AAVE: As bullish signals emerge, where will the altcoin head next?

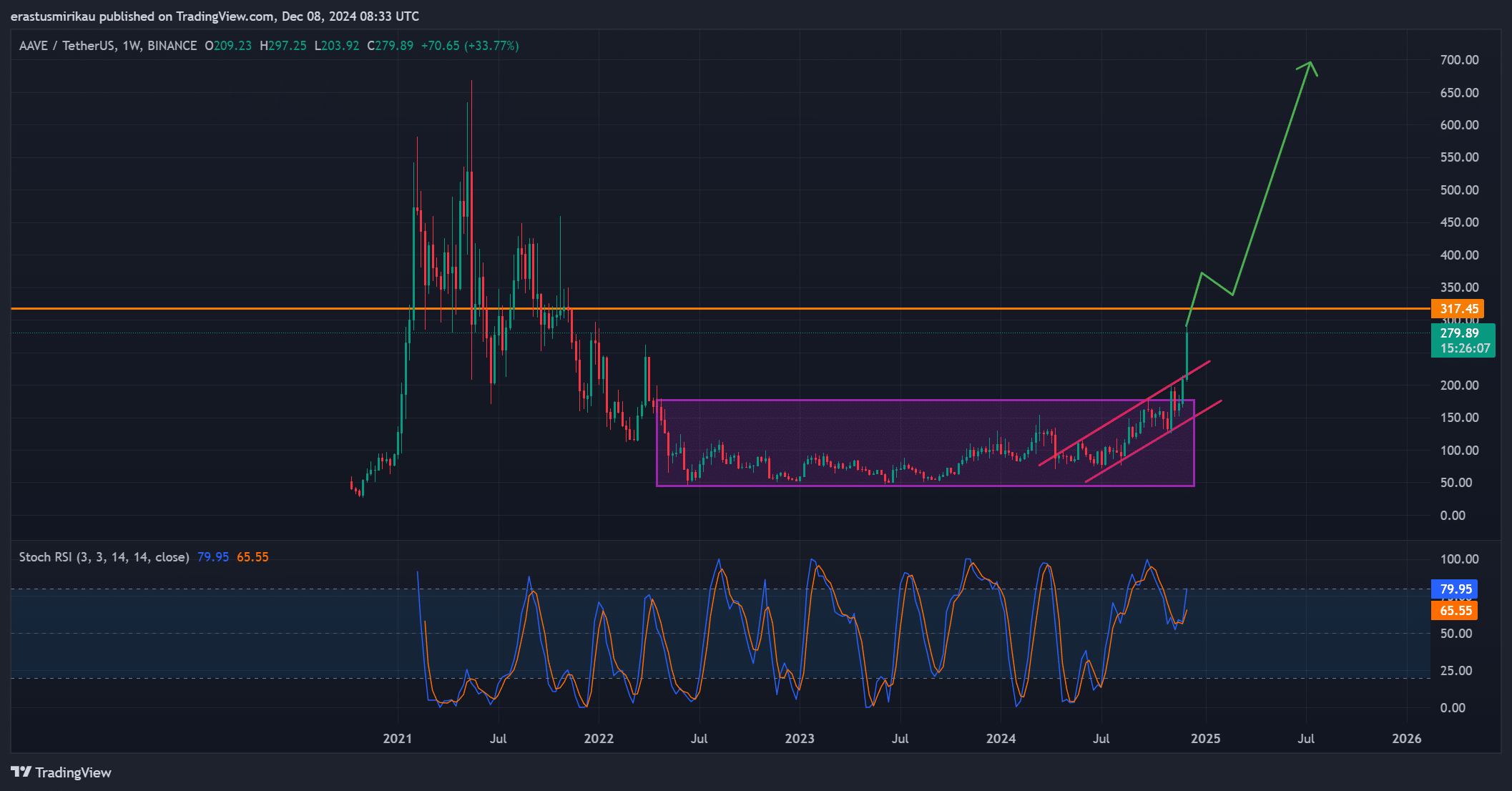

- AAVE has broken out of consolidation and an ascending channel, signaling strong bullish momentum.

- On-chain and exchange data showed growing investor interest, indicating a potential upward trend.

Aave [AAVE] has shattered its long-standing consolidation phase and exited the ascending channel, showcasing strong bullish momentum.

At press time, AAVE traded at $279.53, experiencing a 1.68% decline in the past 24 hours.

However, despite this short-term setback, technical and on-chain indicators pointed to a potential upward trend. Could AAVE be on the brink of a significant bullish breakout in the crypto market?

