Here’s a look at Optimism’s Q3 performance

- Despite market volatility, Optimism’s mainnet witnessed remarkable growth over the last quarter.

- The OP token’s movement remained stable with not much volatility.

Despite the volatility seen in the crypto markets, Optimism[OP] witnessed a massive surge in interest over the last quarter and was one of the few protocols that showed immense growth during this period. The question now was whether this momentum will persist into the fourth quarter.

Is your portfolio green? Check out the Optimism Profit Calculator

Some positive developments

In Q3 2023, Optimism’s mainnet experienced a surge in activity, recording an impressive 96,000 daily active addresses, signifying a substantial 38% quarter-over-quarter increase.

The DeFi sector played a significant role in this growth, accounting for the majority of these addresses. Notably, daily new addresses held steady at 17,000, with a cumulative total of 1.5 million new addresses added over the quarter.

~State of @optimismFND Q3 2023.

OP Mainnet active addresses and transactions recorded all-time highs.

In contrast, transaction fees dipped by 45% QoQ, reaching an average of $0.28. pic.twitter.com/Nhcxfbo4qs

— Nick Garcia (@NickDGarcia) October 27, 2023

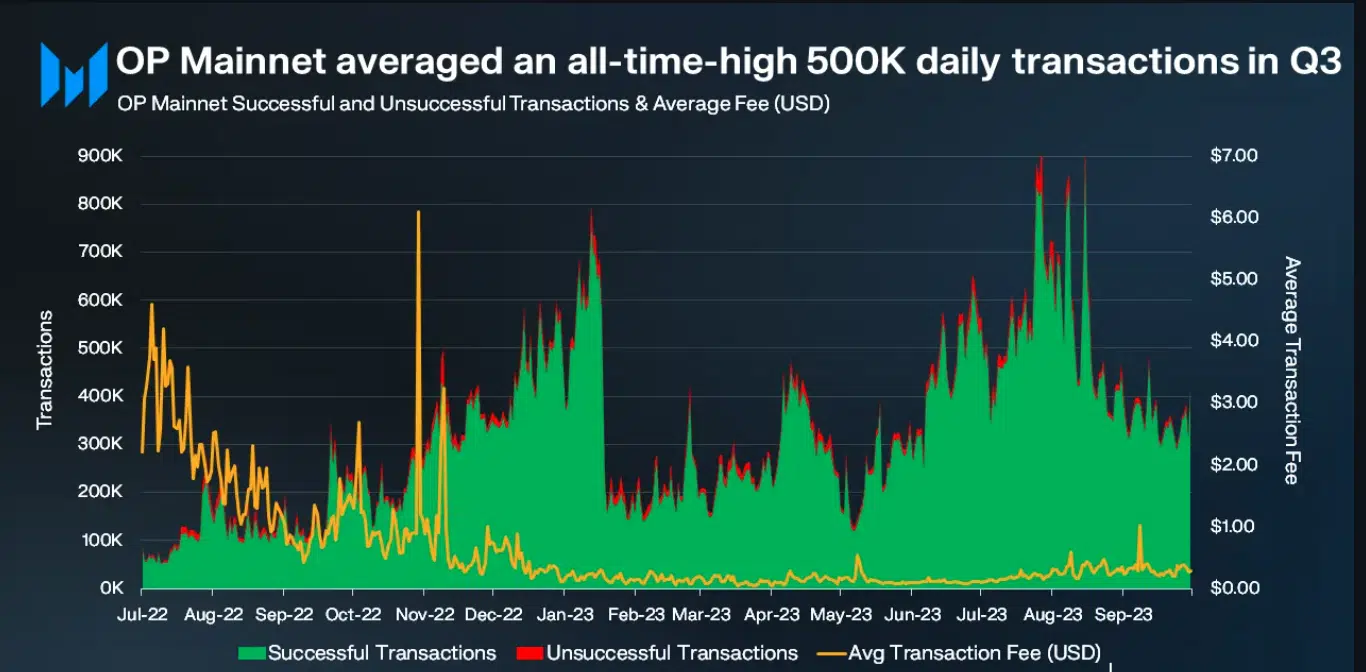

Furthermore, transactions on the Optimism mainnet soared, increasing in six of the last seven quarters. Q3 ’23 witnessed an average of 500,000 daily transactions, a record high for the network.

