A-Z of how Aave protocol performed in the last quarter

Dubbed as the ‘Ghost protocol,’ Aave is non-custodial lending and borrowing platform functioning primarily on Ethereum, Avalanche, and Polygon networks.

In a new report from Messari, the blockchain analytics firm found that in the last quarter, lending and borrowing activity in the cryptocurrency space was significantly impacted by the collapse of Terra and the downturn of the general market.

This led to a drop in Aave’s revenue in Q2.

Decline in Q2 revenue

According to Messari, the decline in borrower leverage demand due to the fall in the prices of crypto assets led to an 18% drop in Aave’s total revenue.

In Q1, the total revenue made by Aave was $63.5 million. It closed last quarter with total revenue of $51.8 million.

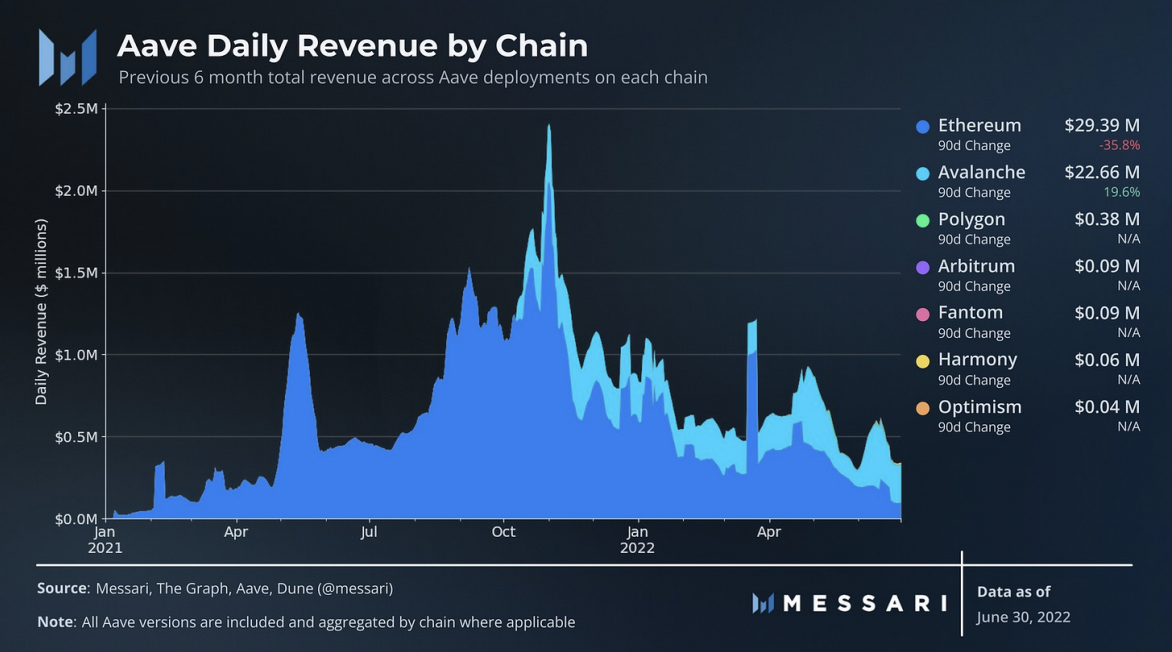

While the protocol’s overall revenue declined, the rate of decline differed across the different chains within which the protocol is housed, Messari found.

Following the collapse of Celsius, one of its largest users, Aave’s Ethereum V2 deployment, suffered the most decline in Q2.

According to the report, circa 20% of all the outstanding debt on Aave Ethereum was repaid by Celsius’s main trading wallet between 9 June and 13 July.

These huge repayments and a more than 50% general decline in the prices of crypto assets led Aave’s Ethereum to post around a 36% decline in revenue within the three-month period.

Aave Ethereum closed the quarter with total revenue of $30 million.

Aave’s deployments on Avalanche, however, told a different tale.

The total revenue made on Avalanche grew by 20% in the last quarter. Outperforming Ethereum, Messari found that Aave’s revenue on Avalanche exceeded its Ethereum-based revenues for May and June.

Commenting on the reason behind the growth of revenue on Avalanche, Messari stated,

“A large amount of the activity behind Aave’s total revenue on Avalanche is currently subsidized by the Avalanche Rush incentives in the form of native AVAX tokens. The incentives offset the borrowing rate below the rate paid to depositors, allowing borrowers to earn nearly risk-free yield by repeatedly redepositing borrowed funds.“

Furthermore, Aave’s deployments on Polygon, Arbitrum, Harmony, Fantom, and Optimism did not post any gains or losses in the last quarter, Messari found.

