A whole lot of Ethereum [ETH] in your portfolio? Here are your LAMBO chances

“With public sentiment, nothing can fail. Without it, nothing can succeed”

It seems, Abraham Lincoln summarized the emotions of the crypto-market long back. While the king coin has been garnering a lot of investors’ interest of late, Ethereum looks complacent in this regard. Well, the painful gas fee could be one of the reasons.

Undeniably, investors who bought the coin at an all-time high might be associating themselves now with Hester Prynne of The Scarlet Letter for their “affair” with Ethereum. While a percentage of ETH holders have walked off cutting losses, others continue to look at the price charts with hope and distress.

Just recently, LUNA surpassed Ethereum in total value staked and this has, as it were, aggravated the investors’ agony.

Furthermore, expensive gas fees and slow transaction times on Ethereum have provided an opportunity for competitors to gain market share. In this regard, investment bank Morgan Stanley issued a report in January 2022, one noting that Ethereum’s dominant market share has greater chances to decrease over time. However, it’s interesting to note that bulls haven’t given up yet.

How so?

At the time of writing, ETH was up by 0.80% over the last 24 hours. After the unprecedented sell-off on 24 February, ETH bulls have been exerting pressure to go up the price charts. The token hit a local top of $3024, however, it invalidated its gains to touch the week-long support of $2591. For the coin to reach $3500, bulls will have to break past the resistance at $3024 and $3205.

The probability of which looks bleak at the moment.

The hike post 24 February was on the back of decreasing volume. This certainly meant that real profit can’t be expected unless the volume recovers. In fact, the RSI, at the time of writing stood at the 38-mark, with no hopes of moving north.

Well, all this goes to say that the current market structure for ETH doesn’t offer a profit-making opportunity. Curiously, it’s just half the truth. A few on-chain metrics reveal that investors clearly haven’t been rekt.

In fact, dreaming of a LAMBO with a huge percentage of ETH in your portfolio might not be a heart-wrenching experience in the decade-long future.

Well, looking at the chart, it can be seen that on 22 November 2020, there was a massive surge in long liquidations. Following the same, the price went down drastically.

It’s interesting to note that after 2020, there hasn’t been any major long liquidations event. However, 22 February 2021 and 19 May 2021 did see a spike in the long liquidations count. Even so, they were not even half of what 22 November 2020 saw.

Investors at this point should note that post 19 May 2021, there hasn’t been any major rise in the long liquidations count. In fact, if we compare the long liquidations on 22 February 2022 with last year, it can be clearly seen that investors are up for some massive profit-making opportunities in the days to come.

