Aave rallies 30% in a month- Are whale transactions responsible for hike?

- Aave [AAVE] has seen increased activity from whales as its value has also increased.

- The Netflow and price movement suggest a positive impact on AAVE.

The whales’ interest in cryptocurrencies recently appears to have intensified. According to recent statistics, Aave [AAVE] has attracted the interest of whales, but how has whale action affected it?

Read Aave’s [AAVE] Price Prediction 2023-2024

Could whale actions be dangerous for AAVE?

The market’s spectacular start to 2023 has leveled out. Some assets are showing signs of corrections while others have still had a bit more pump to start February, suggesting that the asset market is currently in a “hit or miss” state.

But there might be warning signs in the behavior of whales right now. They could be cashing out a portion of their gains or signaling a more dramatic shift away from their cryptocurrency holdings.

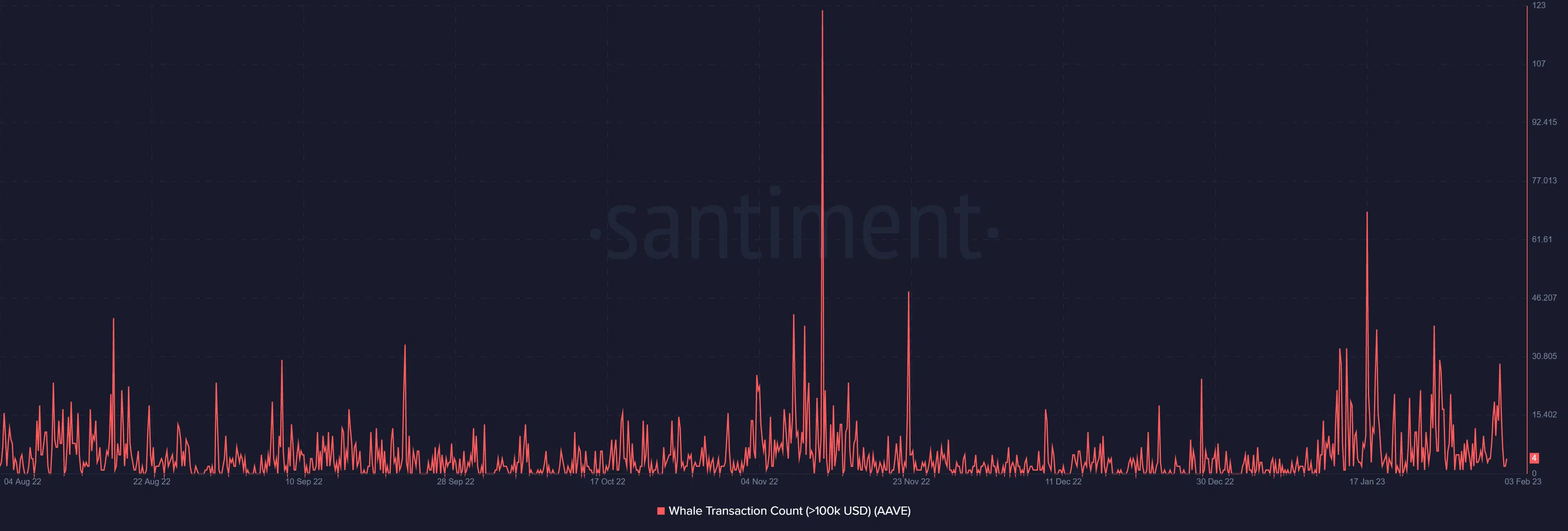

Remarkably, its price has increased by more than 65% in the previous 30 days. Over the past few weeks, there have been three increases in whale transactions of roughly the same amount.

And, the biggest one did indicate a peak per Santiment data. There were 106 deals over $100k or more, which is a lot, but it is still less than the 129 on 16 January. Looking at AAVE’s exchange inflow before determining the effect of the whale’s actions could shed light on the latter.

