The liquid staking space is booming – Here’s a close look

- While Ethereum’s liquid staking gained popularity, its price remained under the $1,600 mark.

- Solana, on the other hand, registered growth both in terms of LSTs and price action.

Messari recently posted an analysis giving insights into the current liquidity staking market. The analysis mentioned that 2023 has been led by the meteoric rise of liquid staking protocols, especially by Ethereum [ETH] and other emerging protocols within Solana [SOL] and Cosmos [ATOM].

Read Ethereum’s [ETH] Price Prediction 2023-24

A look at Ethereum’s state in liquid staking

Recently hitting an all-time high of $22 billion, the vast majority of liquid staking TVL was on Ethereum.

As per Messari’s recent repost, liquid staking has become Ethereum’s largest DeFi sector by far. Liquid staking tokens, and specifically Lido’s stETH, are becoming further entrenched within Ethereum’s DeFi ecosystem, in competition with native ETH.

Liquid staking is now Ethereum's largest DeFi sector by far.

Further, liquid staking tokens, and specifically Lido's stETH, are becoming further entrenched within Ethereum's DeFi ecosystem, in competition with native ETH. stETH's monetary value rivals ETH as it inherits ETH's… pic.twitter.com/617WlwfvHY

— Messari (@MessariCrypto) October 10, 2023

In fact, nearly 22% of all ETH is staked, with Lido leading the way with a 32.2% market share.

According to Messari’s report, Lido accounts for nearly 90% of all ETH in liquid-staking derivative protocols. Lido applies a 10% fee on all staking rewards, split with 5% provided to node operators and 5% received by the DAO Treasury.

Lido’s achievement was also reflected in its wstETH, as its supply has grown from 1 million to 3 million since the beginning of 2023.

Apart from Lido, Maker also recently announced the off-boarding of rETH-A in their main legacy vault by consolidating it in smaller vaults with lower costs.

The consolidation of voting power and staking possibilities worries the Maker community, even though it doesn’t completely eliminate rETH exposure in DAI collateral vaults.

Ethereum’s performance is not on point

While ETH’s liquid staking space reached new highs, Ethereum investors were worried as the token’s price action turned bearish.

As per CoinMarketCap, ETH was down by more than 4% over the last seven days. At the time of writing, ETH was trading at $1,577.24 with a market capitalization of over $189 billion. Its trading volume also dropped along with its price, reflecting a lower willingness of investors to trade the token.

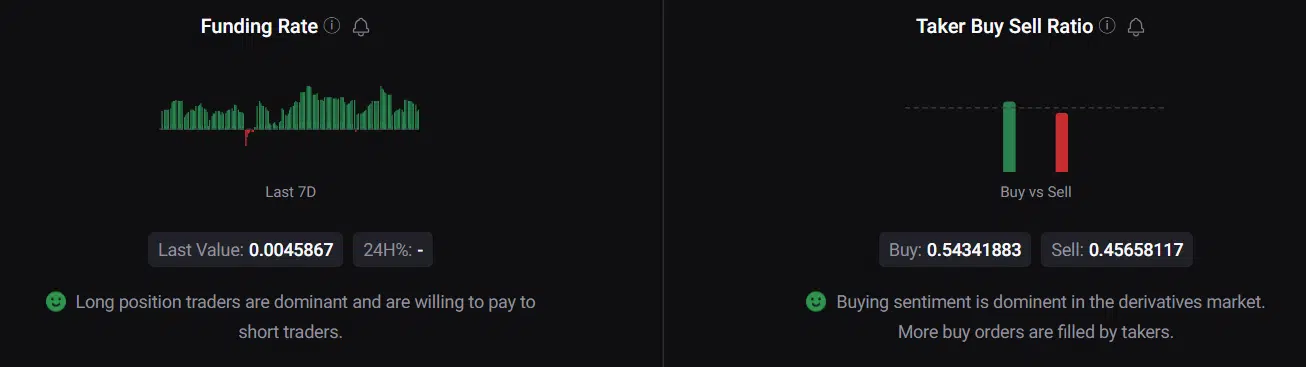

According to CryptoQuant, ETH’s exchange reserve was also increasing, suggesting that the high selling pressure can further push the price down in the days to follow. However, its derivative statistics looked optimistic as its funding rate was green.

Moreover, Ethereum’s taker buy/sell ratio pointed out that buying sentiment was dominant in the futures market.

