Bitcoin reclaims $28.2k, whales show excitement by…

- Bitcoin rallied, causing whales to accumulate BTC.

- Miners saw selling pressure while traders turned bearish.

In recent days, the cryptocurrency market has experienced a notable resurgence, spearheaded by Bitcoin’s [BTC] recovery and successful reclamation of the $28.2k price level.

Is your portfolio green? Check out the Bitcoin Profit Calculator

Whales show interest

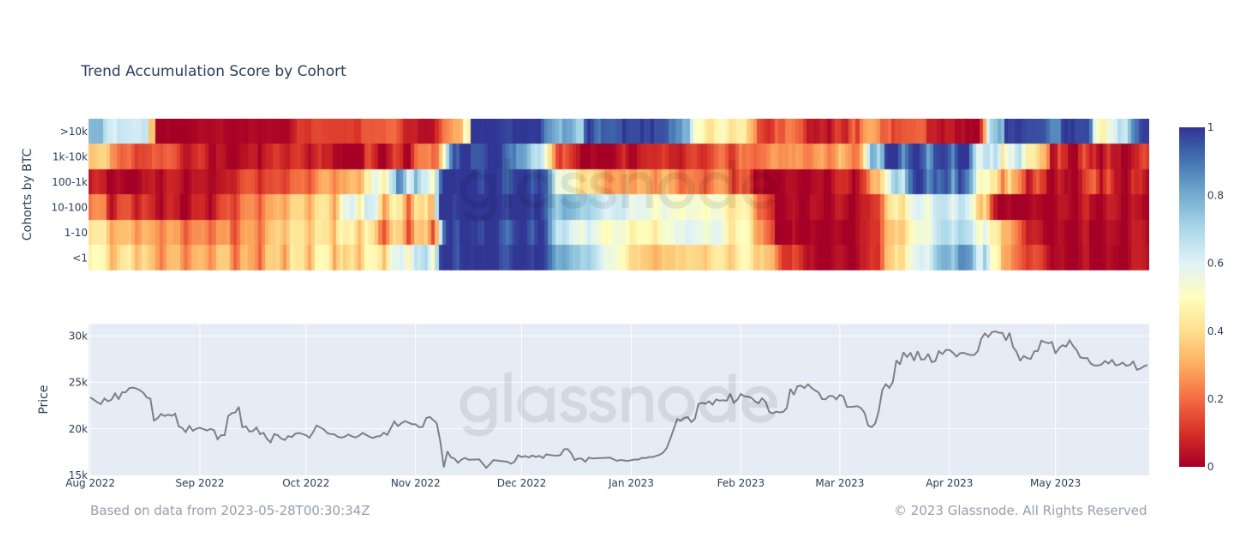

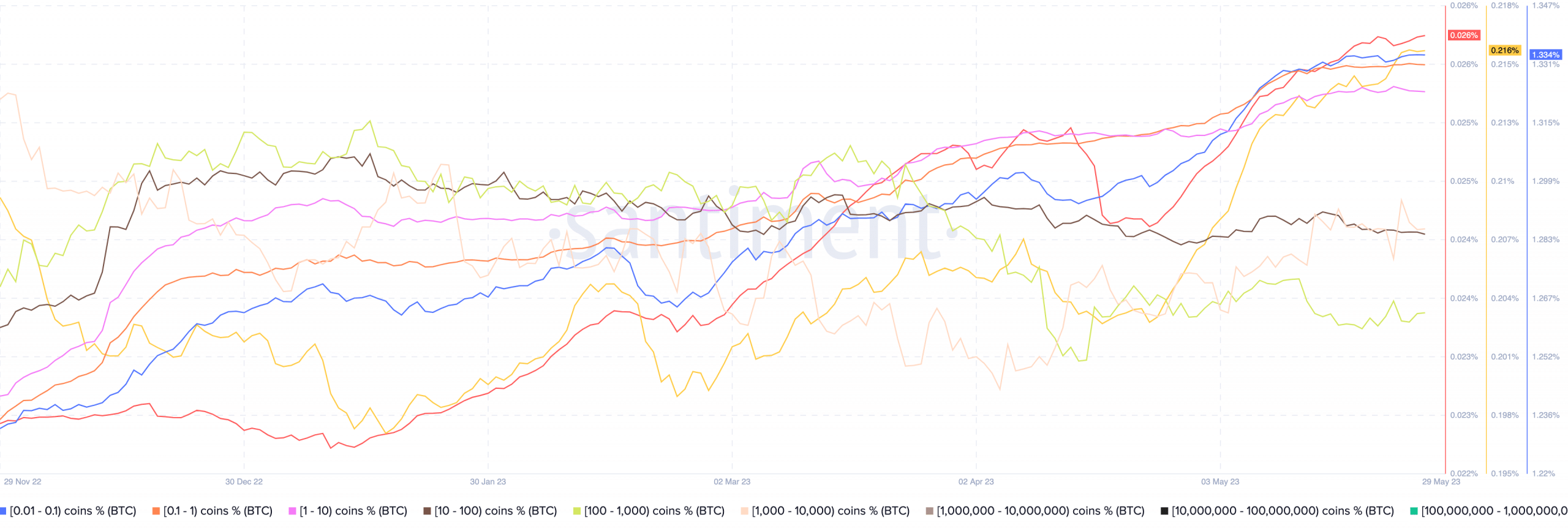

The spike in price was preceded by a rise in Bitcoin’s activity, which occurred over the weekend. However, other factors such as whale behavior also impacted BTC’s price. According to Glassnode’s data, the accumulation of BTC by whales over the last few months grew consistently.

In terms of distribution, an overwhelmingly large majority of BTC is currently being held by addresses holding 10-10,000 BTC. Increased accumulation by whales may help improve BTC’s price going forward. However, it would make retail investors much more vulnerable to whale behavior, which could, in turn, cause large price fluctuations.

Despite the high concentration of BTC held by whales, retail investors have shown the same level of interest in terms of accumulating BTC as the whales.

