FET, RNDR prices – Why Nvidia could be the key to these AI tokens’ rallies

- Increasing money flow into AI firms might trigger a bounce for these tokens

- Healthy social dominance might be key to bringing the rally to life

AI-themed tokens including Fetch.ai [FET] and Render [RNDR] might be set to regain some of their erased gains if the correlation with NVDA is one to consider. For those unfamiliar, NVDA is the stock of NVIDIA Corp, an Artificial Intelligence firm. According to data from Google Finance, NVDA’s value appreciated by 12.26% in the last five days alone.

In fact, AMBCrypto’s findings from a recent Bloomberg report revealed that an increase in capital deployed to AI projects this week propelled the said hike.

Around two weeks ago, NVDA’s price plummeted due to the geopolitical unrest in the Middle East. At the same time, the prices of FET and RNDR recorded severe drawdowns on the charts too.

Attention to shift to these tokens if…

However, this was just one of several periods where the prices of these cryptocurrencies moved in the same direction as the stock. In fact, the potential rise might be beyond dependence on the traditional asset.

In this article, AMBCrypto looks at different on-chain metrics to see if they align with the aforementioned prediction. To start with, we considered the question of social dominance.

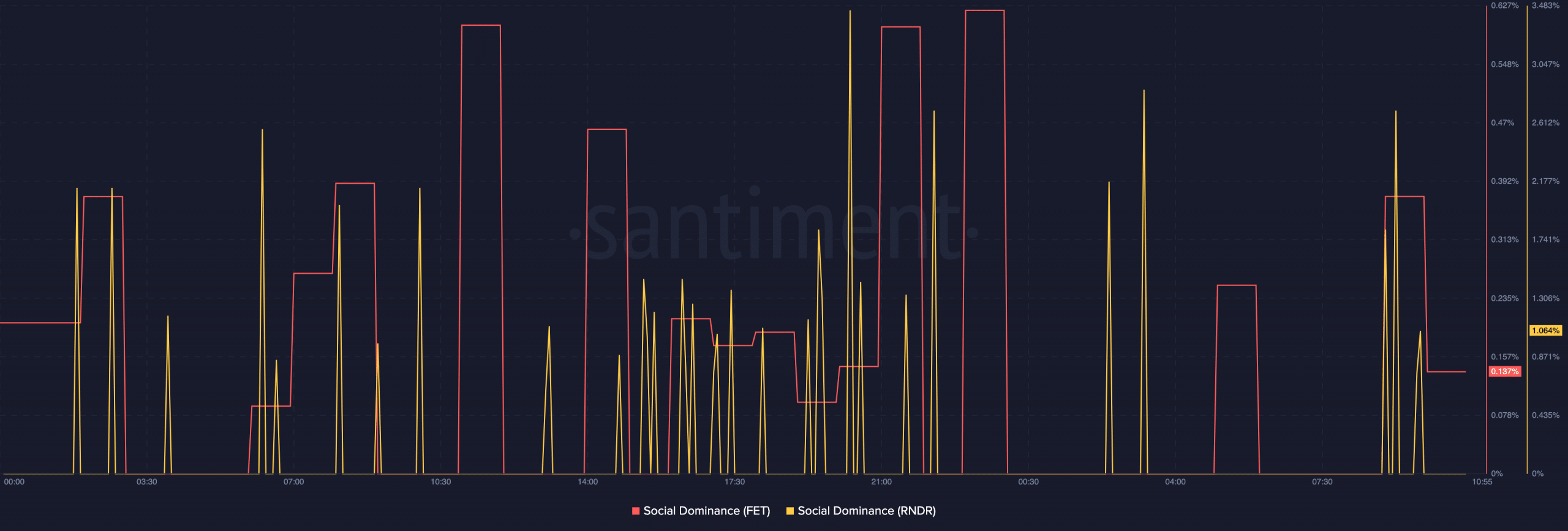

According to Santiment, Render’s social dominance spiked to 2.69% on 27 April, before the reading dropped on the charts. FET also registered a hike to 0.37% before falling to 0.13% at press time.