What do the charts say about AAVE’s technical movement?

AAVE was a crucial resistance level of $317 at press time, a point that could confirm the bullish trend. The breakout from the consolidation phase and ascending channel signals a robust upward movement.

The Stochastic RSI was 79.95, indicating strong bullish sentiment.

However, such a high RSI also suggests overbought conditions, which could trigger a temporary pullback. Nevertheless, AAVE’s consistent upward movement and breakouts showed solid support.

Therefore, a decisive break above $317 would likely drive further bullish momentum and attract more investor attention.

What are the on-chain signals telling us?

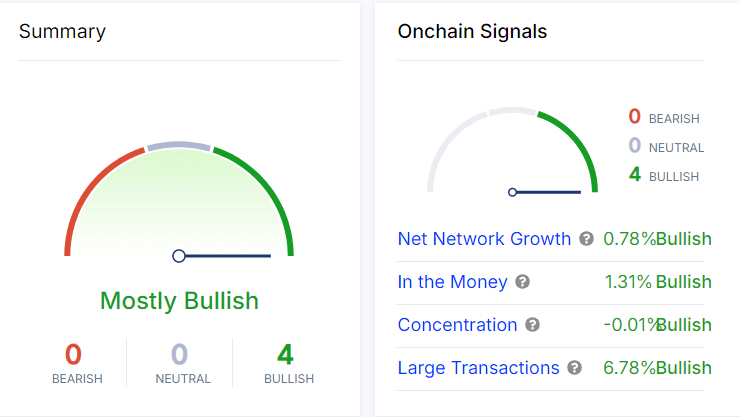

On-chain data adds to the bullish outlook for AAVE. Net network growth stood at 0.78%, indicating an increase in active users. Additionally, 1.31% investors were “in the money,”, reinforcing the bullish sentiment.

Concentration data also reveals a slight bullish trend of -0.01%, while large transactions have surged by 6.78%.

These suggested significant investor interest and activity, highlighting a growing bullish trend within the altcoin ecosystem.

