AAVE, MKR, CRV: Will the market’s ‘higher-highs’ tide lift the DeFi boat

The broader crypto market has been in the “pump-mode” over the last couple of days. Bitcoin’s price managed to touch a level as high as $62.93k while Ethereum managed to pump to $3.97k. In effect, other alts have also been trading at relatively higher targets. But, what about the DeFi market and its tokens?

Assessing the odds of its boat being lifted

AAVE, MKR and CRV – Three of the most prominent tokens from the space have had a quite dry week. At the time of writing, it was noted that these tokens had fetched their investors with merely single-digit returns over the last 7 days. Other tokens from the space – right from typical currencies to other smart-contract-related tokens, have performed comparatively better.

The influx of new participants into the space as a whole and in individual protocols hasn’t been very high. Consider this – since the beginning of October, the number of unique DeFi addresses have not increased by more than 100k. Even though the rise of this metric has been fairly consistent, it should be noted that the pace of increase is a matter of concern at this stage.

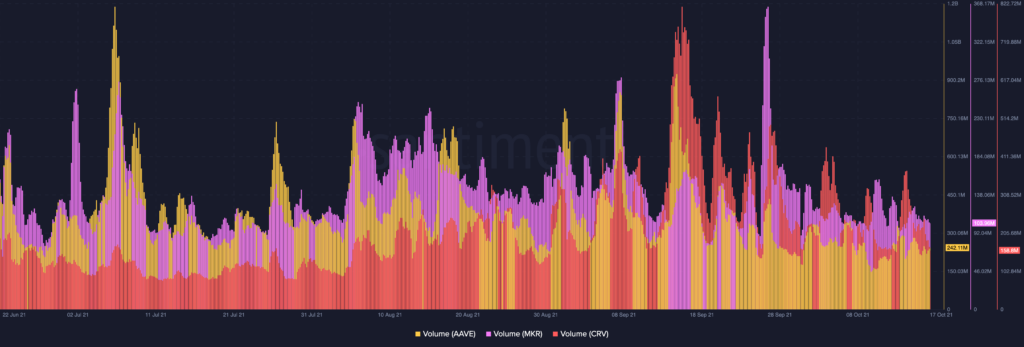

In effect, the trading volume of these tokens has taken a hit, underlining the rusting interest of market participants towards this crypto subset. As observed from the chart attached below, this metric did make a couple of spikes here and there in the August-September period, but has remained more towards the downside since the beginning of October.

Source: Santiment

The market cap/TVL ratio has also been on fall of late, blowing away the HODLing narrative. At the time of writing, this ratio for AAVE, MKR and CRV and stood at 0.25, 0.15,0.07. This, again, underlines the withering interest of market participants.

Further, the net flow on exchanges for most of the aforementioned tokens have registered an uptick, implying inflows and the movement of DeFi tokens from private wallets and cold storage to exchanges. On a daily basis, on average, over 2 million CRV tokens have been flowing into exchanges when compared to the mere 1 million outflows.

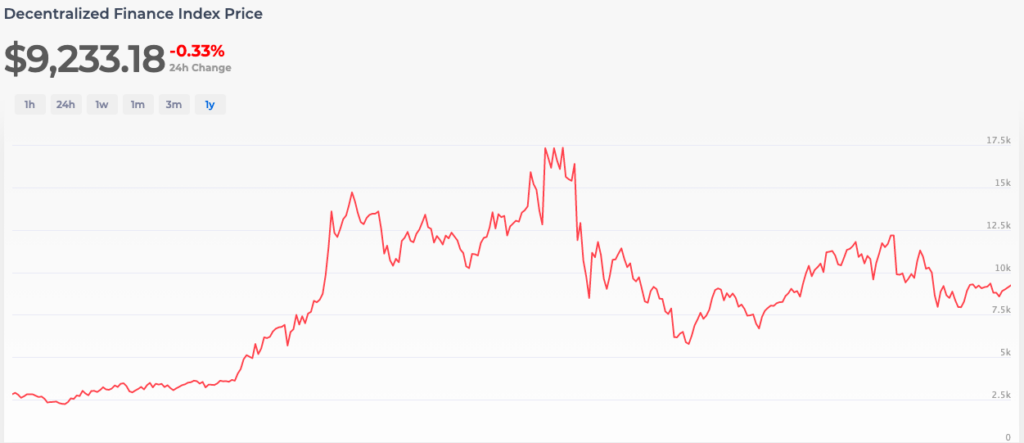

The ripple effect of the dull and gloomy state of the aforementioned metrics was prominently visible on the reading of the DeFi Index. As can be seen from the chart attached below, it hasn’t been able to cross the $10k mark since mid-September – which is arguably bearish.

Source: ethereumprice.org

Well, keeping the inferences drawn from the aforementioned datasets, it can be said that the DeFi token accumulation trend is gradually fading away. If the demand further falls and the prevalent selling-pressure gains more steam, these tokens would find it challenging to attain higher targets in the coming days. If that happens, then even the broader market tide wouldn’t be able to lift DeFi’s boat.