Decoding Polygon zkEVM’s state while MATIC sheds value

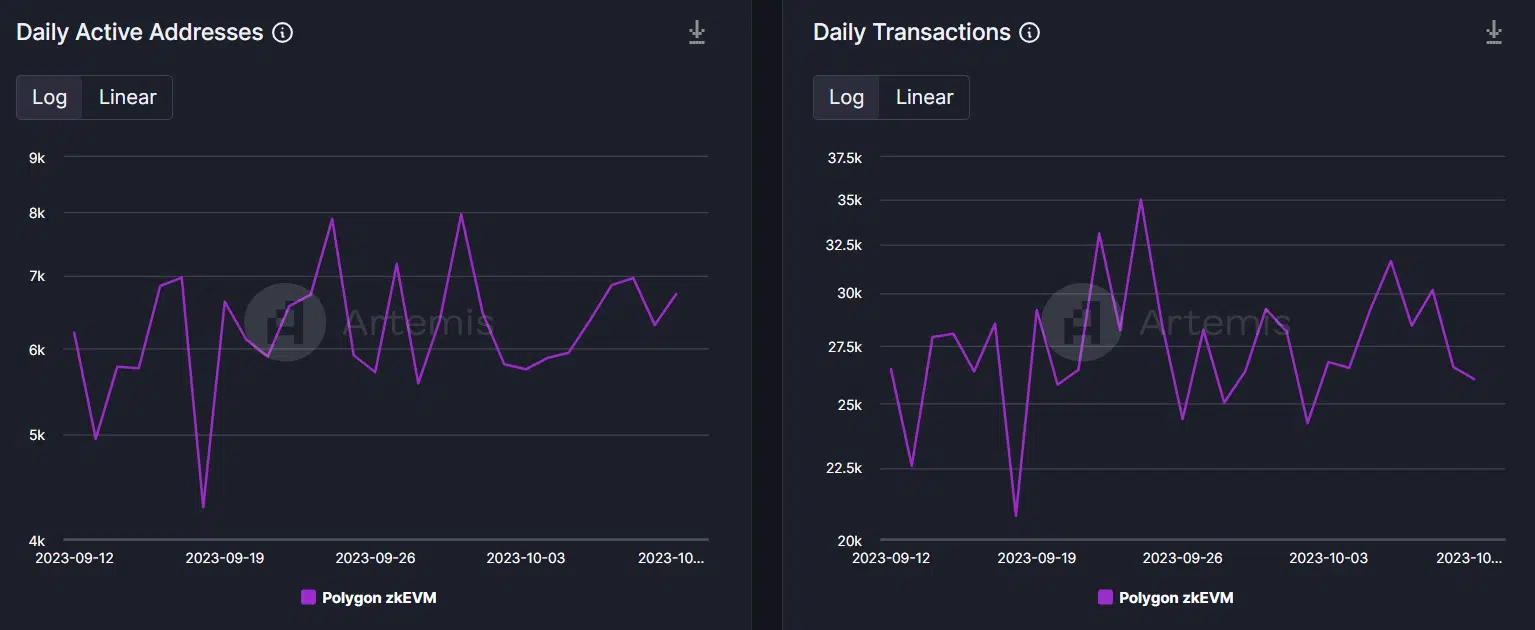

- Apart from TVL, zkEVM’s active addresses and transactions also increased slightly.

- MATIC was down by over 8% last week, and metrics remained bearish.

Over the last few months, Polygon [MATIC] zkEVM registered a decline in a key metric. However, the latest data revealed that the scenario changed a few days ago. To be precise, TVL on Polygon zkEVM has increased by 30% over the last 30 days. This looked optimistic for the rollup, as higher the TVL, the more trustworthy the platform or dApp is perceived to be.

Read Polygon’s [MATIC] Price Prediction 2023-24

Polygon zkEVM is finally reviving

As per Artemis’ data, zkEVM TVL plummeted sharply over the last 3 months, which looked concerning for the rollup’s presence and performance in the DeFi space. But Today in Polygon’s latest tweet rightly pointed out that the rollup was getting back on track as its TVL surged in double digits over the past month.

JUST IN:

TVL on Polygon zkEVM has increased 30% over the last 30 days. pic.twitter.com/XHu4XjhPAb

— Today In Polygon (@TodayInPolygon) October 11, 2023

Not only did the rollup’s TVL register an increase, but a similar increasing trend was also noted in other metrics that suggested a hike in network activity.

As per Artemis, both zkEVM’s daily active address and daily transactions went up somewhat over the last month. Despite the growth in network activity, zkEVM’s fees failed to move up, which was a bit worrying.

Though zkEVM’s few metrics went up, it was still behind its competitors on multiple fronts. For instance, both zkSync Era and Base’s TVLs were considerably higher than those of zkEVM. The Polygon rollup’s DEX volume also remained substantially lower than the rest of the two rollups.

MATIC is underperforming

While zkEVM’s TVL and network activity increased, MATIC’s price action went the opposite route. According to CoinMarketCap, MATIC’s price dropped by more than 8% in the last seven days.

At the time of writing, it was trading at $0.5134 with a market capitalization of over $4.7 billion.

The price decline also propelled negative sentiment around the token, which was evident from the drop in its weighted Sentiment in the recent past. Nonetheless, its Social Volume remained relatively high.

Is your portfolio green? Check the MATIC Profit Calculator

If metrics are to be believed, MATIC investors might have more reasons to worry. The token’s trading volume dropped, meaning that investors were not willing to trade MATIC actively.

Its MVRV ratio also dropped over the last week, which could further push Polygon’s price down in the coming days. Nonetheless, its Network Growth remained high. As per CryptoQuant, MATIC’s Exchange Reserve was also decreasing, which meant that the token was not under selling pressure.