BTC’s latest rally is good news, but for how long?

![This is what investors should expect out of Bitcoin’s [BTC] latest bull rally](https://ambcrypto.com/wp-content/uploads/2023/06/BTC-2.png)

- BTC’s funding rate declined just before it started its recent bull rally

- Bitcoin’s derivatives market indicators were bullish, as were other on-chain metrics

Bitcoin [BTC] surprised investors with price gains, which earlier took a blow. The SEC vs. Binance episode caused trouble in the crypto space, because of which almost the entire market witnessed a slight price correction.

To clear the air, the SEC recently accused Binance and its founder, Changpeng Zhao, of operating a web of deception. Due to this, the government watchdog charged Binance with 13 offenses.

Is your portfolio green? Check the Bitcoin Profit Calculator

A look at the scenario

Though BTC’s weekly price action was marginally red, its value increased by more than 4% in the last 24 hours. According to CoinMarketCap, at the time of writing, BTC was trading at $26,856.52 with a market capitalization of over $520 billion.

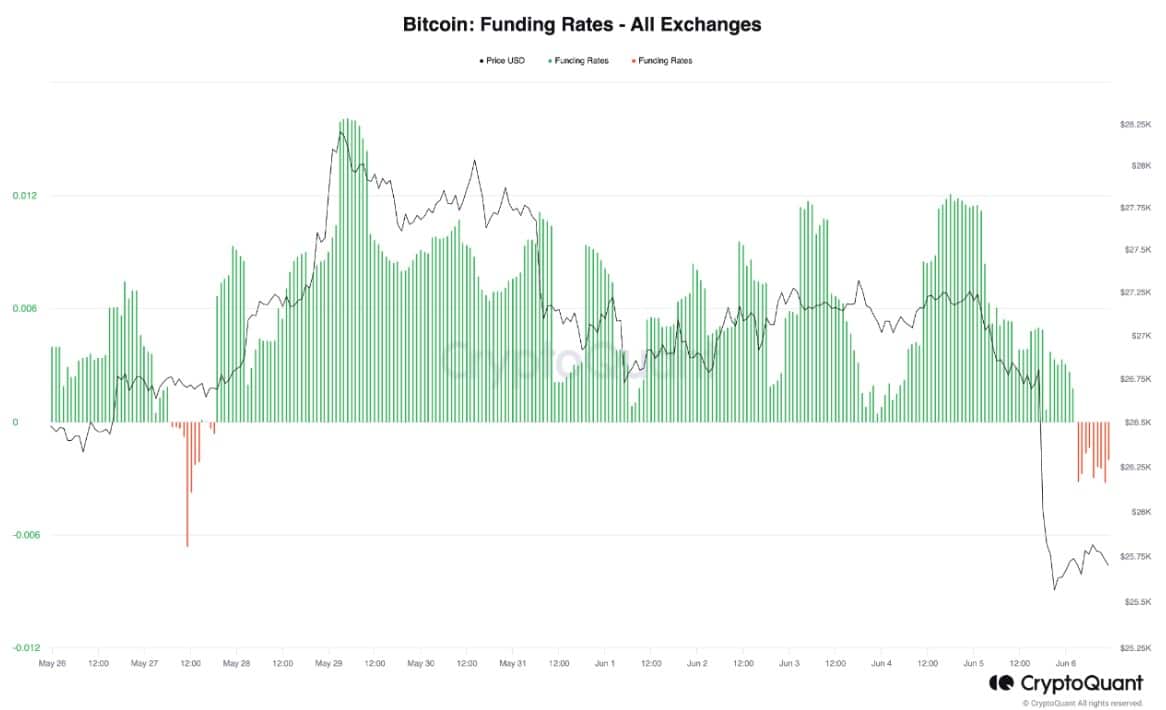

CryptoQuant’s recent analysis pointed out an interesting development that was happening at the time BTC’s price was getting ready for the latest pump. Eralp Buyukaslan, an author and analyst at CryptoQuant, revealed in his latest analysis that this could have played a role in the bull rally.

Retail investors’ short positions have been increasing dramatically for hours. While BTC’s price dropped, its funding rate turned negative. Historically, BTC’s price has moved at the opposite rate of its funding rate.