Solana’s liquid staking ecosystem is also growing

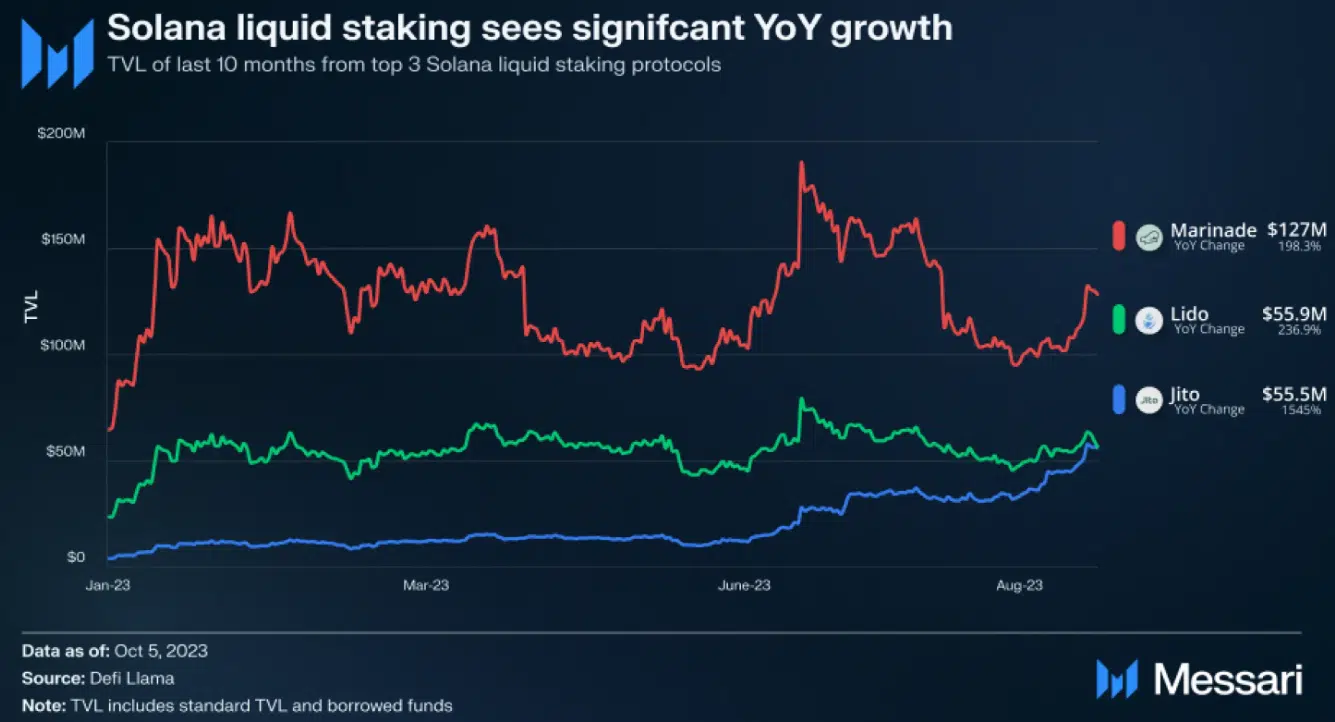

While Ethereum topped the table, other blockchains like Solana were also gaining momentum in the liquid staking space. It was interesting to note that, despite 70% of SOL currently staked, less than 3% are in liquid staking protocols.

A reason behind this could be because the external DeFi landscape within Solana is still developing beyond its skeleton.

Additionally, Messari’s report mentioned that because Solana offers 7% APY for staking automatically, users are less inclined to risk their SOL on liquid staking options in exchange for an extra 2-3% APY.

TVL has doubled for Lido-Solana and Marinade since the start of 2023, suggesting increased use of LSTs. Staked Solana (mSOL), owned by Marinade, accounts for 54% of Solend’s TVL.

Although LSTs are already the most sought-after loans on Solend, their total amount is insignificant when compared to Ethereum.

Solana’s value increased sharply last month

Like Ethereum, Solana’s weekly chart was also red. But a look at SOL’s monthly chart revealed that its price shot up by more than 25%. At the time of writing, SOL was trading at $22.26 with a market cap of over $9.2 billion, making it the seventh largest crypto.

The token’s volume also increased substantially during its price hike, which was optimistic. The good news for investors was that a few of the market indicators turned bullish, suggesting a price uptick in the days to follow.

Is your portfolio green? Check the SOL Profit Calculator

For example, SOL’s Relative Strength Index (RSI) was above the neutral mark. The Chaikin Money Flow (CMF) also registered an uptick and was heading towards the neutral mark.

Solana’s Money Flow Index (MFI) was also relatively high. However, the MACD displayed a bearish crossover, which could cause trouble in the coming days.