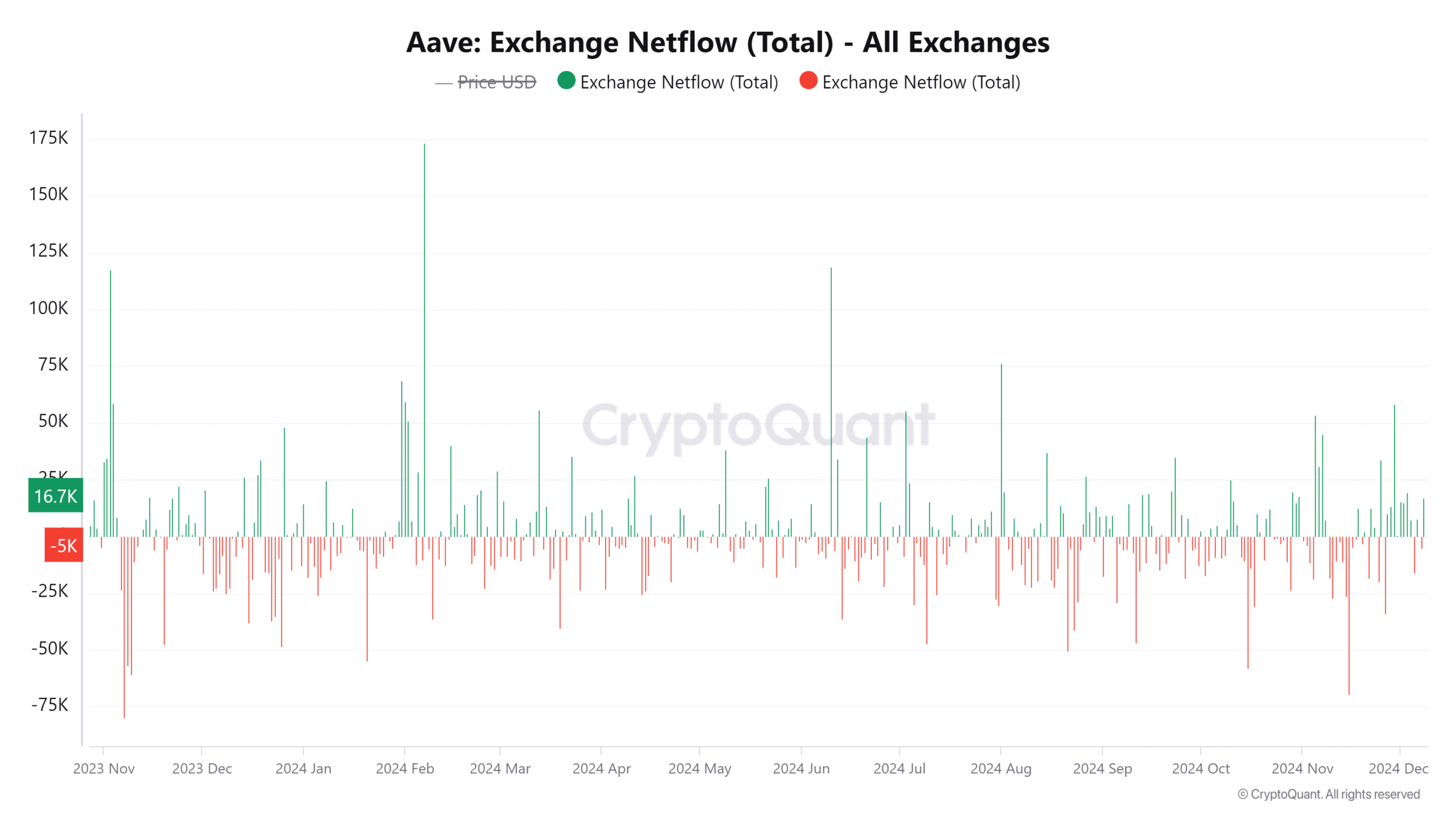

What does the exchange netflow reveal about AAVE’s strength?

The exchange netflow saw a 24-hour drop of 3.35%, reaching 22.5459k. This suggested that more investors were moving their holdings off exchanges, a sign of long-term bullish sentiment.

Investors prefer storing assets in private wallets rather than on exchanges, expecting higher returns in the near future.

What do long and short positions say about market sentiment?

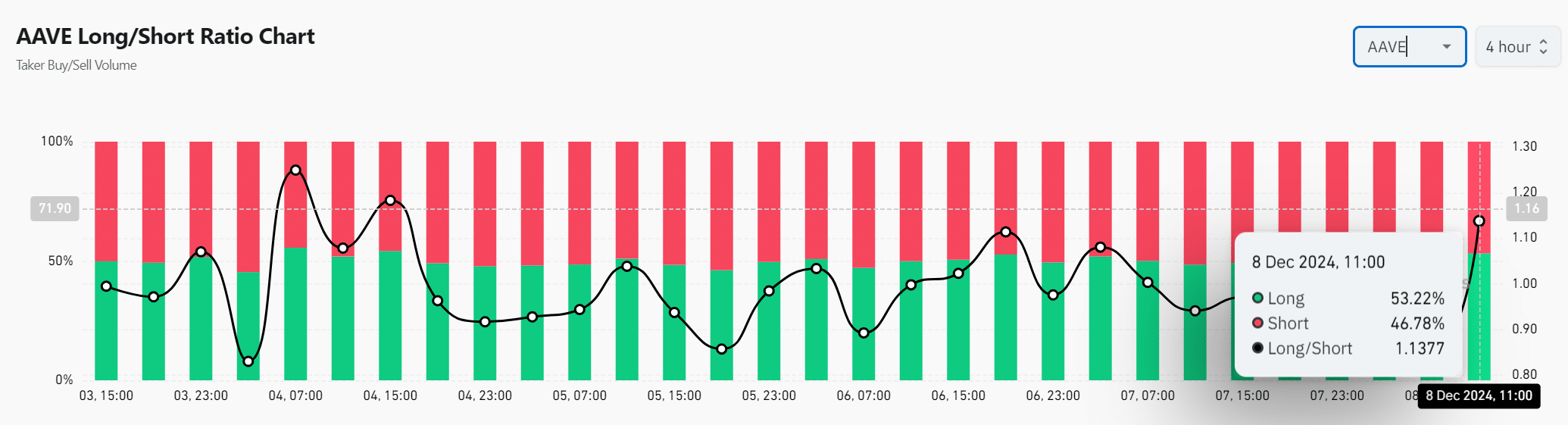

The long/short ratio was 1.1377 at the time of writing, with long positions at 53.22% and short positions at 46.78%. The higher percentage of long positions indicated strong bullish sentiment among traders.

Therefore, investors remained confident in AAVE’s continued upward movement and anticipated significant gains.

Read Aave’s [AAVE] Price Prediction 2024-25

AAVE shows bullish momentum across technical, on-chain, and exchange indicators. The $279.53 price level, combined with the breakout from the long consolidation phase and ascending channel, signals strong bullish interest.

Therefore, AAVE is likely on the verge of a breakout, with a significant upward trend anticipated in the near future.