AAVE’s price consolidation could end at this range: Will investors benefit

Disclaimer: The information presented does not constitute financial, investment, trading, or other types of advice and is solely the writer’s opinion.

- AAVE could break out from its recent parallel channel pattern.

- Holders sustained a decline in gains during the price consolidation period.

Aave’s [AAVE] recent rally offered investors and traders impressive returns. It rose from $52 to $91, posting over 70% gains. However, the price consolidation that followed after hitting $91 undermined extra profits.

Read Aave’s [AAVE] Price Prediction 2023-24

At the time of publication, AAVE’s value was $83.20 and could attempt to break from its current price consolidation range.

The price consolidation range of $79 – $90: Is a breach likely?

Since mid-January, AAVE oscillated between $79 and $90, curving a parallel channel pattern (yellow). Notably, the price action was predominantly in the upper range of $85 – $90 in the same period.

How much is 1,10,100 AAVEs worth today?

In the next few hours/days, bulls could attempt to break above the parallel channel and aim at the bullish target of $97.7 based on the channel’s height. However, bulls must clear the hurdles at the channel’s mid-range level of $85 and overhead resistance level of $90 for such a move to be feasible.

Alternatively, bears could gain leverage and inflict a bearish breakout below the channel’s lower boundary of $79. The move would invalidate the above bullish bias. But such a drop could settle at the bearish target of $71.3, with a couple of potential steady grounds along the way.

AAVE’s development activity spiked, but hodlers’ profits fluctuated

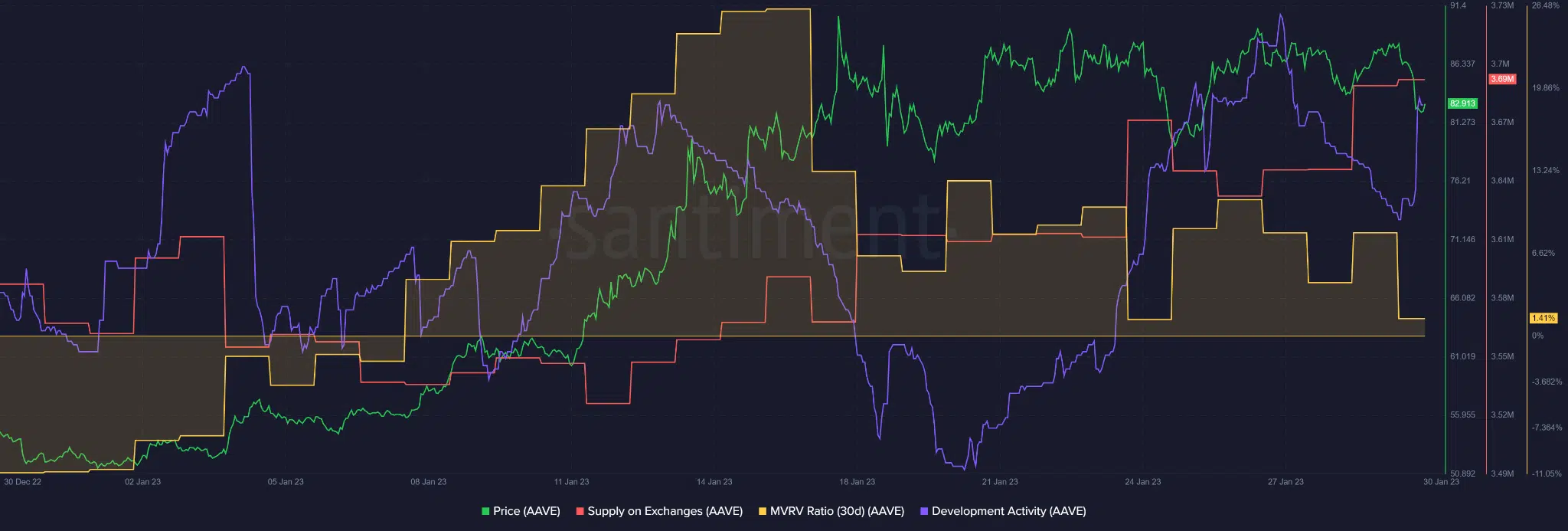

According to Santiment, AAVE recorded a sharp increase in development activity, indicating the network saw massive building growth at press time. This could boost investors’ confidence and the token’s value in the long run.

However, holders’ profits fluctuated, as evidenced by fluctuating MVRV, because AAVE’s price was restricted in a consolidation range. Nevertheless, a 10% gain was likely if a bullish breakout happened in the next few hours/days.

But traders and investors must be cautious with the short-term sell pressure, which was indicated by the spike in Supply on Exchanges.