Circle launches USDC on Polygon – Will it be beneficial for the stablecoin?

- Circle has launched the native version of its USDC stablecoin on Polygon.

- The stablecoin’s market dominance continued to plummet.

Stablecoin issuer Circle has launched the native version of its USD Coin [USDC] on leading Layer 2 network (L2) Polygon [MATIC], allowing the network’s users to mint, redeem, and transfer USDC directly on the network without having to bridge it from another chain.

1/ It’s official. #ItsStillStableSeptember and $USDC is now available natively on @0xPolygon PoS mainnet!

Learn the benefits of native USDC and how to switch from bridged USDC.e ?https://t.co/KcK55sT4KH pic.twitter.com/Gm6HjR62KW

— Circle (@circle) October 10, 2023

Read Polygon’s [MATIC] Profit Calculator 2023-24

The stablecoin’s launch on the L2 chain forms part of a broader trend of USDC being launched natively on multiple chains in the last month. The stablecoin has been launched on Optimism [OP], Base, Near [NEAR], and Polkadot [DOT] within the last 60 days.

USDC’s struggle for market share lingers

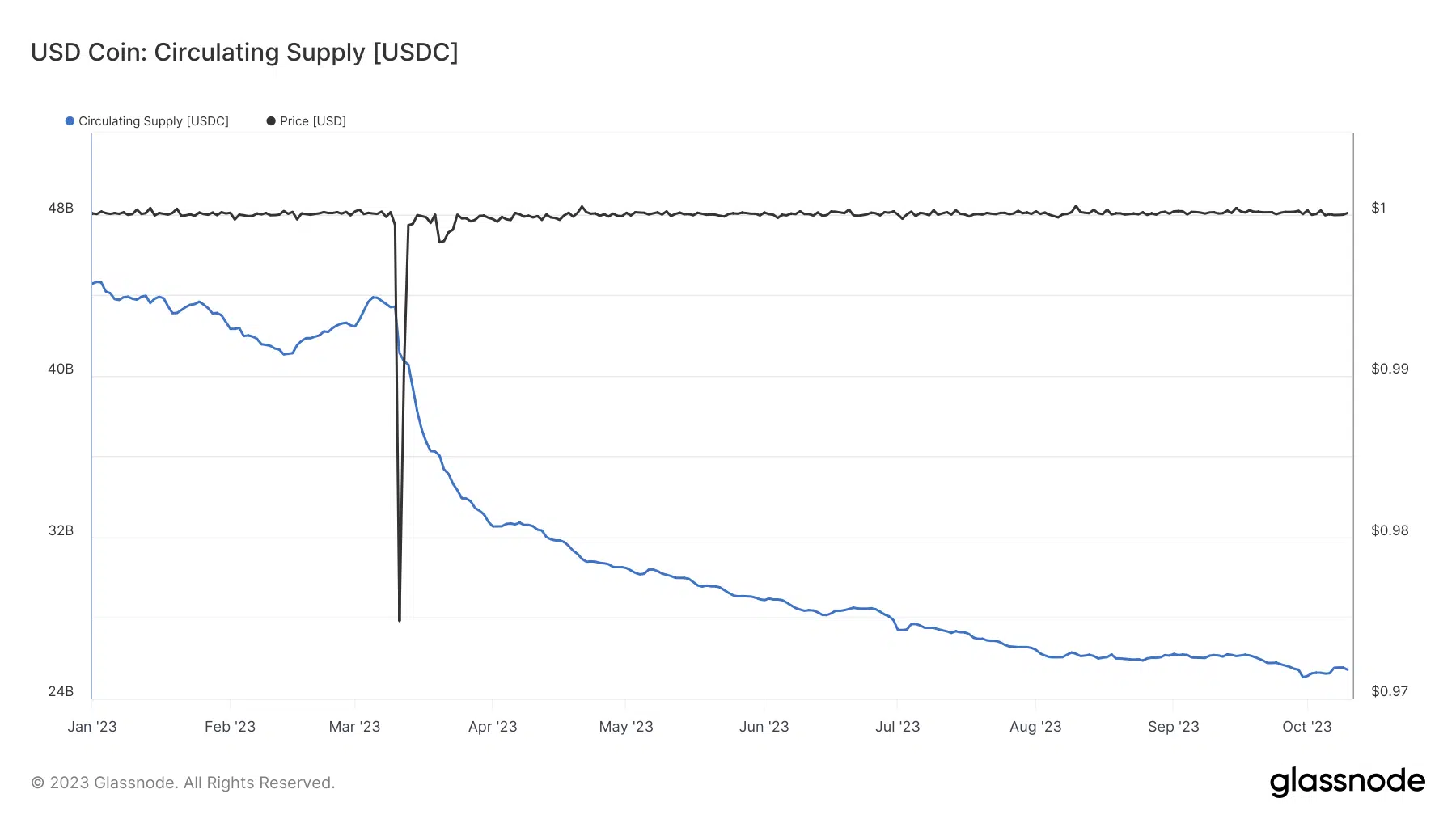

In March, the coin’s market share suffered a blow following the unexpected collapse of Silicon Valley Bank (SVB). On 11 March, the coin’s issuer Circle, announced its inability to access $3.3 billion out of the $40 billion in USDC reserves held at SVB.

This promptly led to USDC briefly losing its $1 peg, to trade for as low as $0.96 on 12 March before eventually stabilizing and returning to its peg on 16 March.

