Stablecoins reach a crossroads: What does the future hold?

- The flattening of stablecoins’ growth curve came as a stark contrast to other cryptocurrencies.

- The world’s largest stablecoin by market cap, USDT, retained its numero uno position.

The presence of stablecoins has added a semblance of calmness in an otherwise turbulent world of cryptocurrencies. These derivatives of popular fiat currencies made crypto trading hassle-free, allowing traders to preserve their fiat value without having to cash out of the market.

As flat as stablecoins

However, the current state of the market won’t exactly cheer the stablecoin proponents. According to popular on-chain analyst Patrick Scott, stablecoin market cap has trended sideways over the last three months or so.

Citing DeFiLlama, Scott mentioned that the trajectory plateaued after declining for a year and a half. Recall that the decline was precipitated by the implosion of stablecoin Terra USD [UST] in May 2022.

The flattening of stablecoins’ growth curve comes in a stark contrast to the spirited recovery of other cryptocurrencies. The world’s largest crypto, Bitcoin [BTC], has more than doubled since the start of the year.

Ethereum [ETH], the largest altcoin, accumulated gains of more than 50% year-to-date (YTD).

Having said that, the fact that the downtrend was halted meant that money stopped exiting the market, as stated by Patrick Scott.

Lull on the trading front

The flat line also reflected lackluster trading activity in the market. As mentioned earlier, stablecoins are the primary way for traders on non-fiat crypto exchanges to enter and exit trades.

However, with the volatility remaining elusive, trades on exchanges dipped, and so did demand for stablecoins.

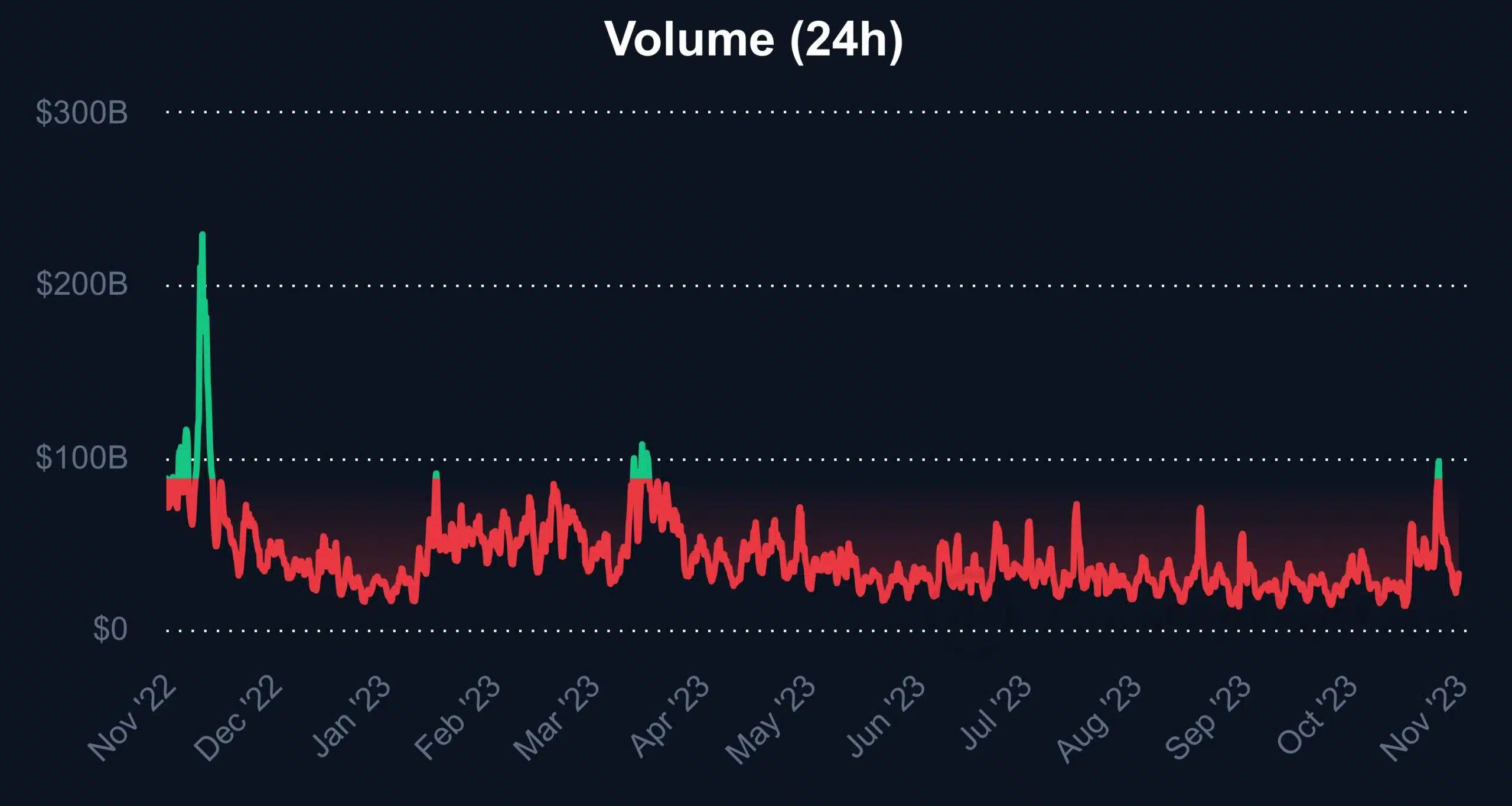

The following chart from CoinMarketCap highlighted the dramatic drop in trading volumes for much of the third quarter (Q3).

