NEAR, RNDR, TAO prices jump: AI tokens on the move?

- NEAR, RNDR and TAO prices have climbed in the past 24 hours.

- However, these tokens may be unable to maintain this trend.

The artificial intelligence (AI) token market has rallied following Bitcoin’s [BTC] recent surge above $71,000.

Over the past 24 hours, the AI token market capitalization has climbed by 5%, while trading volume has increased by 20%, according to CoinMarketCap.

The values of leading AI and big data-based cryptocurrency assets, such as Near [NEAR], Render [RNDR], and Bittensor [TAO], have climbed by 8%, 5%, and 7%, respectively, in the past 24 hours.

No clear sign of a continued rally

An assessment of the tokens’ key momentum indicators, which track buying and selling activity, revealed that their price increase has not been backed by any real demand from market participants.

It merely mirrors the uptick in the general cryptocurrency market in the past 24 hours.

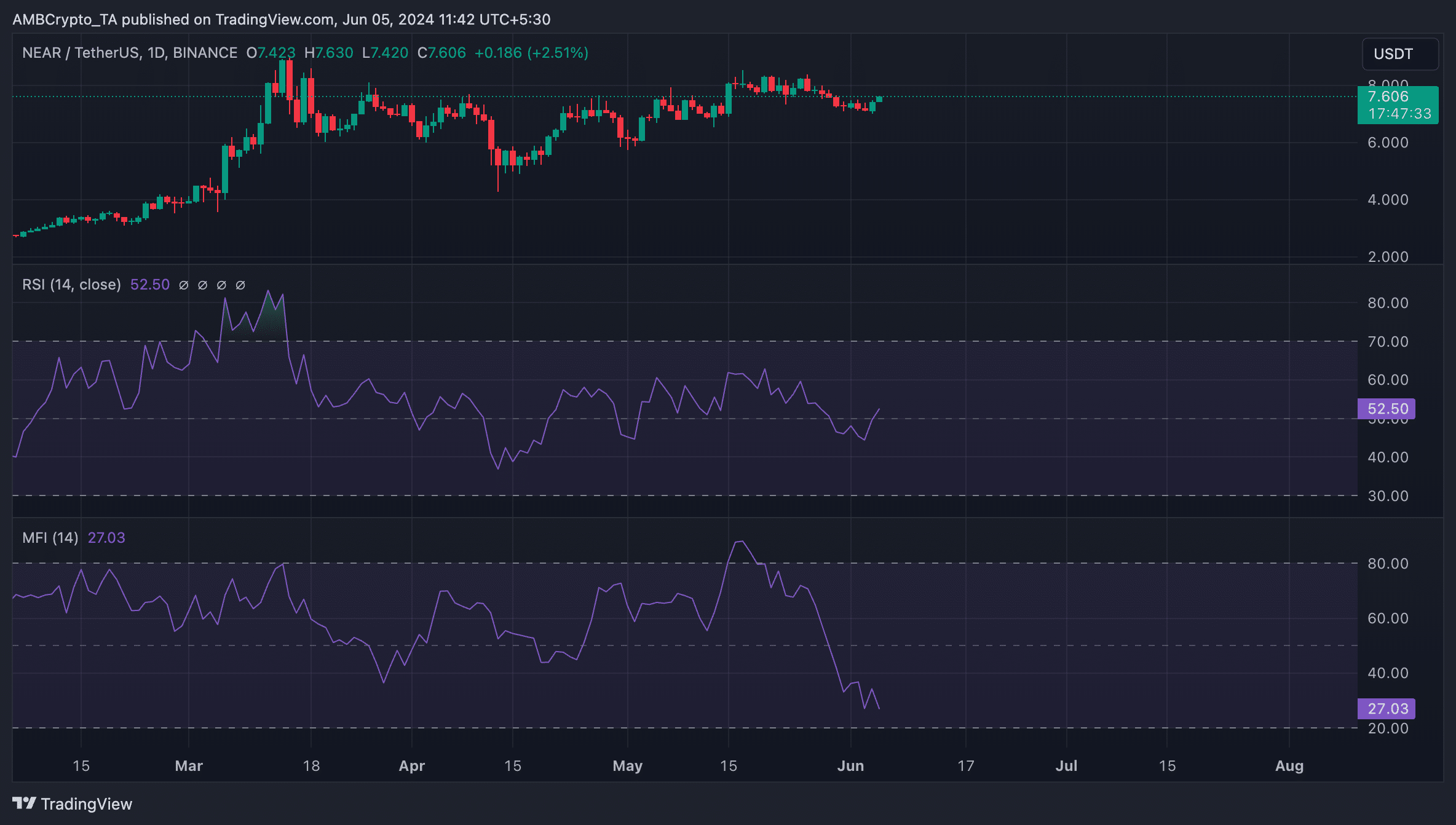

For example, NEAR’s Relative Strength Index (RSI) was 52.29, while its Money Flow Index (MFI) was 26.96.