In theory, the state of the metric suggests that discussions around the token have been okay relative to other assets. For the price, this could be good news considering the fact that the reading has remained in a healthy position.

If the metric was above 3.45%, historical data revealed that the tokens would have been overheated. In this case, instead of the potential to climb, the prices might tumble on the chart.

Therefore, if slight demand comes in for these tokens, FET might go past its weekly peak of $2.62. RNDR, on the other hand, might also be able to revisit $9.53.

Is no one there to help?

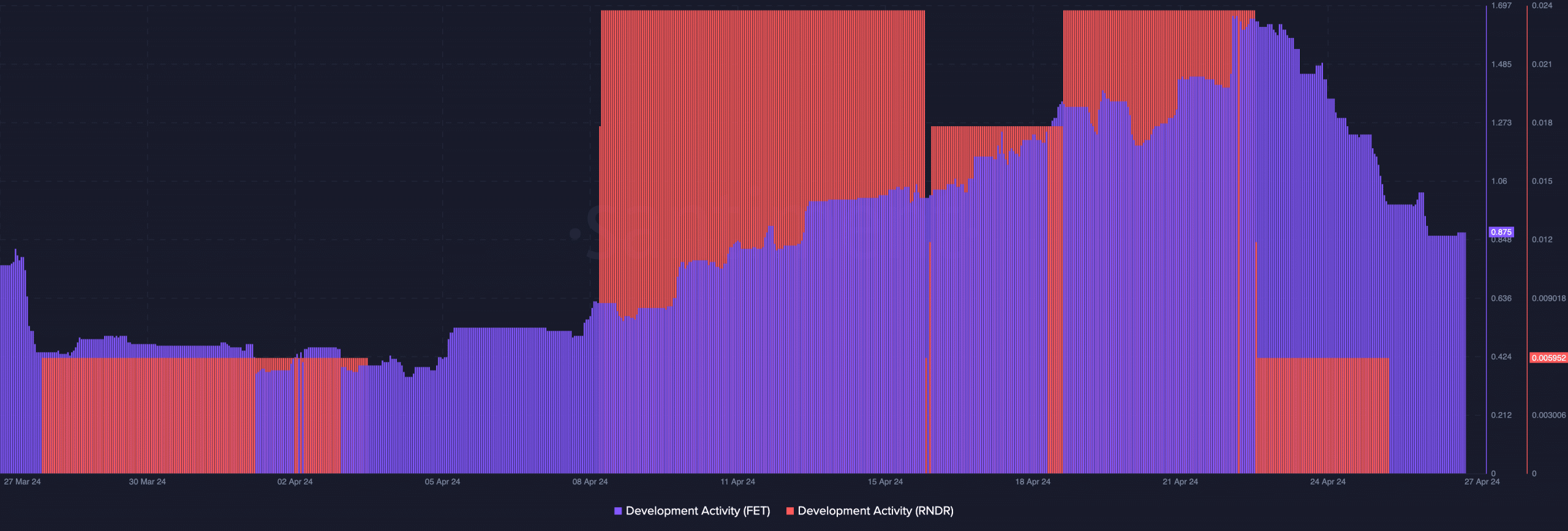

Besides the social metrics, another indicator to consider is development activity. This indicator is important because the AI crypto economy plans to enhance the use cases offered by these projects. A look back at the plan to merge FET with AGIX and OCEAN was a testament to this resolve. As such, if utility has to trigger demand, development should not decelerate.

Unfortunately, Fetch’s development activity dropped after rising to a new monthly cliff on 22 April. It was around the same period that the metric in Render’s terms also started to fall.

A decline in the metric means that developers slowed down on pushing out codes committed to shipping features on the network. However, market participants might need to keep an eye on these metrics, as well as NVDA.

Realistic to not, here’s FET’s market cap in RNDR’s terms

Should social dominance rise alongside NVDA’s price, then RNDR and FET might swing north. If this happens with rising development activity, a double-digit hike might be possible in the short term. In addition, a decline in the factors mentioned above might invalidate the bullish thesis.