The derivatives market gave many hints

A look at Coinglass’ data revealed that BTC’s open interest was on a declining trend. A plummet in the metric generally means that the market will witness a trend reversal, and that’s what happened this time as Bitcoin’s price went up.

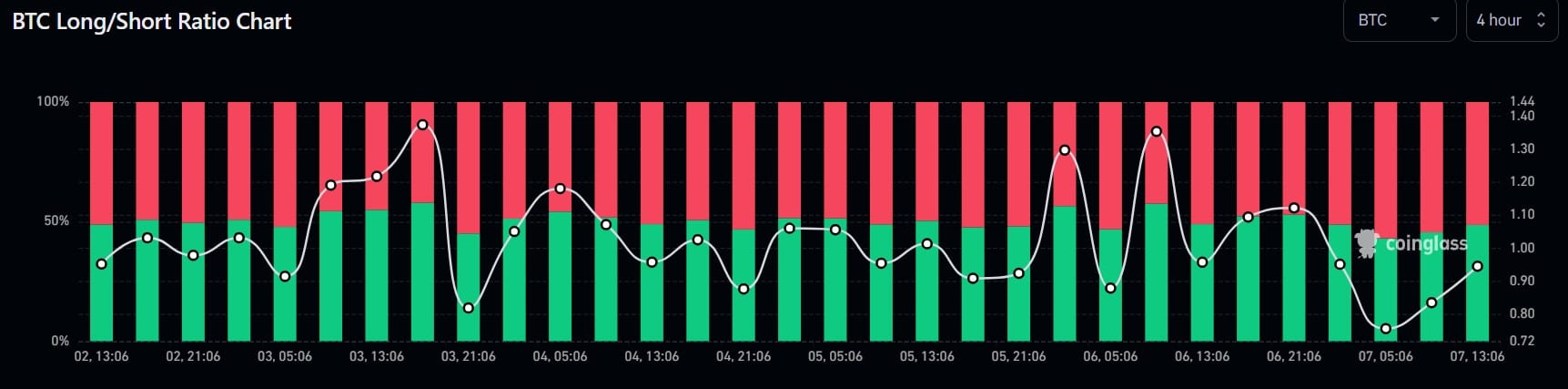

In addition to that, BTC’s long/short ratio also registered an uptick. A high long-short ratio indicates positive investor expectations, giving hope for a continued uptrend in the coming days. BTC’s taker buy/sell ratio was also green, suggesting that buying sentiment was dominant in the derivatives market.

