Why ARB could have investors worried despite much cheer around Arbitrum

- Arbitrum witnesses a high amount of user retention on its protocol.

- Despite the positive performance of the protocol, the ARB token’s price continues to decline.

Over the last few months, Arbitrum garnered significant attention due to its much-anticipated airdrop. Due to the increased level of attention, the overall activity on the protocol surged.

However, even after the airdrop was launched, the activity remained consistent with the protocol and did not drop much.

Is your portfolio green? Check out the Arbitrum Profit Calculator

The Arbitrum protocol’s high consistency in terms of activity can be attributed to its remarkably high user retention rate. Recent data revealed that new users constitute merely 18% of the total user base, while the remaining 72% are recurring users.

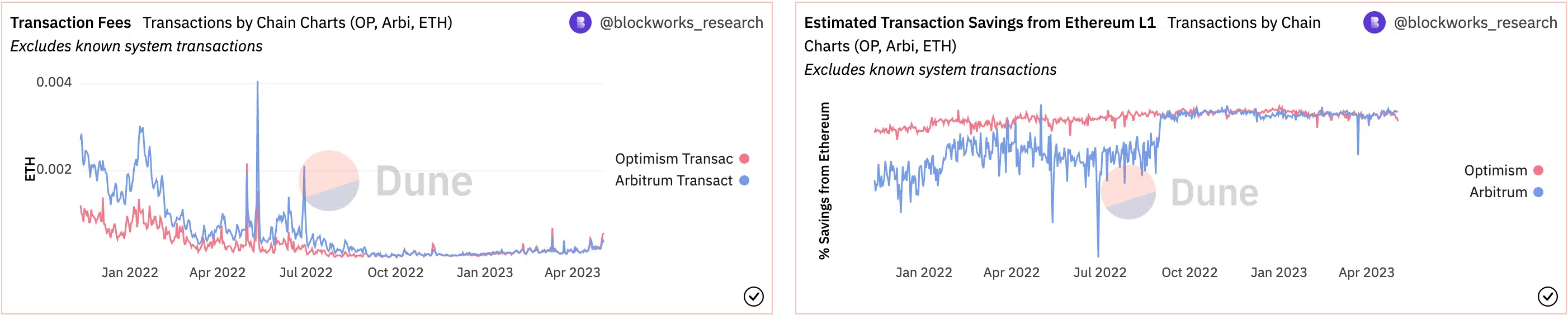

One of the reasons why Arbitrum has managed to retain a high number of users on its network is the fact that it is able to save large amounts of ETH for its users. According to Dune Analytics’ data, Arbitrum users saved around 93.5% of ETH while they were using the Arbitrum protocol.

This was due to the low transaction fees on the Arbitrum network.

However, the high retention rate of Arbitrum could be threatened soon.

Are things taking a turn?

