

The stochastic RSI dipped into the oversold zone on the daily chart, suggesting that sellers may take a break soon. Similarly, the RSI faced rejection at 40-mark at press time – pointing to likely building buying pressure.

In addition, the ADX (Average Directional Index) moved slightly upwards, reiterating that a recovery could be likely.

If that’s the case, ATOM could rebound from $10.58 and target the local supply zone of $13. However, bulls must clear the dynamic resistance hurdles at 50-EMA and 200-MA.

Ergo, a pullback retest or long wicks (similar to the ones seen around 10 March) could confirm a potential recovery and signal a buying opportunity.

A daily close below $10.58 will invalidate the bullish thesis above. The downswing could set ATOM to more aggressive selling and sink the asset to January lows of $9.45 or December swing low of $8.56. These levels can act as short-selling targets in such a downtrend scenario.

Funding rates fluctuated

Is your portfolio green? Check ATOM Profit Calculator

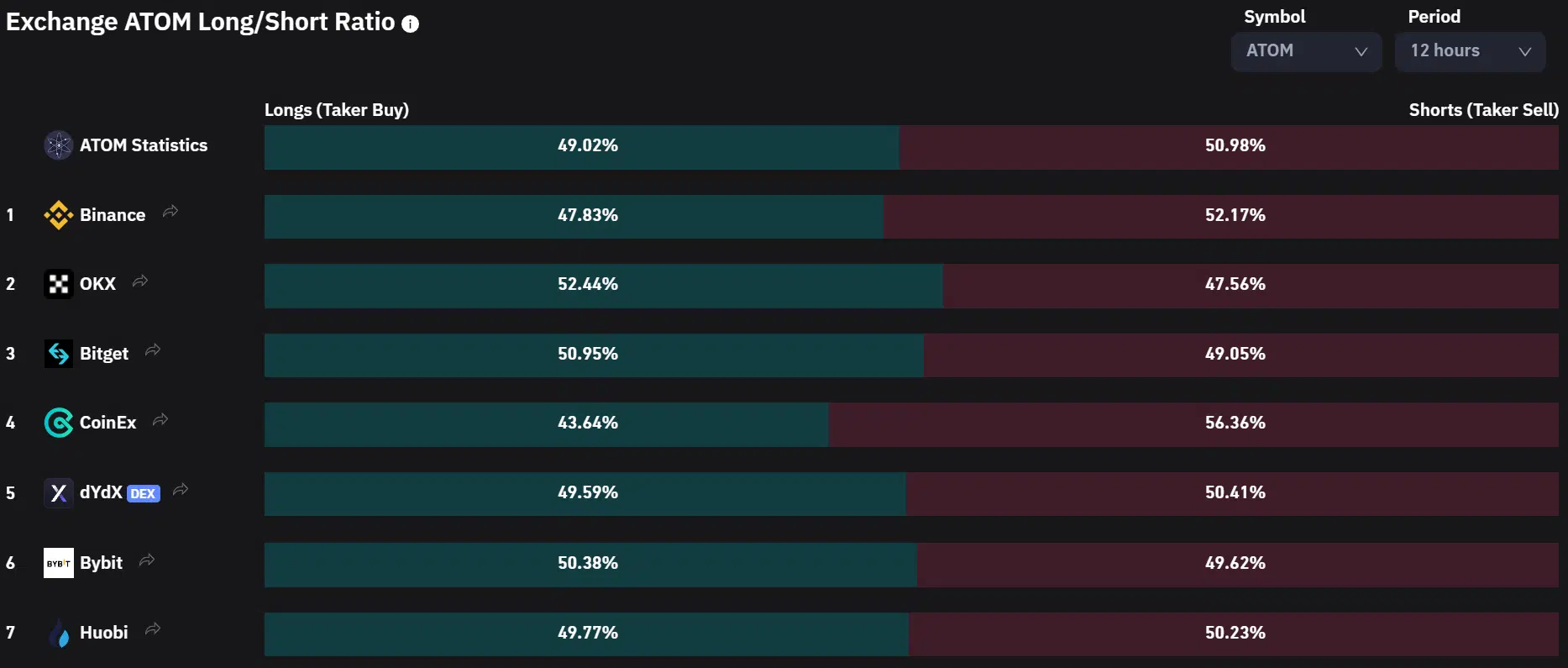

From 20 April, ATOMs sustained fluctuating funding rates – an indication of wavering demand in futures markets. Fluctuating demand could tip sellers to gain more leverage in the market. In addition, the exchange long/short ratio showed sellers had a little upper hand in the mid and long-term prospects.

However, BTC recovery could sweep sellers off their positions and tip ATOM for a recovery. Hence, investors should track BTC price action and overall ATOM sentiment before making moves.