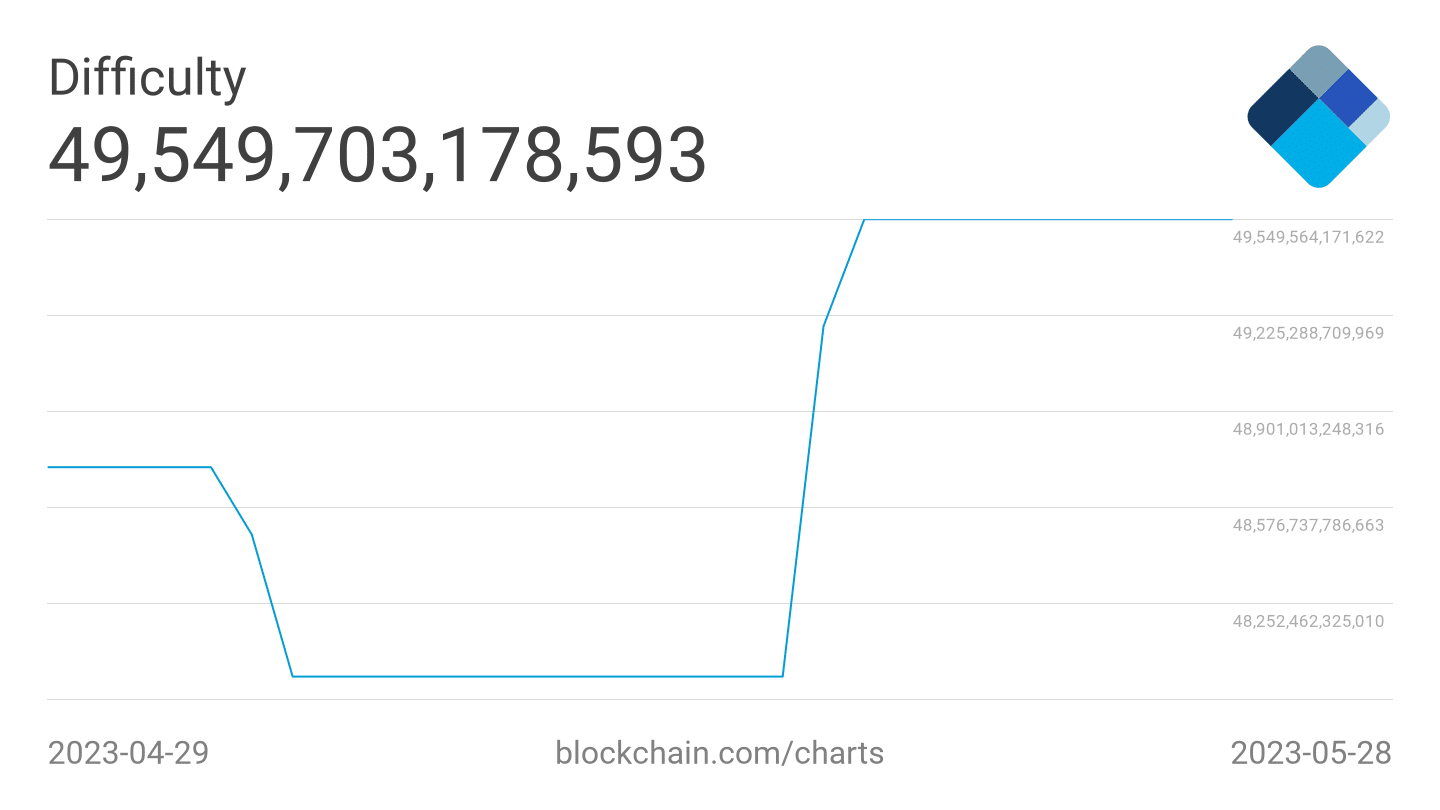

However, miners may not show the same enthusiasm for BTC despite the rising prices of Bitcoin. According to BTC.com, miner revenues have plummeted from $41.74 million to $29.01 million over the past month. Coupled with that, the difficulty of Bitcoin mining has continued to increase materially in the same period.

With increased difficulty, miners need to invest more computational power and resources to mine BTC, which can lead to higher electricity costs and reduced mining profitability.

High difficulty levels make it more challenging for individual miners to compete and receive block rewards, potentially forcing smaller miners out of the network and consolidating mining power in the hands of larger and more resourceful operations.

