AAVE plans to expand DeFi’s reach, but will the alt finally react

AAVE, for the longest time, had been one of the most competitive DeFi protocols in the world. However, the $6 billion drop in its total value locked (TVL) towards the beginning of this month replaced it off its #1 position.

Recovering slowly, AAVE last week incorporated the idea of furthering the cause of DeFi using institutions.

AAVE and its new Arc

AAVE Arc is basically an isolated market and sandbox environment for institutions to experience DeFi in its entirety and push it to their clients and users going forward. This way, AAVE intends for people to understand how effective decentralized governance and automated smart control-based execution protocols can be in this time.

Notably, Arc will still be governed by the Aave Governance, but here “whitelisters” play an important role.

They are guardians in the Arc market who provide all KYC and onboarding services to users. Besides, they also maintain the sustainability and security of Arc by keeping a check on what AIP should be approved. By doing so, they make sure it does not hamper the compliance obligations.

Reportedly, Fireblocks LLC was announced to be the first firm to apply to become a whitelister. It is already a known name thanks to its institutional MPC wallet which supports AAVE V2.

This idea is a big step for AAVE and DeFi in general. Mainly because if the move proves to be a success, we can expect several institutions to create diverse use cases of the technology and help DeFi achieve its purpose.

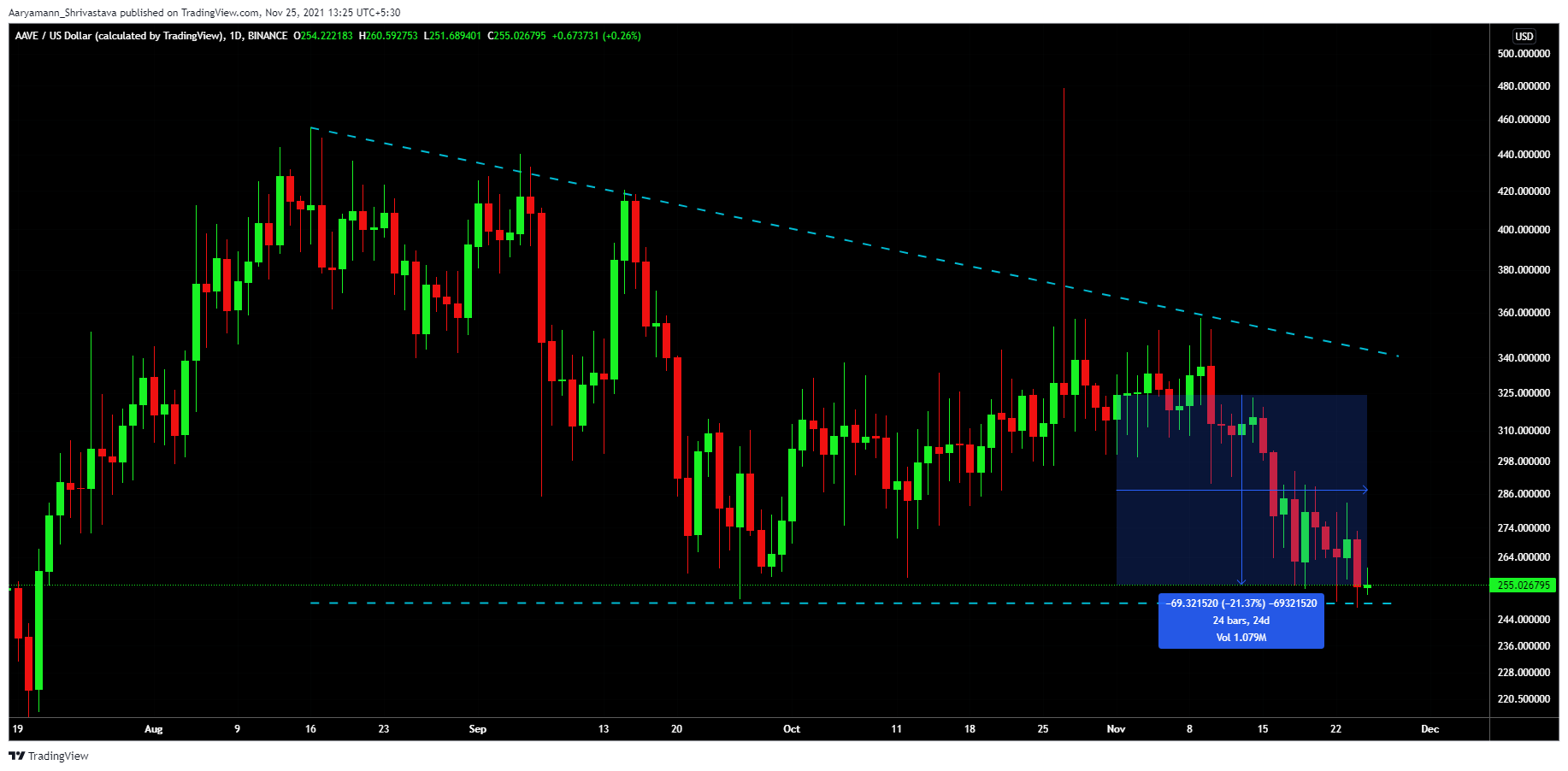

However, the announcement is yet to have any major effect on the network in any way. AAVE is continuing to perform poorly as the altcoin is still stuck in its two-month-long downtrend wedged structure, marking another 21% drop this month.

AAVE price action | Source: TradingView – AMBCrypto

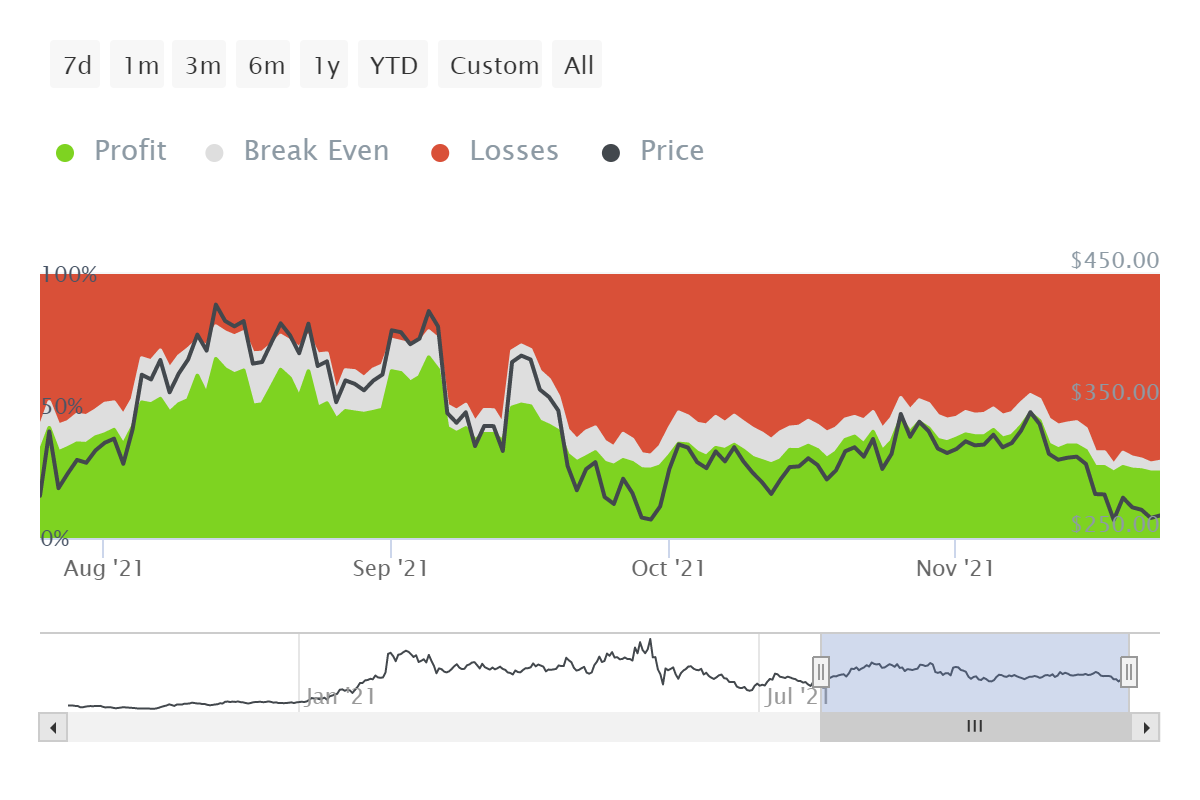

This has led to almost 75% of all AAVE investors suffering losses. And, with the crypto’s volatility at its lowest in a long time, the path to recovery is going to be a slow one.

AAVE addresses’ profitability | Source: Intotheblock – AMBCrypto

Fortunately, the network continues to have the support of its investors who remain consistently active and keep transactions’ volumes’ averaged around $100 million.

AAVE transaction volumes | Source: Intotheblock – AMBCrypto