Remarkably, despite the 40% quarter-over-quarter rise in transactions, the average transaction fee decreased by 45% to a mere $0.28. This surge in activity can be attributed to the development of the OP Stack, the Bedrock Upgrade, and the third airdrop.

Growth in the DeFi sector

Breaking down the network activity by sector on the Optimism mainnet, the DeFi sector dominated, constituting a substantial 83% of active addresses in Q3 ’23.

Following closely were NFTs at 12%, while the Gaming and Social sectors showed minimal activity by comparison. The less active sectors on the network hint at untapped growth potential.

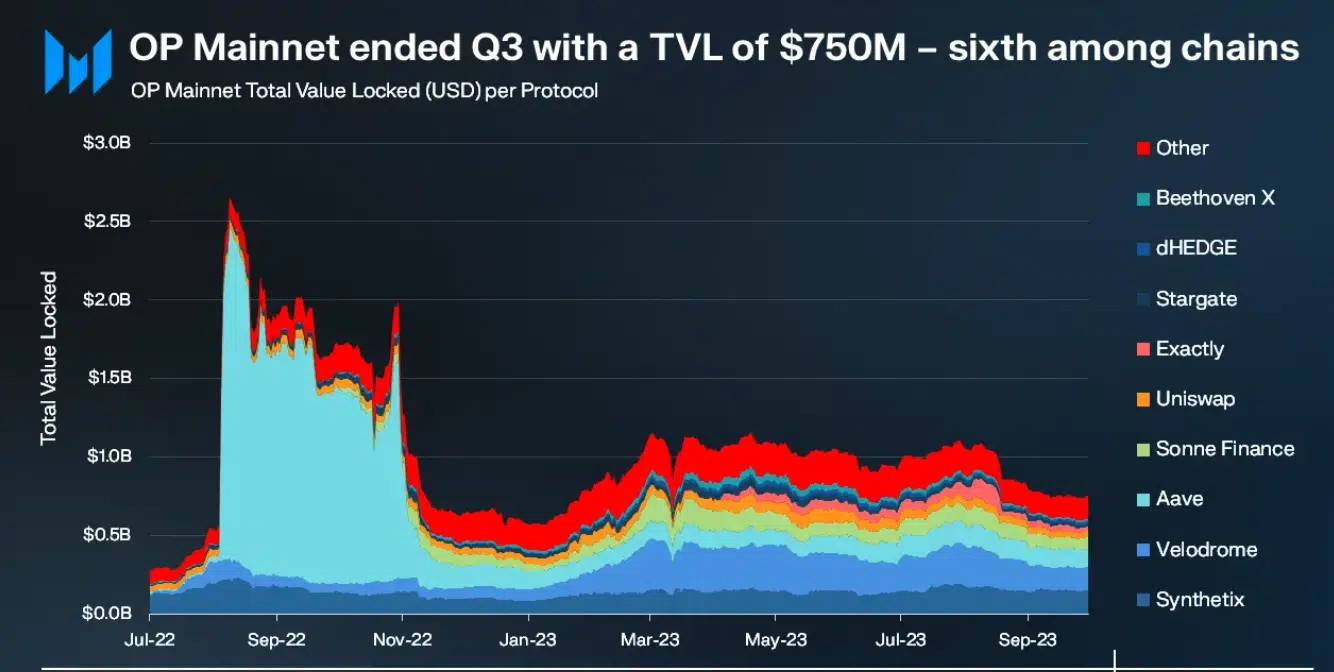

However, it’s worth noting that Optimism’s Total Value Locked (TVL) experienced a 20% quarter-over-quarter decline, closing the quarter at $750 million. This drop in TVL was consistent with the broader market trend, which began its descent after reaching its peak in mid-2022.

Realistic or not, here’s OP’s market cap in BTC terms

Token growth stagnates

Optimism’s native token, OP also demonstrated significant growth during the quarter. The circulating market capitalization of OP expanded by 3.4% quarter-over-quarter, reaching $860 million by the end of the quarter.

OP was trading at $1.356 at press time. Although its price experienced a minor correction in recent days, the MVRV ratio for OP remains high, indicating that many OP holders are in profitable positions, possibly leading to future sell-offs.