The declining profits made by miners could force them to sell their BTC to stay afloat. The increasing selling pressure on these miners may impact BTC’s price negatively in the future.

Read Bitcoin’s [BTC] Price Prediction 2023-2024

Bitcoin traders turn bearish

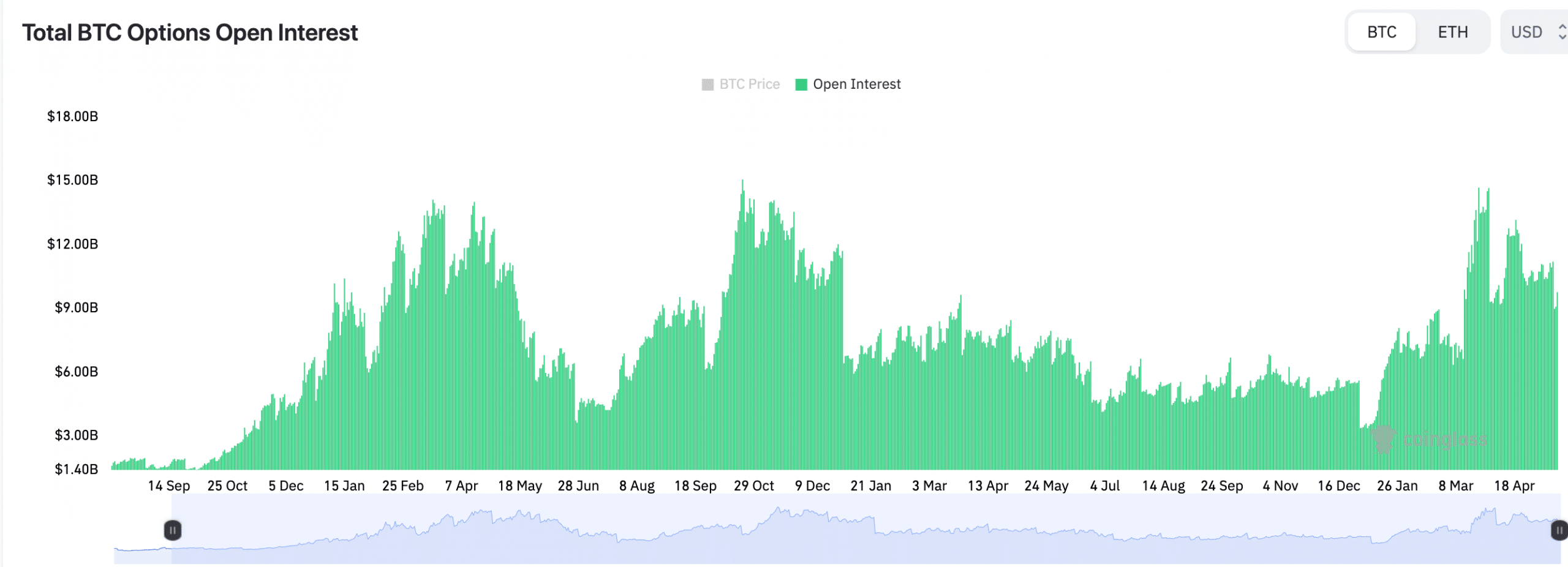

Despite the volatility experienced by BTC over the last month, the open interest in Bitcoin options continued to rise. Additionally, bearish sentiment around BTC also observed a spike. This was showcased by Bitcoin’s increasing put-to-call ratio.

Over the last few days, the put-to-call ratio for BTC increased from 0.42 to 0.48 according to TheBlock’s data.