A combined reading of the values of the two momentum indicators showed that while market sentiment remains predominantly neutral, there has been a considerable outflow of money from the NEAR market.

This hints at the possibility of the altcoin shedding its most recent gains as selling pressure gains traction.

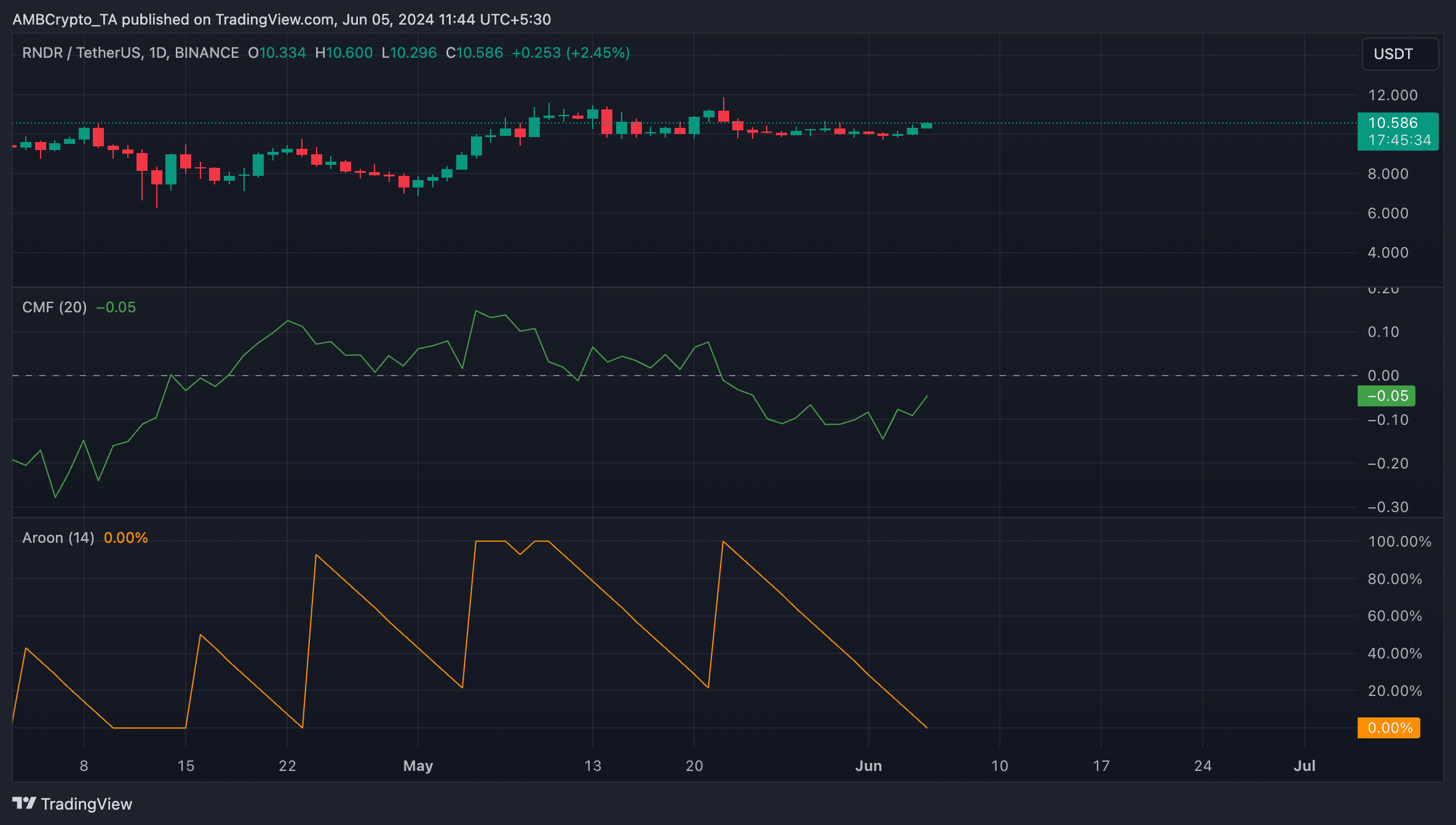

Regarding RNDR, its Chaikin Money Flow (CMF) was spotted below the zero line at the time of writing. This indicator gauges the flow of money into and out of an asset’s market.

