Former Coinbase manager gets sentenced to prison for insider trading

- The main perpetrator of the Coinbase insider trading scandal was sentenced to 2 years in prison

- The convicted’s brother was also sentenced to prison earlier this year, while the third accused is still at large

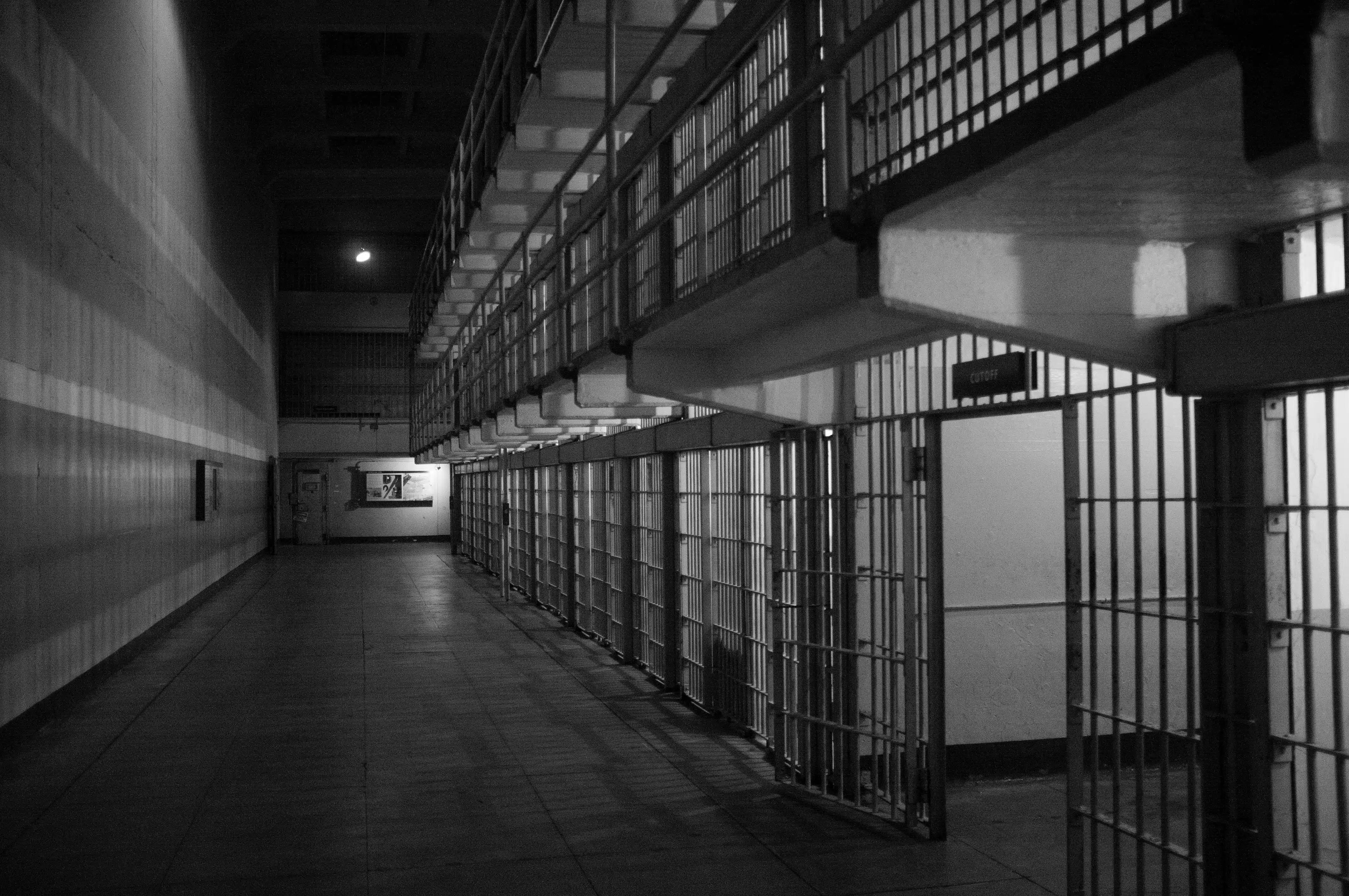

Ishan Wahi – former Coinbase product manager – has been sentenced to prison by U.S. prosecutors on 9 May. According to a report by Reuters, Judge Loretta Preska sentenced Wahi to two years in prison.

The former manager has been convicted of charges related to insider trading. Notably, this is the first insider trading case related to the cryptocurrency market. The case involved three men who made profits based on material information about the tokens listed on Coinbase.

The case hit the spotlight in July 2022, with the US Securities and Exchanges Commission (SEC) and Commodities and Futures trading commission (CFTC) chiming in on the matter.

Others involved in the Coinbase fiasco

It is, however, not the first sentencing related to it. In January 2023, a US court sentenced Wahi’s brother to prison for the same crime. The brother identified as Nikhil Wahi was sentenced to 10 months in prison.

He was also accused of trading in cryptocurrencies based on the inside knowledge he gained from his brother. This, eventually, resulted in him pleading guilty to conspiring to commit wire fraud.

Notably, the third-person accused is yet to come under the grasp of law enforcement agencies. Additionally, the person identified as Sameer Ramani and was reported to be the friend of Ishan Wahi. The three had made a profit of $1.5 million from insider trading and had traded 25 digital currencies prior to its listing.

While a verdict on the insider trading case has been passed, some key statements are yet to be sealed. In its insider trading lawsuit, the SEC claimed that nine tokens that were traded by the accused were securities.

This included tokens like Powerledger (POWR), Kromatika (KROM), and DerivaDAO (DDX). Coinbase, however, dismissed this claim by labeling it as an “unfortunate distraction”.

Subsequently, this is not the only insider case related to the crypto exchange. Just recently, an investor accused the top executives and board members of profiting off of investors. The lawsuit even accused Brian Armstrong – Coinbase CEO. The main claim of the lawsuit was that these individuals sold a substantial amount of shares before negative news was released to the public.