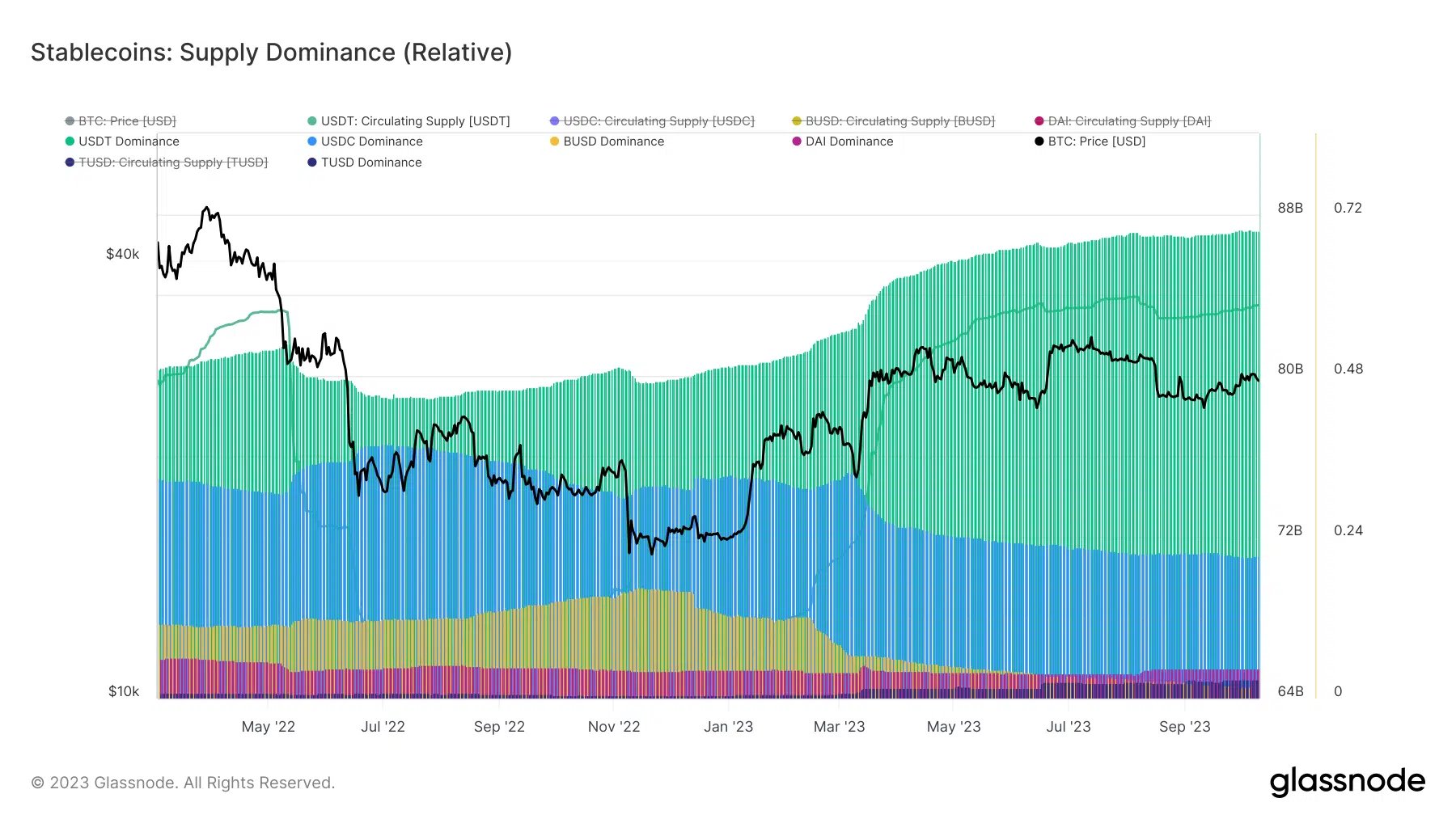

Since the de-pegging event, USDC’s share of the stablecoin market has plummeted significantly. Data sourced from Glassnode revealed that USDC’s supply has declined by over 40% since 11 March, shedding over $18 billion.

