DeFi tokens UNI, MKR lose lucky break: What’s going on?

- The tokens’ volume dropped by 71.30% after reaching a high level in March.

- Sentiment has begun to improve, but participants hesitated adding liquidity to the protocols.

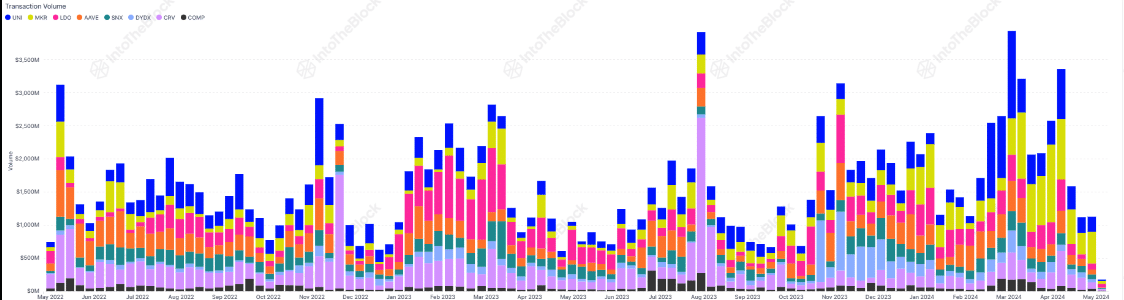

Two months after registering an amazing rise in transaction volume, Uniswap [UNI] and Maker [MKR] have lost a chunk of that figure.

According to data from IntoTheBlock, the volume last week was only a little above $1 billion.

This represented a 71.30% decrease since the hike, which happened in March. Volume can have a good impact on price action. For instance, when the metric jumped in March, the price of these tokens rallied.

Numbers go down

At that time, there was speculation that UNI and MKR might lead the revival of DeFi tokens that were lagging.

DeFi stands for Decentralized Finance, and these cryptocurrencies have fundamentals related to the sector.

As of this writing, UNI’s price was 7.50%— a 33.62% decrease in the last 24 hours. MKR also plunged within the same period by 23.17%.

These declines could be linked to the decreasing interest in the tokens. It could also serve as proof that AMBCrypto’s inference that DeFi tokens would find it hard to compete with meme coins could be valid.

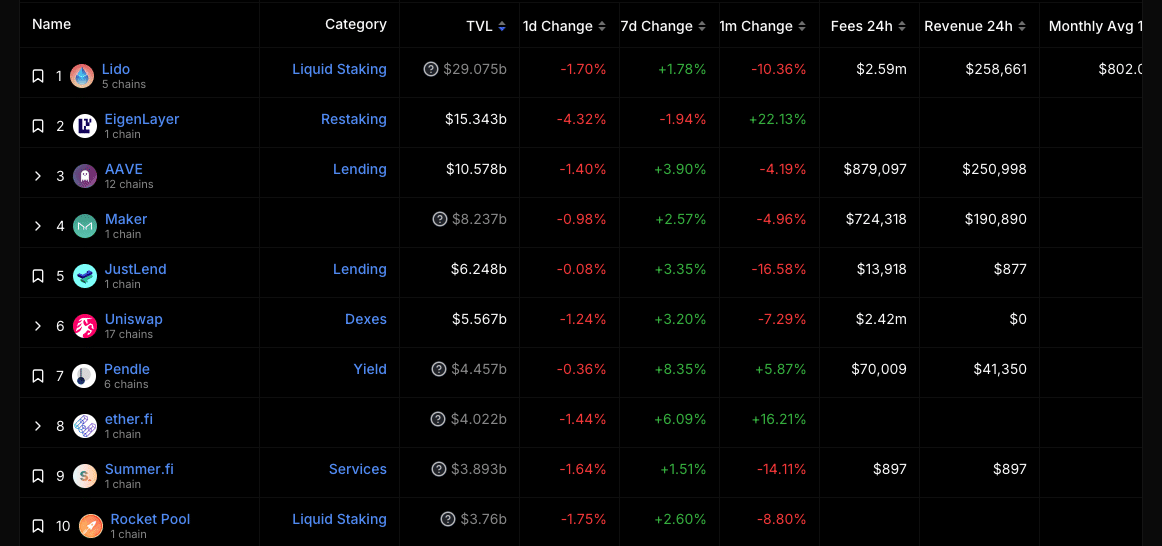

Besides the price action and volume, Uniswap and Maker have been displaced from their spots in the ecosystem. Previously, both projects were in the top three when it came to TVL.

