A closer look into Stellar’s [XLM] daily chart presents this opportunity

Disclaimer: The findings of the following analysis are the sole opinions of the writer and should not be considered investment advice.

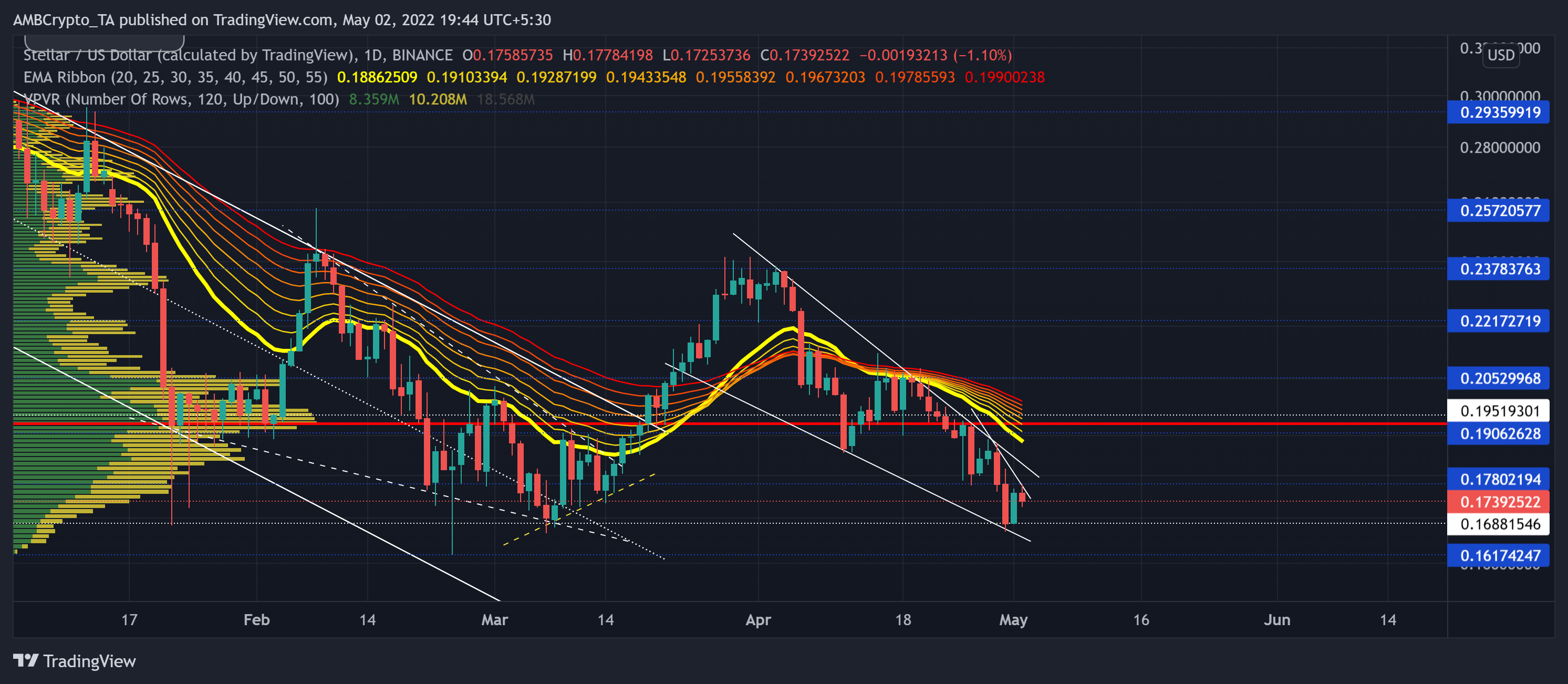

Stellar (XLM) was approaching to retest $0.168 within a falling wedge and was close to a make-or-break situation in the coming times. A move below its immediate support could spiral into an undesired loss by opening a route to $0.1617.

A likely upswing from its immediate floor would position the altcoin for a revival rally in the near term. At press time, XLM traded at $0.1739, up by 1.91% in the last 24 hours.

XLM Daily Chart

Since XLM did a one-eighty from the $0.8-level and plunged to consolidate between the $0.168-$0.39 range for over a year. This bearish phase marked a down-channel (white) on its daily chart as the alt lost nearly 63.4% (from 10 November) and hit its 13-month low on 24 February.

Meanwhile, the EMA ribbons constricted most recovery over the last five months. However, the mid-March bullish revival propelled a much-desired hike that halted at the $0.23-level. Since then, the sellers have recouped their force while triggering a falling wedge decline over the last month.

As this wedge approached the 16-month support at the $0.1688, XLM could repeat history by igniting a short-term bull run. But with the rising gap between the EMA ribbons, this rally would likely be halted by the bonds of its Point of Control (POC, red).

Rationale

The RSI depicted a strong selling edge while witnessing a steep downward slide below the mid-line. A close below the 36-mark could propel a recovery from the 32-base.

Over the last four days, the bearish CMF pulled off higher peaks on the daily timeframe. Thus, revealing a bearish divergence with price. However, the OBV managed to keep its immediate grounds despite the recent sell-offs.

Conclusion

In view of the falling wedge setup alongside the sturdiness of the immediate support, XLM could eye to break out of the wedge to test its POC. But with a bearish divergence on the CMF, the alt could delay this recovery by retesting the immediate support.

Finally, the investors/traders should factor in the broader market sentiment and the on-chain developments to make a profitable move.