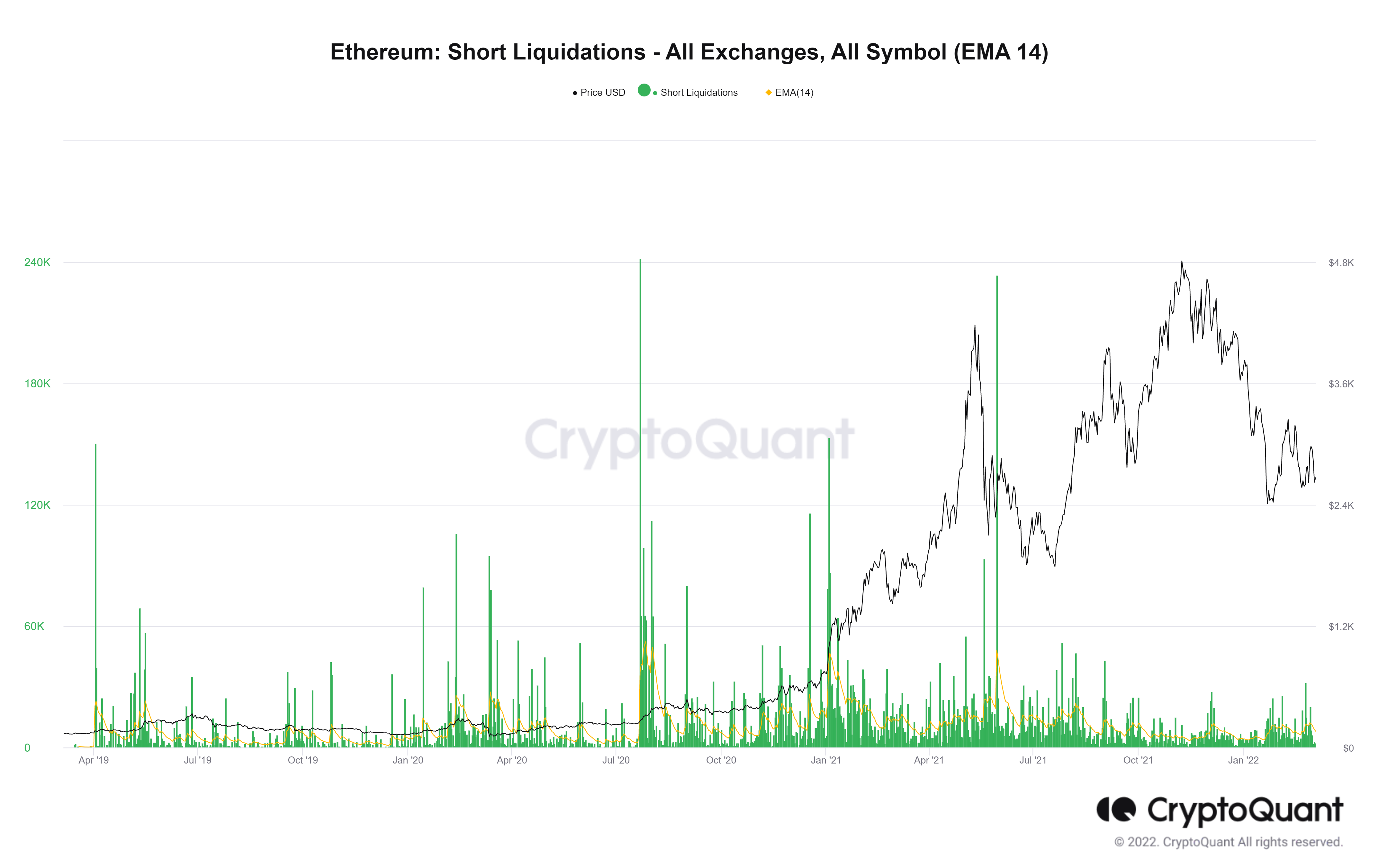

Interestingly, short liquidations are not going down after December 2021. In fact, it has been witnessing a short spike. If it manages to break above its 29 May 2021 count, ETH might see a rally in the future.

HODLing in this case, wouldn’t be a poor decision.

What you should and should not do?