When it returns a value below zero, it signals market weakness. It suggests a spike in selling pressure, marked by capital flight, and an indication of a potential price decline. As of this writing, RNDR’s CMF was -0.05.

RNDR’s Aroon Up Line (orange) was 0%, confirming the current uptrend’s weakness. An asset’s Aroon Indicator measures its trend strength and potential price reversal points.

When the Aroon Up Line is close to zero, any market uptrend is deemed weak, and the most recent high was reached a long time ago.

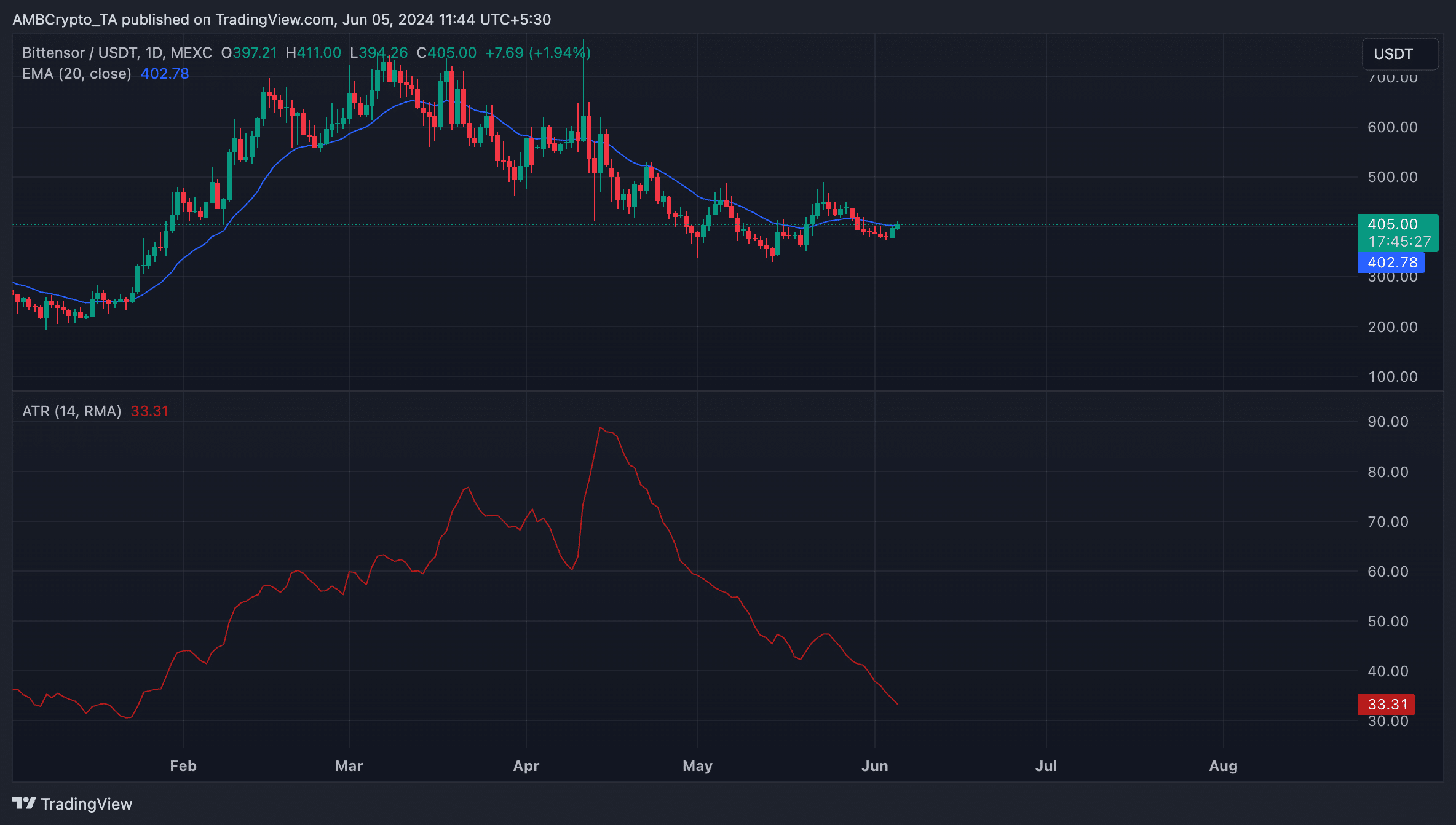

TAO’s performance is no different, as its price currently trades close to its 20-day exponential moving average (EMA).

When an asset’s price trades close to this key moving average, the market consolidates as the price lingers within a range.

This was confirmed by TAO’s declining Average True Range (ATR). This indicator measures market volatility.

When it declines this way, it suggests a period of indecision or consolidation in the market.