Winners and losers

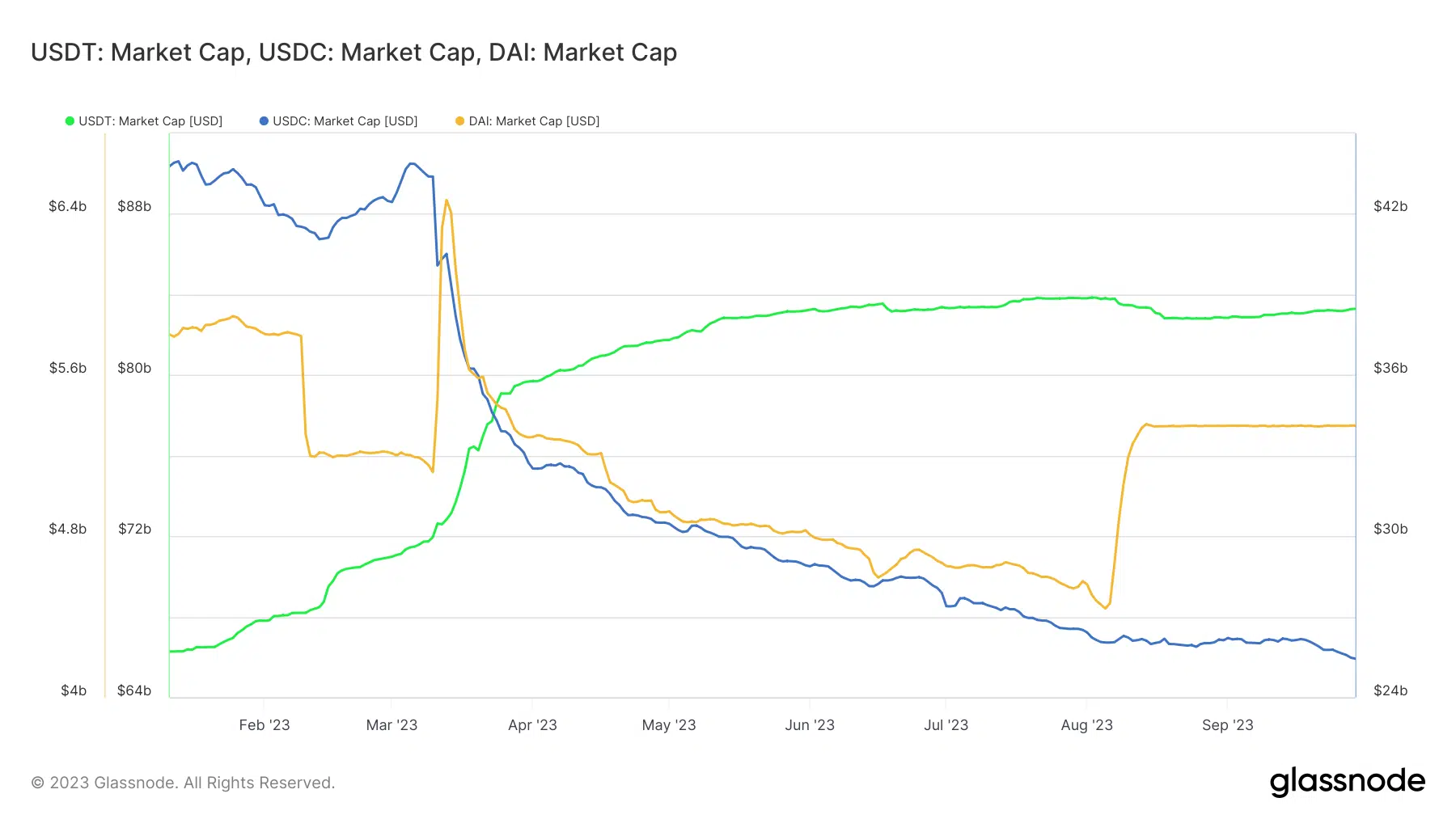

Notably, Tether [USDT] expanded its dominance in 2o23. The U.S. Dollar-pegged crypto’s market value rose 25% YTD to $83 billion as of this writing, per Glassnode. Barring minor depegging episodes, USDT remained rock solid throughout the year.

On the other hand, USD Coin [USDC] has failed to recover since its exposure to the March banking crisis. Though still the second-largest stablecoin, its market cap has shrunk by 41% since the fiasco.

The algorithmic stablecoin DAI also suffered the same fate as USDC because of deep linkages. However, concerted efforts by the issuing protocol MakerDAO [MKR] revived demand for the stablecoin.

A real threat emerging?

Most experts agree that stablecoins could face the biggest challenge from Central bank digital currencies (CBDCs). Many emerging markets have been doubling down on their CBDC efforts lately.

As the name suggests, these assets will be issued by the country’s central bank. Moreover, each CBDC will be pegged to the national currency. The motive behind backing these assets is to extend the benefits of stable digital currencies without losing regulatory control over them.