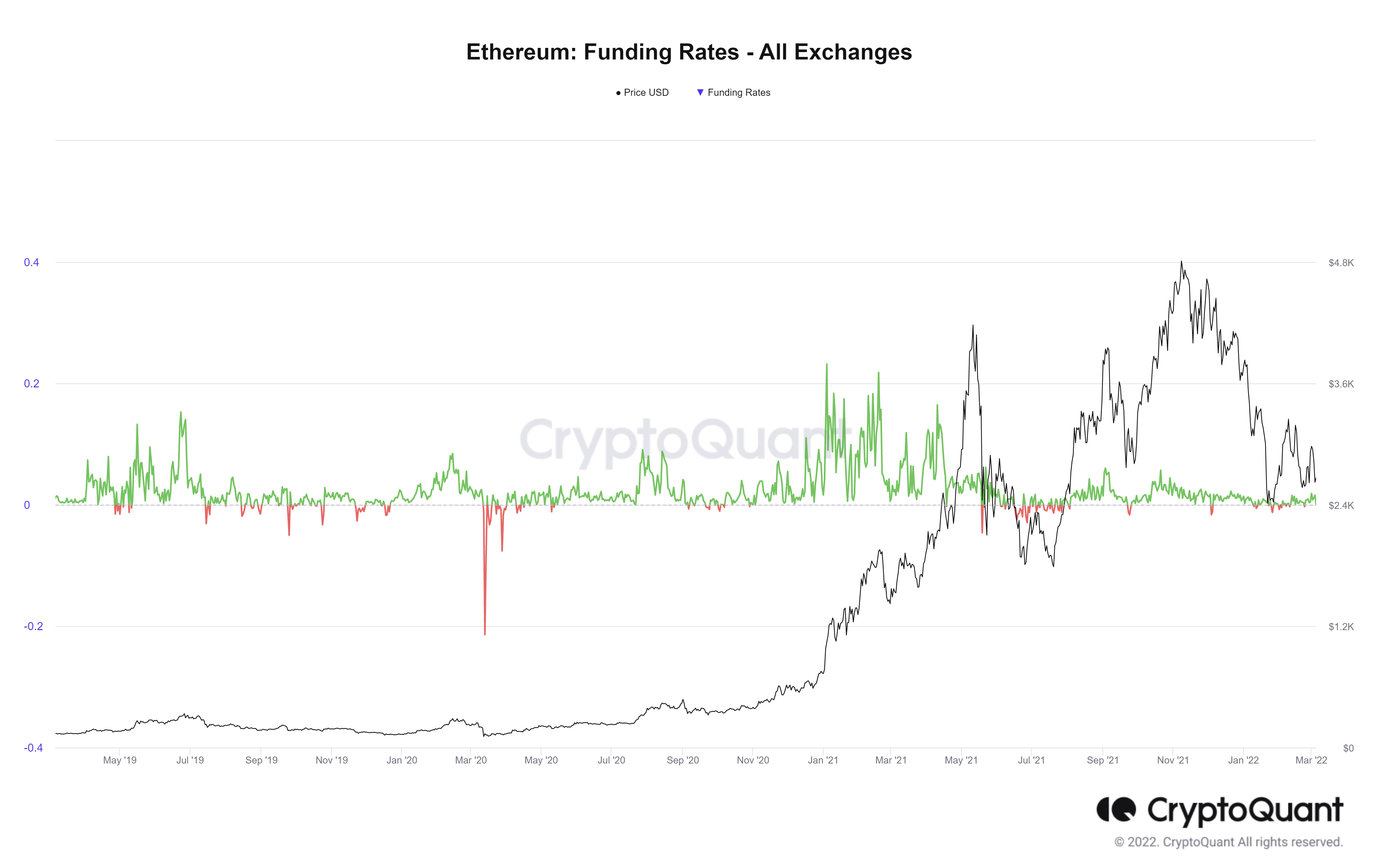

Basically, the funding rate for ETH has been above zero for the most part of 2020 and 2021. It simply means that more investors are predicting a bullish move for the Ethereum market.

Therefore, making an exit during the ‘dip’ might disappoint investors in the future.

