ADA’s recovery wavers near $0.3950 – Here are key levels to consider

Disclaimer: The information presented does not constitute financial, investment, trading, or other types of advice and is solely the writer’s opinion

- Recovery stalled near moving averages.

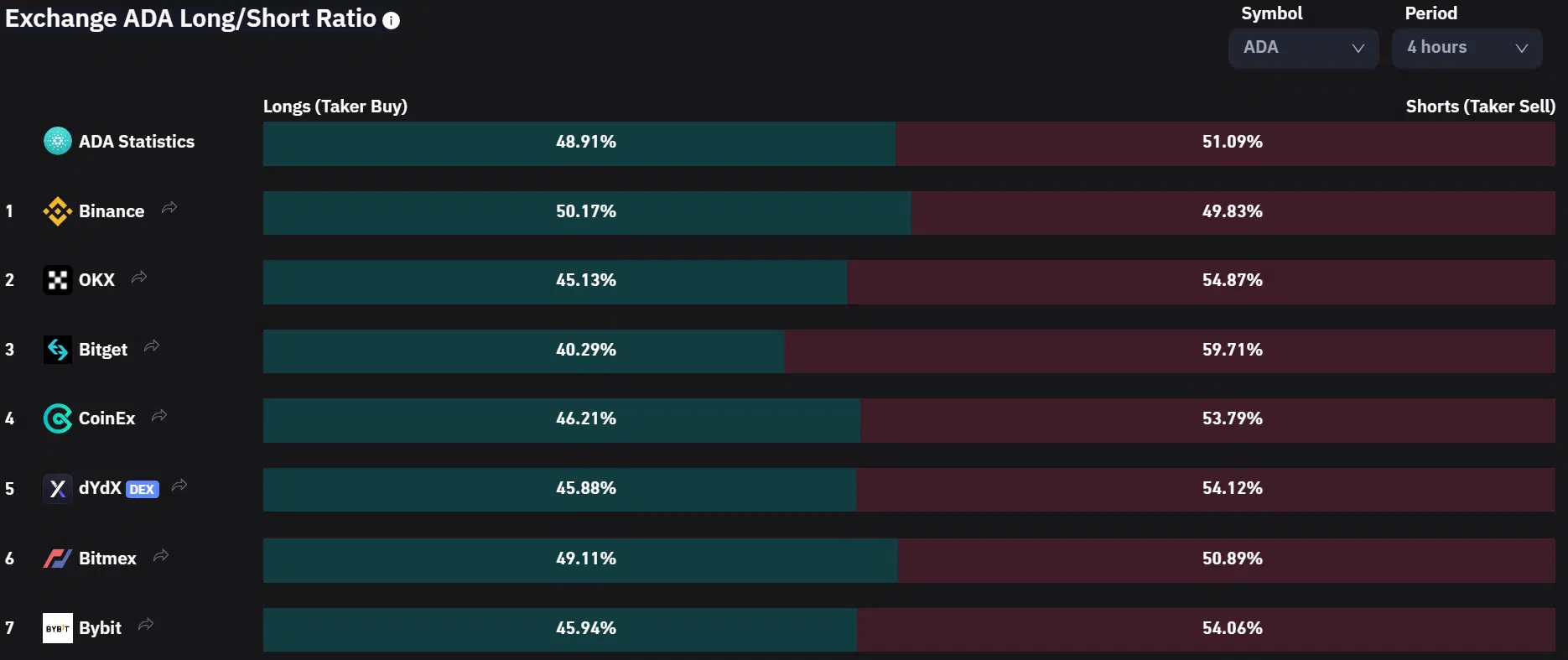

- The overall futures market was overly bearish.

After the Fed rate hike, the crypto market saw some choppiness. By the time of writing, Cardano [ADA] struggled to go beyond $0.3950. Similarly, Bitcoin [BTC] had surged to $29k only to fall back to $28k within hours on 4 May.

Is your portfolio green? Check ADA Profit Calculator

On the other hand, the futures market was extremely bearish. About $14 million worth of long positions have been wrecked in the past four hours, Coinglass data revealed.

In the same period, only $1.7 million worth of short positions were liquidated – reinforcing the short-term bearish pressure. The downward pressure could push ADA to these levels.

Can sellers fill in the FVG gap?

During ADA’s rally on 4 May, it left an imbalance and Fair Value Gap (FVG) within $0.386 – $0.390 (white). At press time, price action faced rejection at the moving averages (50-EMA and 200-EMA). The drop headed to the FVG.

If the FVG is filled and the price rebound from this level, ADA/USDT pair could attempt to clear the hurdle near the moving averages ($0.3950) and target the bearish order block (OB) at $0.4114.

Conversely, if the price falls below FVG and retests the $0.3750 support, the pair could also rally to the bearish OB at $0.4114 if the $0.3750 support remains steady. The latter will offer the best risk ratio compared to the former.

But a close below $0.3750 will invalidate the above bullish bias. Such a move could sink ADA to $0.3490 or $0.3400.

Meanwhile, the Relative Strength Index (RSI) hovered near the 50-mark, reiterating a neutral position – the price could go in either direction. But the OBV had an uptick – an indication of increased demand in the past few hours.

Sellers had slight leverage

How much are 1,10,100 ADAs worth today?

Based on Coinglass’s exchange long/short ratio, shorts dominated at 51.09% while longs trailed at 48.91%. It means sellers had the upper hand and could drive ADA’s price down.

Similarly, over $73k worth of long positions were liquidated in the past four hours, while shorts suffered zero casualties. It paints a short-term bearish outlook that could sink ADA lower. However, sellers must clear the FVG zone of $0.386 – $0.390 to gain leverage.