Loans on Aave are powered by a wide range of crypto assets, from stablecoins to unbacked cryptocurrencies. Since Q1 2021, stablecoin loans have contributed up to 98% of Aave’s quarterly revenue.

Although still high, Messari found that stablecoin loans contributed only 82% of Aave’s revenue in the last quarter.

According to the report,

“The decline in stablecoin revenue share was largely due to two factors: the repayment of DAI, and the surge in demand to borrow ETH and BTC. Since DAI is issued as debt, its market cap dropped by a third as debtors unwound many of their positions following May’s Terra implosion. The jump in ETH and BTC interest revenues came as users sought to profit from the broader market declines by borrowing and selling these assets (i.e. shorting these assets).”

Some growth?

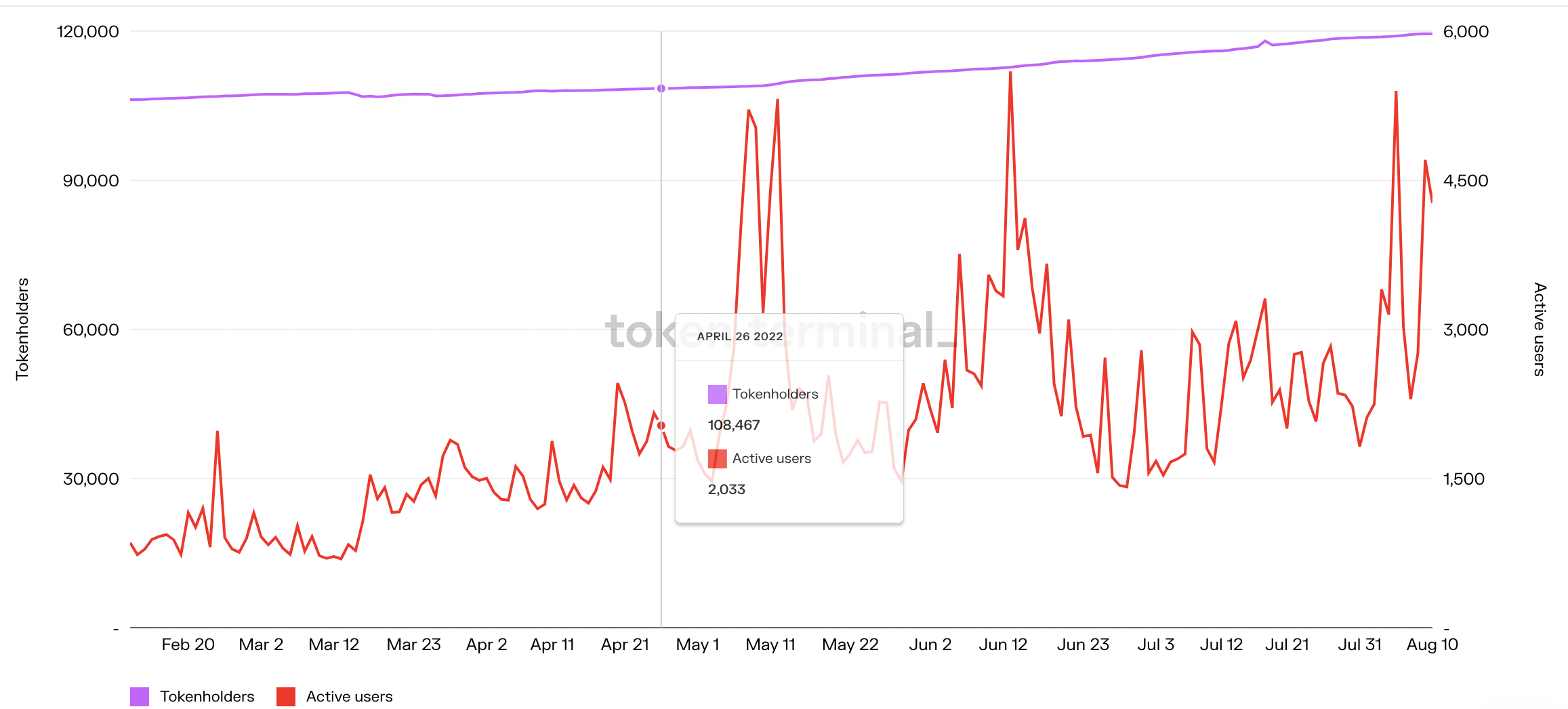

According to Token Terminal, token holders on Aave grew by 6% in Q2. By 30 June, token holders on the protocol stood at 114,572. Within the 90-day window period, the count of active users on the protocol rallied by 32%.