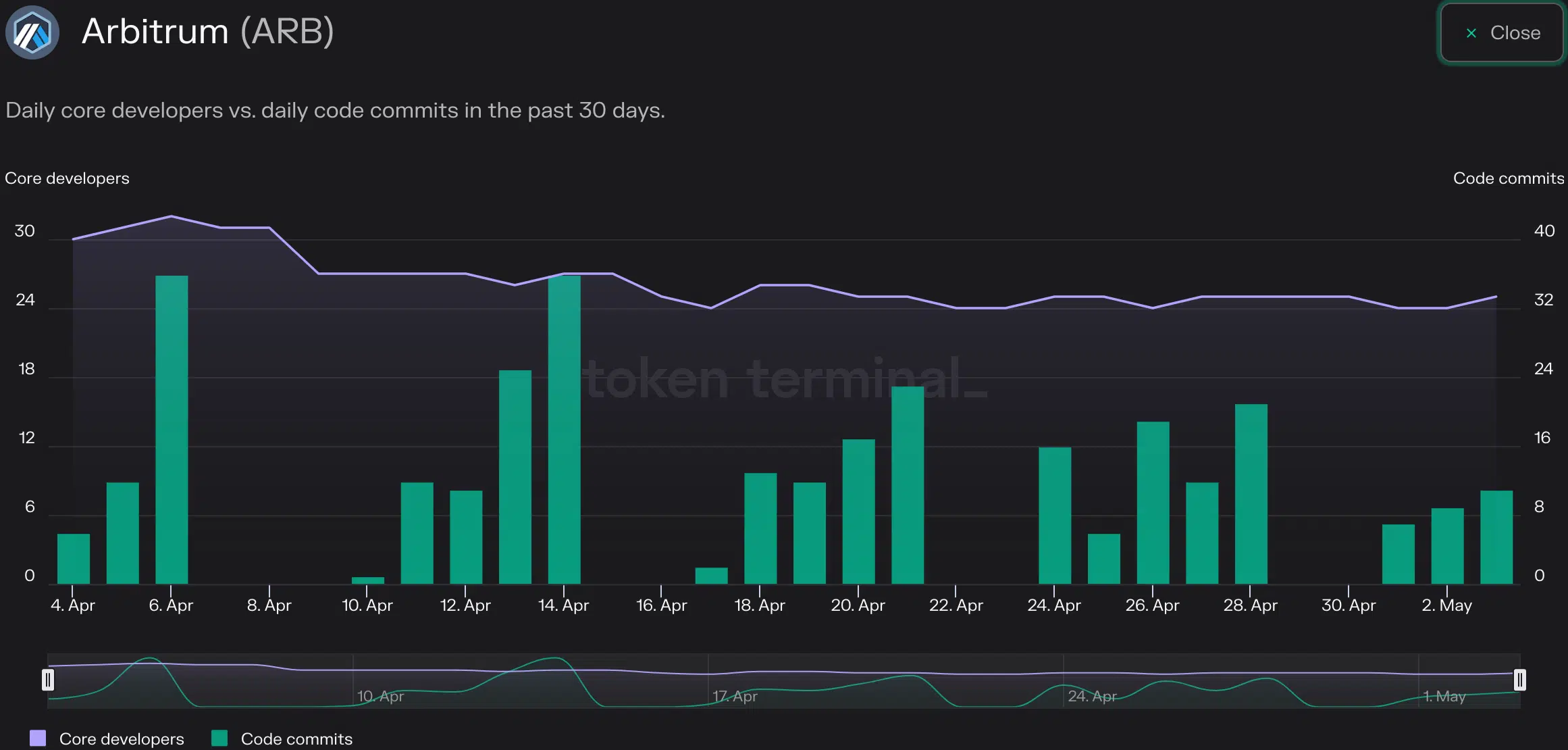

Based on data from token terminal, the number of code commits being made to Arbitrum’s GitHub started to fall. Additionally, the overall number of core developers on the network also declined.

A decline in development activity could mean that there would be fewer upgrades and updates on the protocol. Arbitrum’s competitors, such as Optimism and Polygon, could use this to their advantage and attract users to their protocols instead.

Things get macARBe

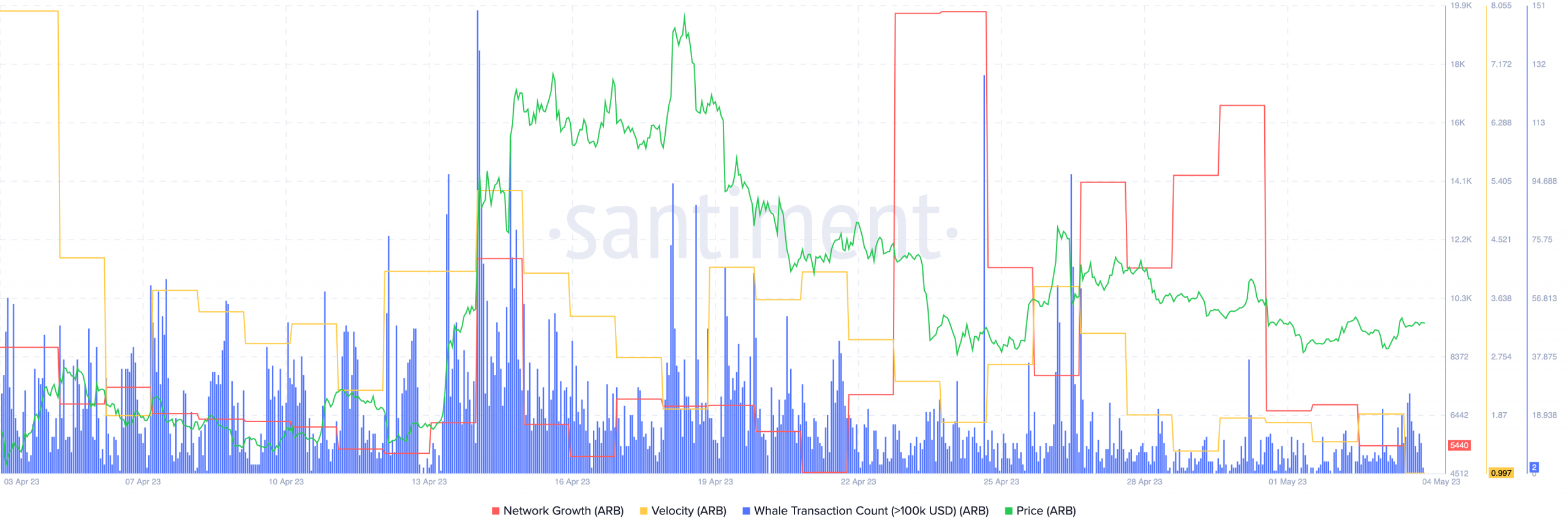

Coming to the ARB token, the price of ARB started to decline over the past few days. Along with the decline in price, the network growth of ARB also began to fall.

This indicated that new addresses were not as interested in the ARB token. During this period, the velocity of ARB also took a hit. A decreasing velocity meant that the frequency with which ARB was being traded significantly declined.

Realistic or not, here’s ARB market cap in BTC’s terms

The falling velocity of Arbitrum could be attributed to the decline in interest in ARB from whales. According to Santiment’s data, the overall ARB whale transactions fell immensely over the last few weeks.