A look at the Bitcoin [BTC] correlation score and its essence for investors

![A look at the Bitcoin [BTC] correlation score and its essence for investors](https://ambcrypto.com/wp-content/uploads/2023/02/aleksi-raisa-DCCt1CQT8Os-unsplash-1-1-e1676700728719.jpg)

- There is a growing convergence between Bitcoin [BTC] and traditional stocks.

- Bitcoin’s correlation with DXY is, however, still at a divergence.

After dropping for months beforehand, the price of Bitcoin [BTC] has been increasing since the beginning of the year. Despite the significant price increase, it is yet to recover to the level that saw it reach $60,000.

Particularly following the Covid-19 outbreak, Bitcoin’s price has correlated with traditional assets. How does the BTC correlation score now stand, and what does it mean for cryptocurrency investments?

Read Bitcoin’s [BTC] Price Prediction 2023-24

Explaining the Bitcoin correlation score

When comparing the price of Bitcoin to another asset or basket of assets, the correlation score can be used to gauge the degree to which the two prices move in tandem.

To determine the correlation, we look at Bitcoin and the other asset’s price movements over time and see how closely they have tracked one another.

If the correlation score is -1, then the values of the two assets are perfectly uncorrelated with one another; if it’s zero, then there is no association between the prices of the two assets; and if it’s 1, then there is a perfect positive correlation between the prices of the two assets (meaning that the prices of the two assets move in the same direction).

To help diversify their holdings, investors can use the correlation score. Investing in several types of assets with low correlation helps mitigate risk.

However, it’s important to remember that correlation ratings can shift over time. This highlights the need for constant asset correlation monitoring and subsequent investing strategy adjustments.

Bitcoin correlation score post Covid-19

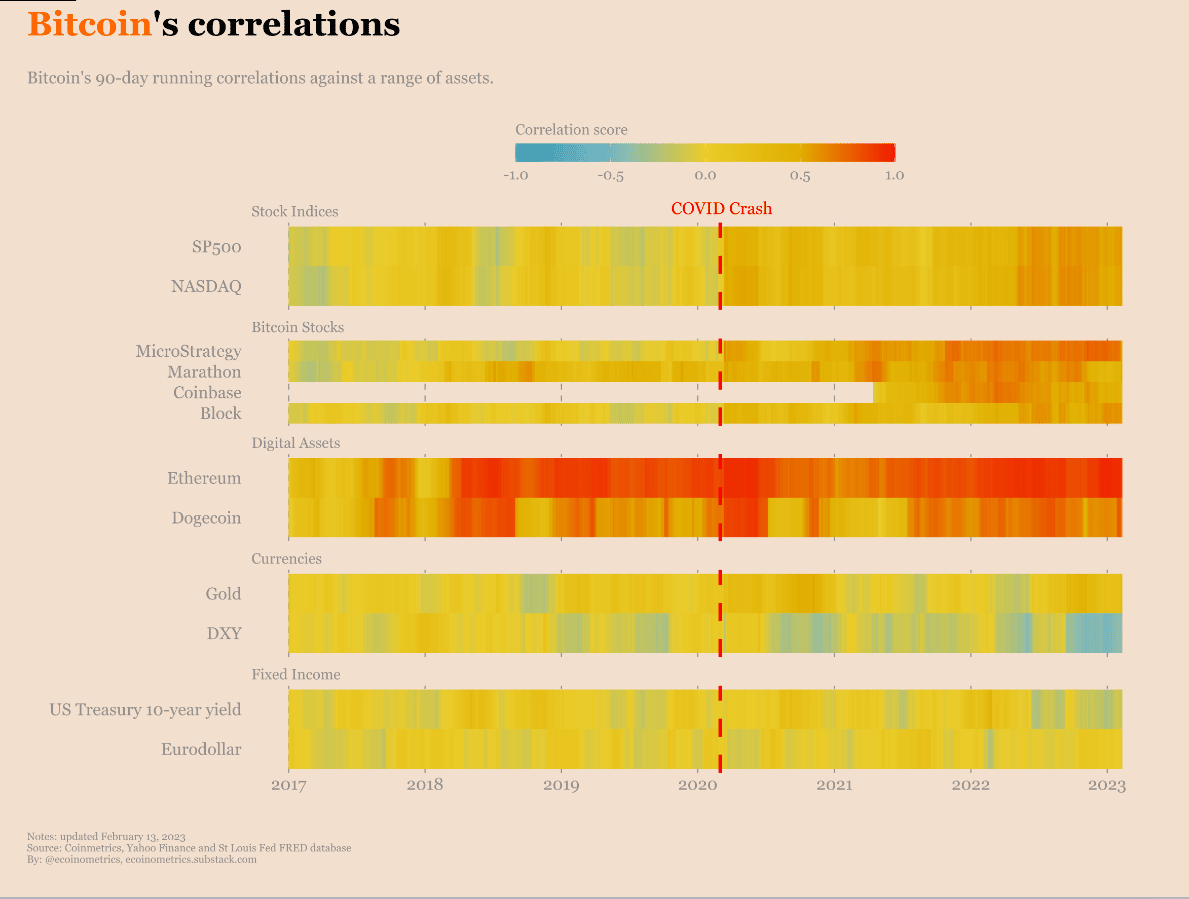

Ecoinometric data shows that following the Covid-19 epidemic, Bitcoin’s correlation score changed significantly. Some types of investments were chosen for this study so that we could get a feel for the correlation score that is now available.