In terms of dominance, USDC’s dominance has since fallen from 32% on 11 March to 21% at press time, data from Glassnode showed.

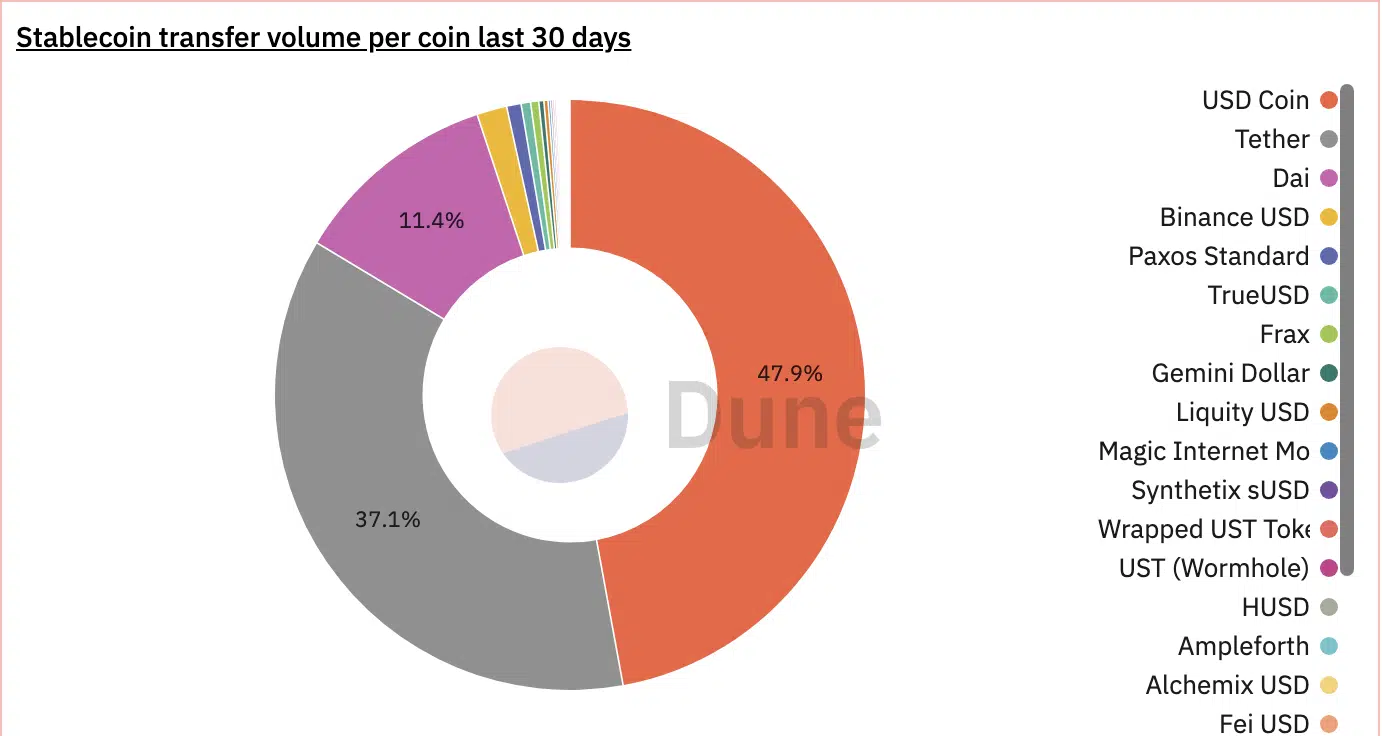

Interestingly, despite the steady decline in its supply dominance and circulation, USDC continues to lead Tether’s USDT in terms of overall transaction volume.

