TRX eases at $0.085: Can bulls hope for a recovery?

Disclaimer: The information presented does not constitute financial, investment, trading, or other types of advice and is solely the writer’s opinion.

- Capital inflows and buying pressure dropped but remained positive at press time.

- TRX retested a previous breakout level of $0.085 as support.

Tron [TRX] defended the $0.085 support since 6 October. However, a solid upswing from the level remained elusive amidst recent Bitcoin [BTC] losses.

Read Tron’s [TRX] Price Prediction 2023-24

A TRX price analysis published on 10 October noted that the early October pullback to $0.085 couldn’t deter bulls from seeking more gains. Bulls regrouped at $0.085 in the past three days, showing a recovery could be feasible if BTC doesn’t post more losses.

Is it a buying opportunity or a trap?

At press time, there was neutral bias on the daily charts. The decline in RSI went flat at the 50-mark, indicating buying and selling pressure has been equal since 9 October.

In addition, capital inflows have declined since early September but remained positive, as shown by the CMF being above zero. These two indicators suggested bulls could defend the $0.085 and target higher levels ($0.08970 or $0.0944).

However, the extended decline in Spot market demand, as shown by the OBV downtick, could delay bullish efforts. So, TRX could ease to $0.080 if the bearish pressure persisted and demand dried.

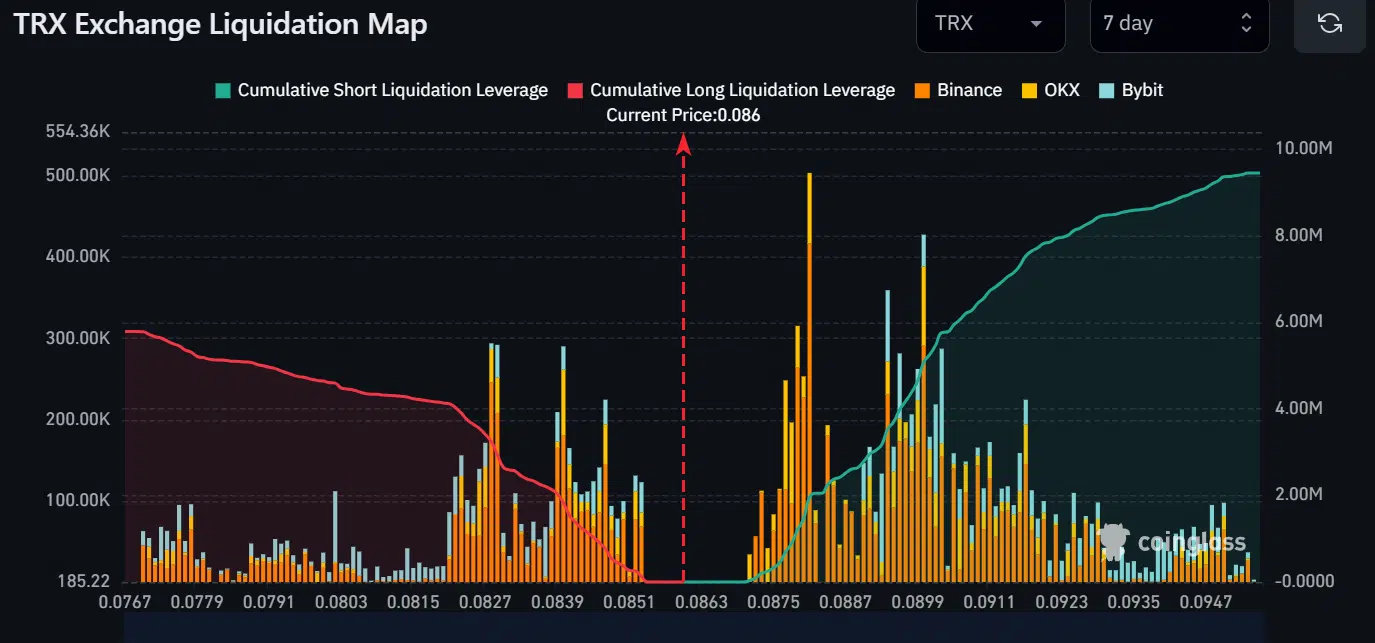

Key liquidity areas exist at $0.0875 and $0.09

How much are 1,10,100 TRXs worth today?

According to Coinglass’s weekly Liquidation map, TRX had key liquidity areas at $0.0875 and $0.90, as shown by the long bars. The long bars are high-risk liquidation areas. Prices tend to react strongly at high liquidation areas; hence, TRX could hit $0.0875 or $0.09.

But the Futures market volume and Open Interest rates were down 5% and 4%, respectively, as of the time of writing. It indicated that a solid rebound at $0.085 could be delayed.