Stock market indices like the SP500 and the NASDAQ, Bitcoin stocks like MicroStrategy, Marathon, Coinbase, and Block, the U.S. Dollar Index (DXY), and Eurodollar futures were chosen to examine whether or not they correlate with the price of BTC.

Well, interestingly, Ethereum and Dogecoin were also chosen to check their correlation.

Pre-March 2020 (pre-Covid), the stock market indices were largely unrelated to Bitcoin. After that, there is a consistent orange pattern, indicating a link.

As would be anticipated, Bitcoin has a strong relationship with other cryptocurrencies. The price of Bitcoin and gold has been highly correlated as of late, notwithstanding their past movements into and out of correlation zones.

Despite this, there has been zero correlation between the DXY and Euro futures, either before or after the outbreak. High correlation is denoted by deep red, high anti-correlation is denoted by deep blue, and no correlation is denoted by yellow.

BTC’s price movement

The SP500, Nasdaq, and Bitcoin Index as of this writing revealed that they were all moving in separate directions.

The SP 500 and Nasdaq were experiencing losses, but they were less than 1%, while the Bitcoin Index flashed green and recorded gains of over 1%. The DXY, however, as well as the Euro futures, were flashing green.

Is your portfolio green? Check out the Bitcoin Profit Calculator

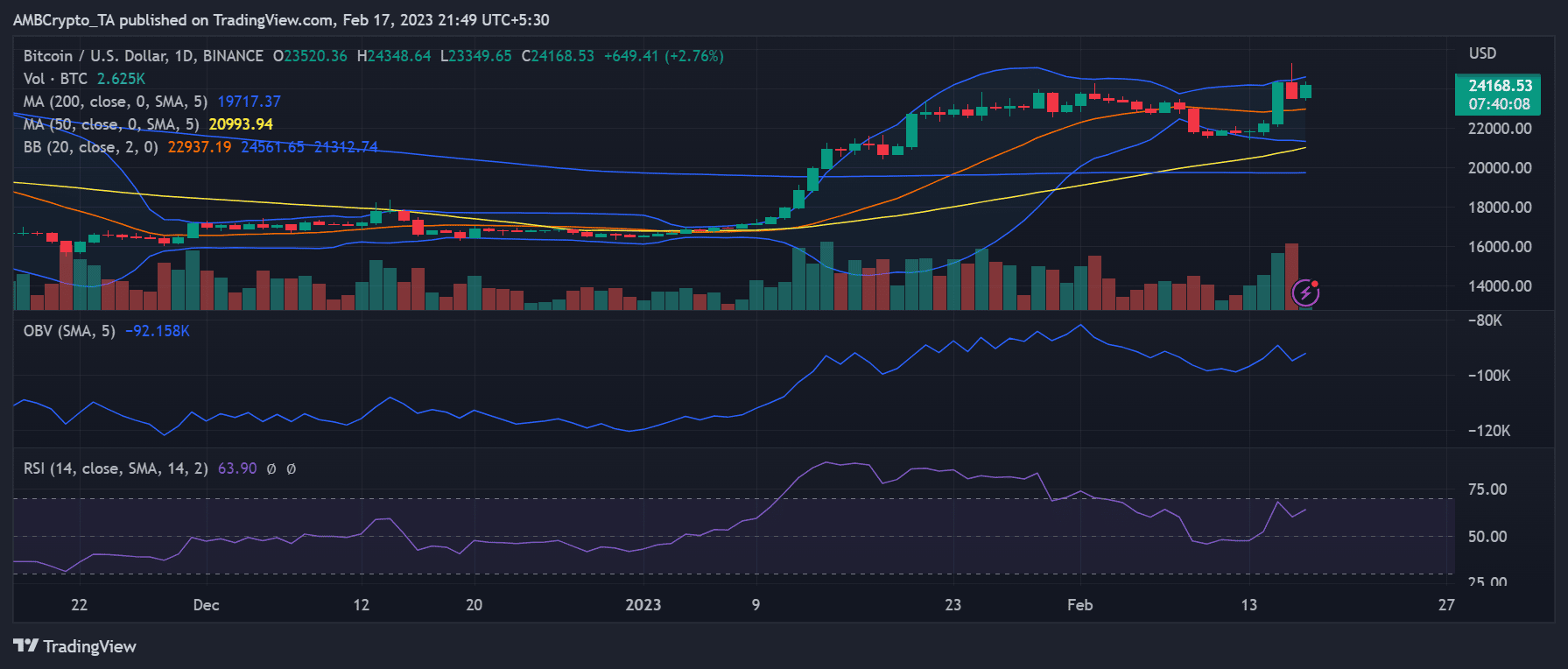

Looking at the daily chart of BTC’s price action, we can see it trending upwards. A bullish trend was indicated by the Relative Strength Index line being above 60.

As of this writing, the price of a single Bitcoin was just over $23,700. It also reflected a gain of more than 2% since the start of the trading day.