Bitcoin investors are now confident

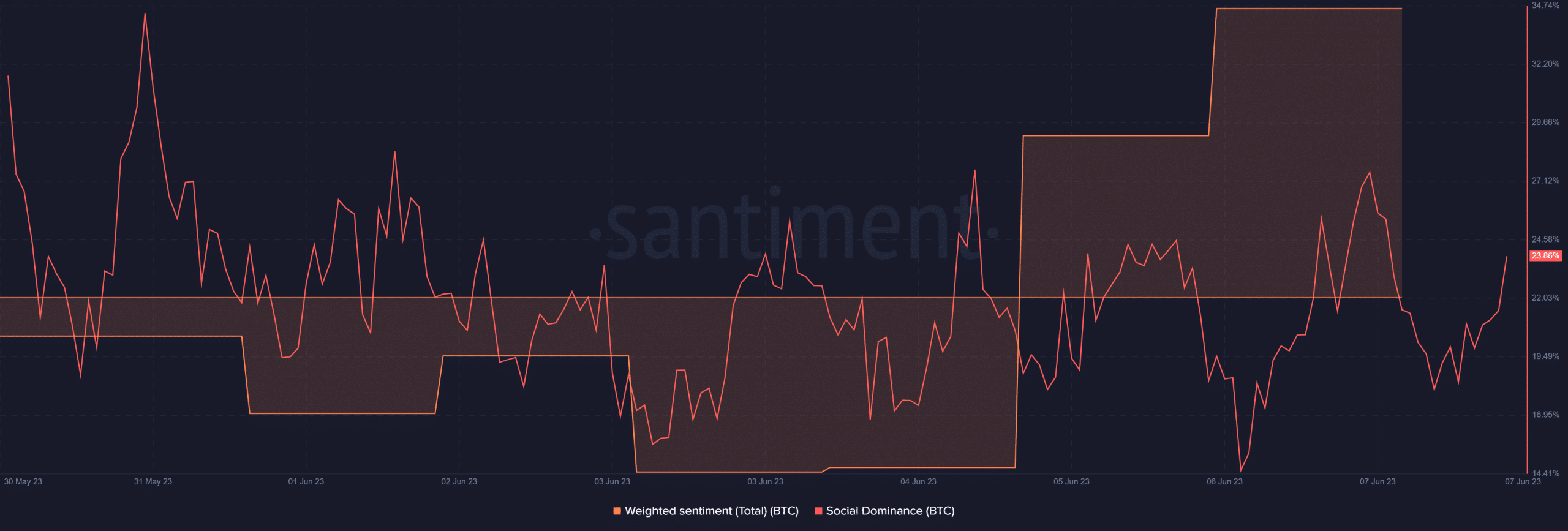

Thanks to the uptick, market sentiment around BTC turned positive. This was evident from the rise in BTC’s weighted sentiment. However, it was interesting to see that its popularity declined as its social dominance went down over the last week.

Read Bitcoin’s [BTC] Price Prediction 2023-24

What on-chain data has to say

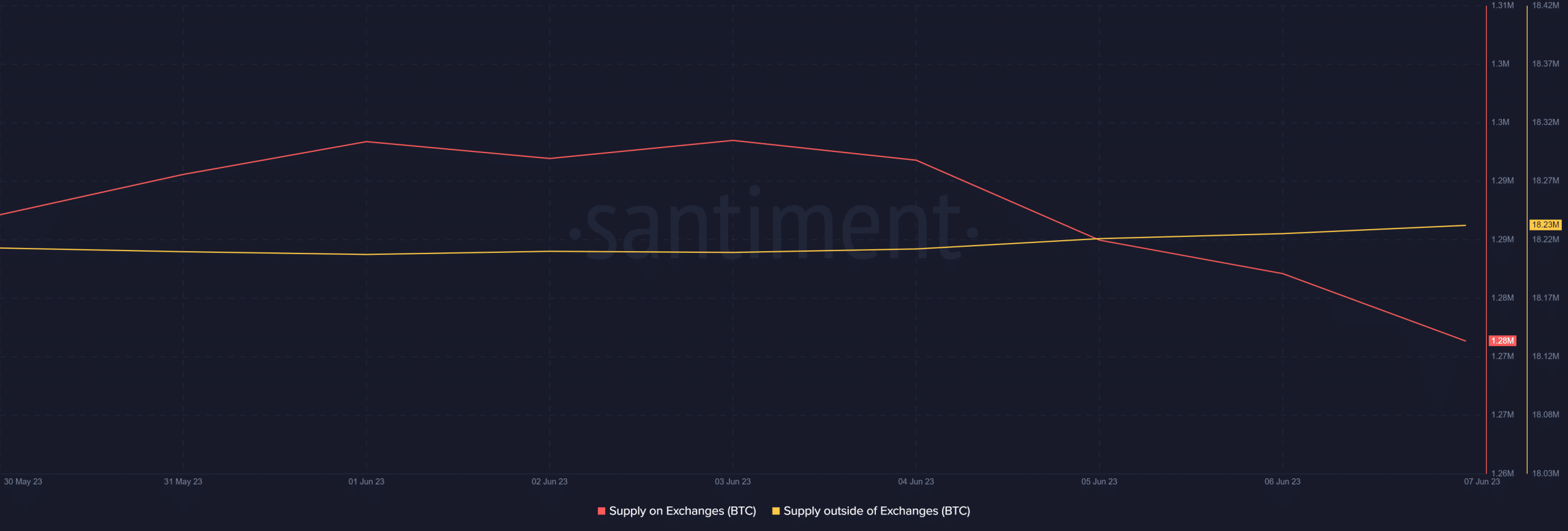

A look at CryptoQuant’s data revealed that Bitcoin was not under selling pressure. The coin’s exchange reserve was decreasing, which is a typical bullish signal.

Furthermore, BTC’s supply on exchanges declined while its supply outside of exchanges went up. BTC’s binary CDD pointed out that long-term holders’ movements in the last seven days were lower than the average. This reflected their willingness to hold their assets.