TVL is an acronym for Total Value Locked. The higher the TVL, the more trustworthy a protocol is perceived to be. But at press time, Maker was number four, while Uniswap was sixth.

Participants are not convinced yet

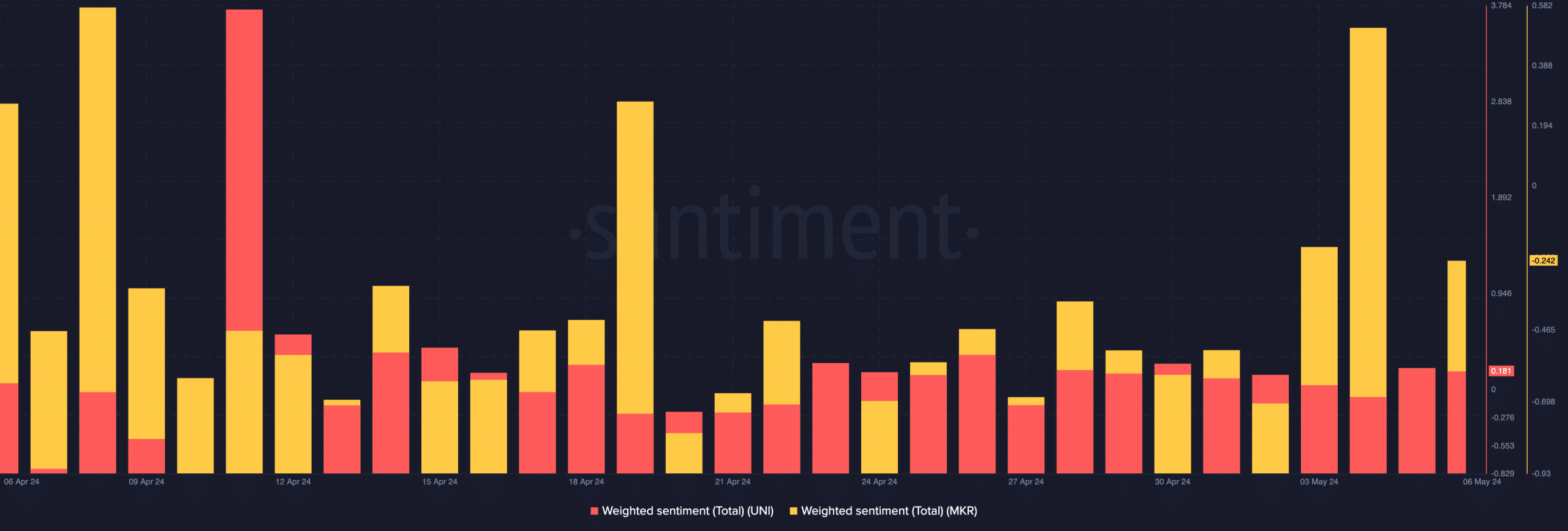

Despite the price correlation, the sentiment around both tokens differed. For example, Santiment data showed the UNI’s Weighted Sentiment was 0.181.

The sentiment for MRK, at press time, was -0.242. Positive values of the metric indicate a rise in positive comments about a project.

Negative readings, on the other hand, suggest that participants are not bullish on a token.

Therefore, one can infer that the market offered UNI some goodwill while it was not the same for MKR. But one thing AMBCrypto noticed was that the Weighted Sentiment for MKR was rising.

Realistic or not, here’s MKR’s market cap in UNI’s terms

Should the metric jump into the positive area, interest in the token might improve. In the short term, MKR and UNI’s transaction volume might not increase to the levels seen in March.

Also, the prices of the token might move sideways for some time. However, if altcoins begin to move up simultaneously, the price of UNI might revisit $10. For MKR, an uptrend could lead the value to $3,300.