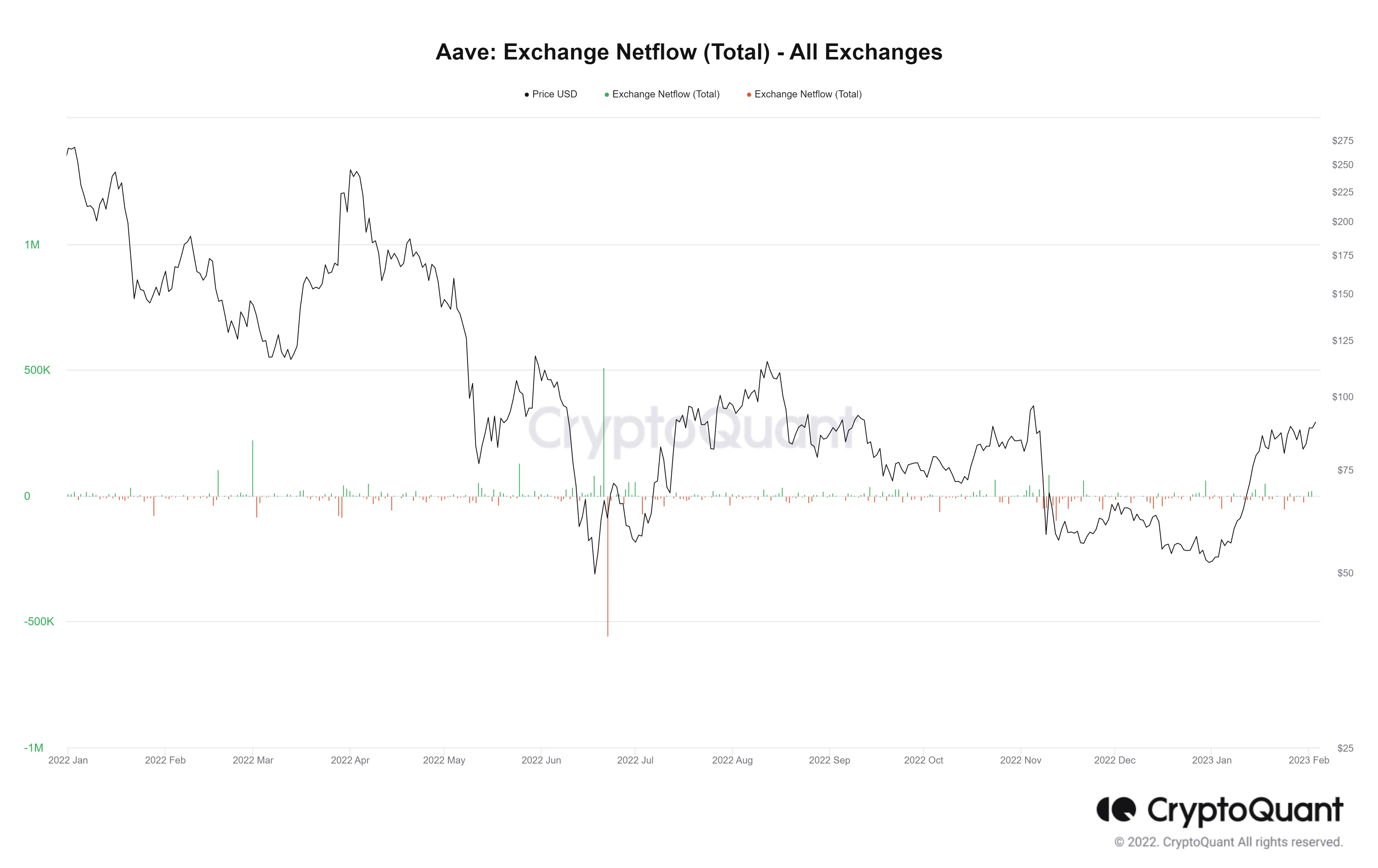

More AAVE leaves exchanges

Even with whale transactions, the Netflow of AAVE, as seen on CryptoQuant, indicates that there has been more outflow than influx. When looking at the Netflow on 16 January, it was clear that there were more outflows than inflows, notwithstanding the increase in whale transactions. Since outflow is so prevalent, it can be inferred that investors prefer holding onto their tokens rather than selling them.

Whale activities impact the price

Additionally, a review at Aave [AAVE] on a daily timeframe chart revealed that the days with higher whale transaction volumes had a favorable effect on the price.

The Relative Strength Index on the daily period chart also demonstrated that it was still in a bull trend. At the time of writing, the RSI line was higher than 60. The token was selling for about $89 as of this writing.

However, the price movement revealed that the whale’s actions had brought instability. Its level of volatility could be seen using the Bollinger Band. Its current volatility suggests that an upswing or downswing could happen depending on the key trades.