Data from Dune Analytics put USDC as the stablecoin with the highest transfer volume in the last month. With a transfer volume of $446 billion in the last 30 days, 48% of stablecoins moved during that period were USDC. USDT trailed behind with a transfer volume share of less than 40%.

Polygon’s dwindling network activity

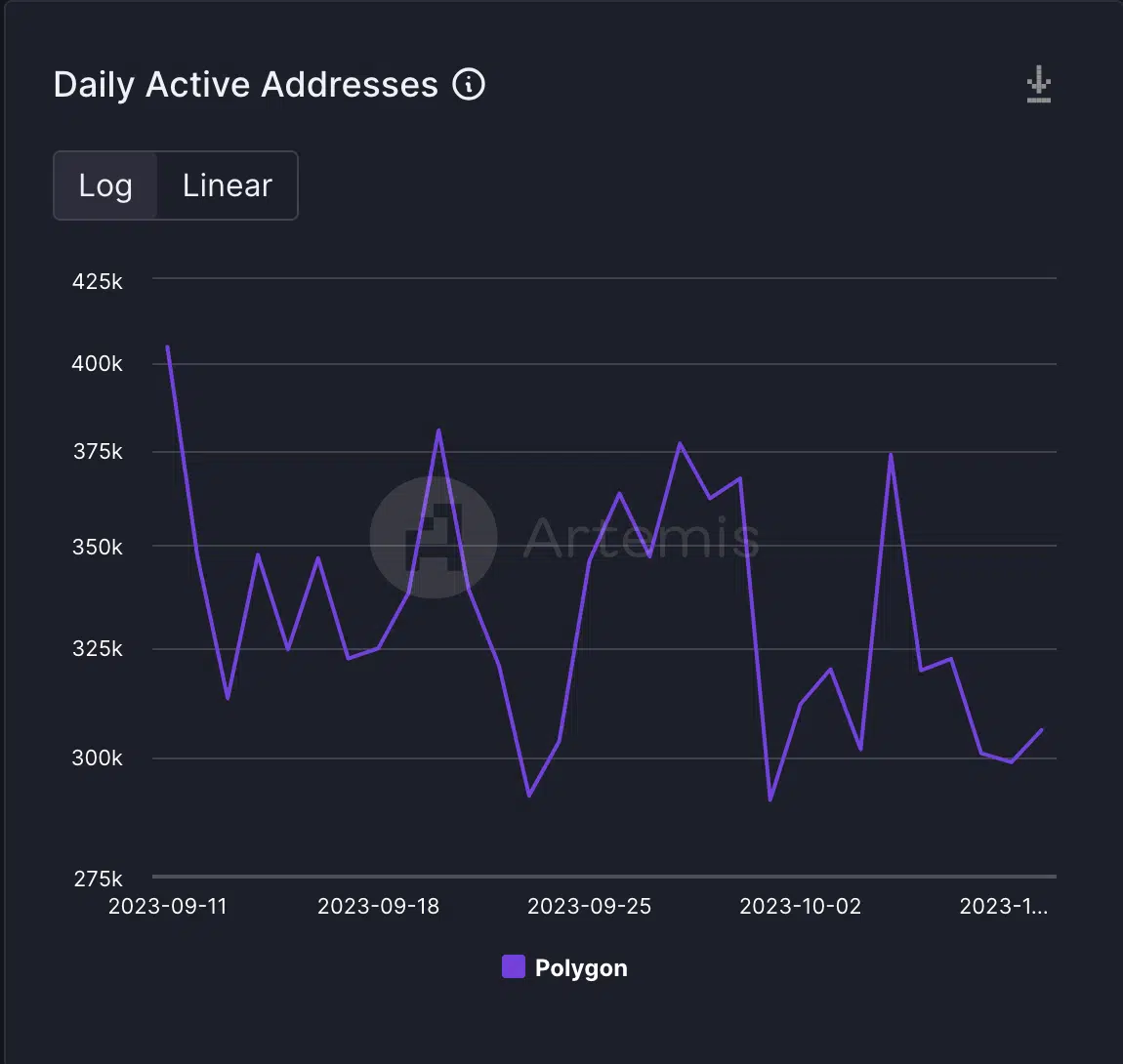

An assessment of Polygon’s on-chain performance revealed a decline in user activity in the last. Data tracked by Artemis showed that the daily count of unique wallet addresses sending on-chain transactions on the L2 network has dropped by 25% in the past 30 days.