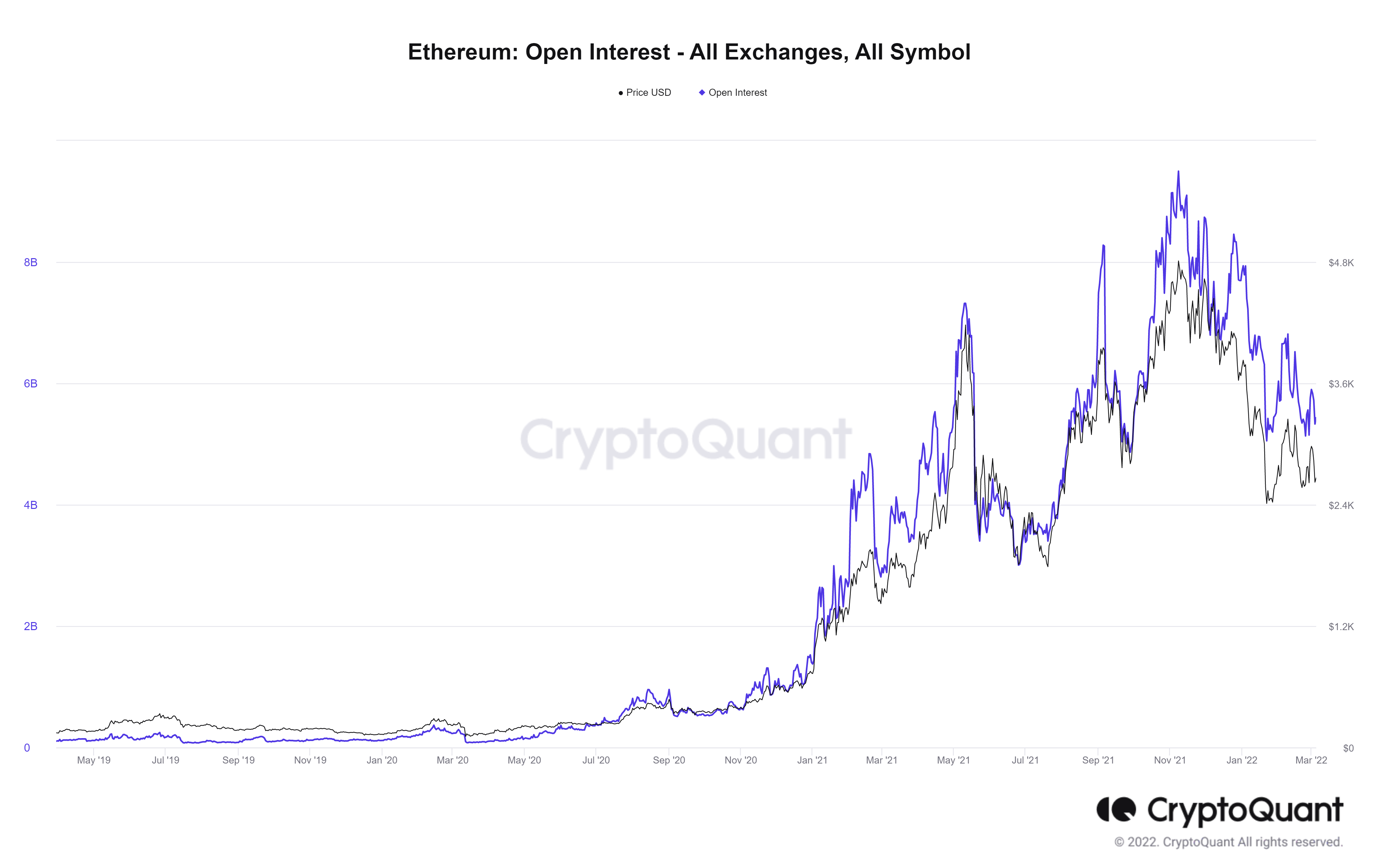

Well, the Open Interest saw an exponential increase post-December 2020. After reaching its high in November 2021, it dropped down by a significant margin.

Now, since the beginning of 2022, it hasn’t seen any massive surge. All this goes to say that the market volatility so far has been nominal when compared to the year 2021. This doesn’t hint at a bullish or bearish move. But, it reveals that the price of ETH might go down to find strong support before recording another rally.

The prospects of ETH for the long-term market look bright. However, an area of concern remains its daily active addresses which haven’t seen a major increase.

Despite the buzz of the Ethereum network switching to PoS, many investors don’t look highly interested to continue their journey with Ethereum. In fact, a lot of them have switched to Ethereum’s rival blockchains like Solana and Avalanche.

While the current market is giving an absolute bearish signal, it’s important to know that HODLing ETH might as well give a billion-dollar opportunity in the future.