Is your portfolio green? Check out the MATIC Profit Calculator

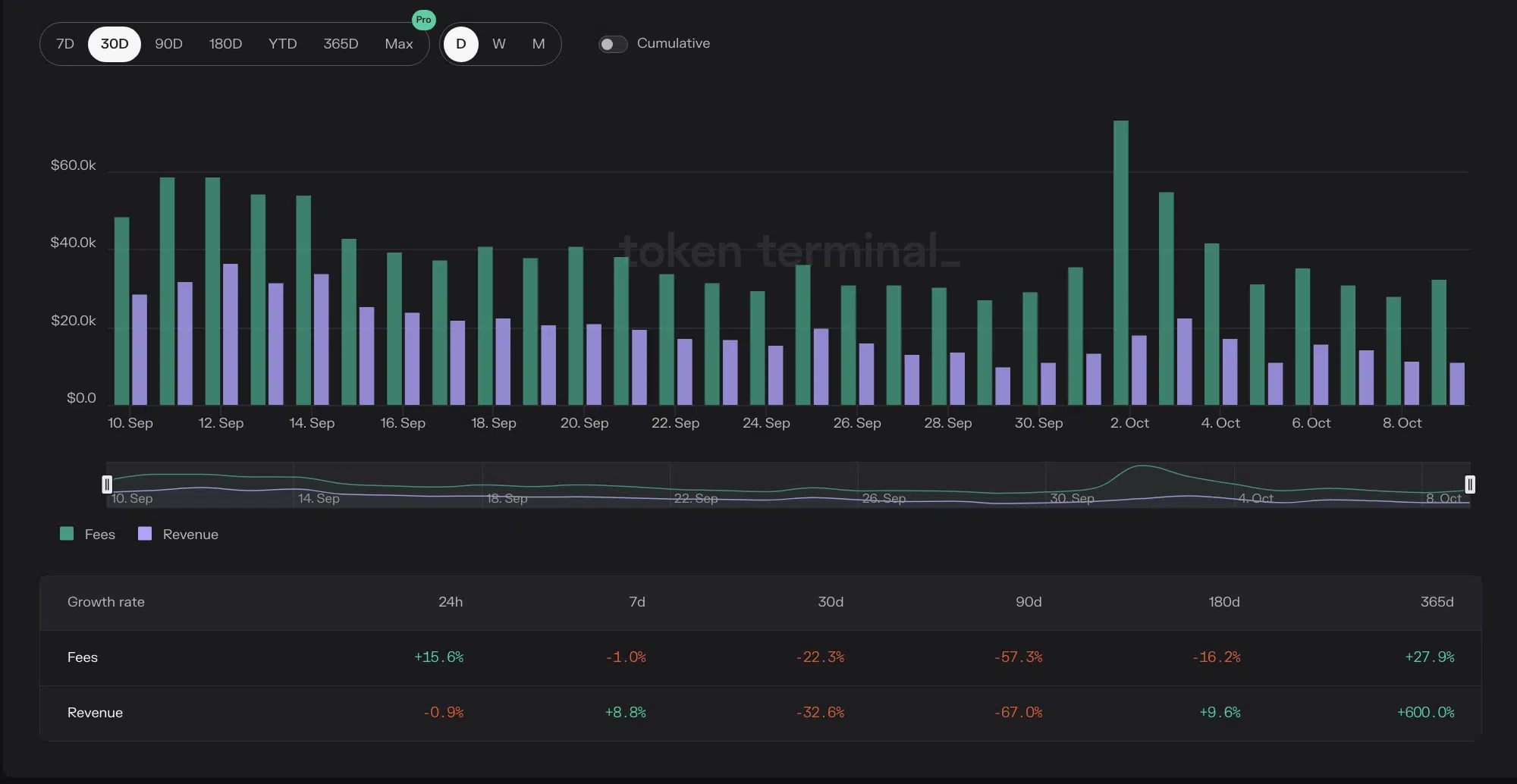

The decline in daily active addresses has impacted network fees, which have also dipped by 22% during the period under review.

Due to this, the network’s monthly revenue has also taken a hit. According to data from Token Terminal, Polygon’s revenue in the last month totaled $585,000, dropping by 33%.