Aave: Rebound or extended retracement — where is AAVE headed?

Disclaimer: The information presented does not constitute financial, investment, trading, or other types of advice and is solely the writer’s opinion.

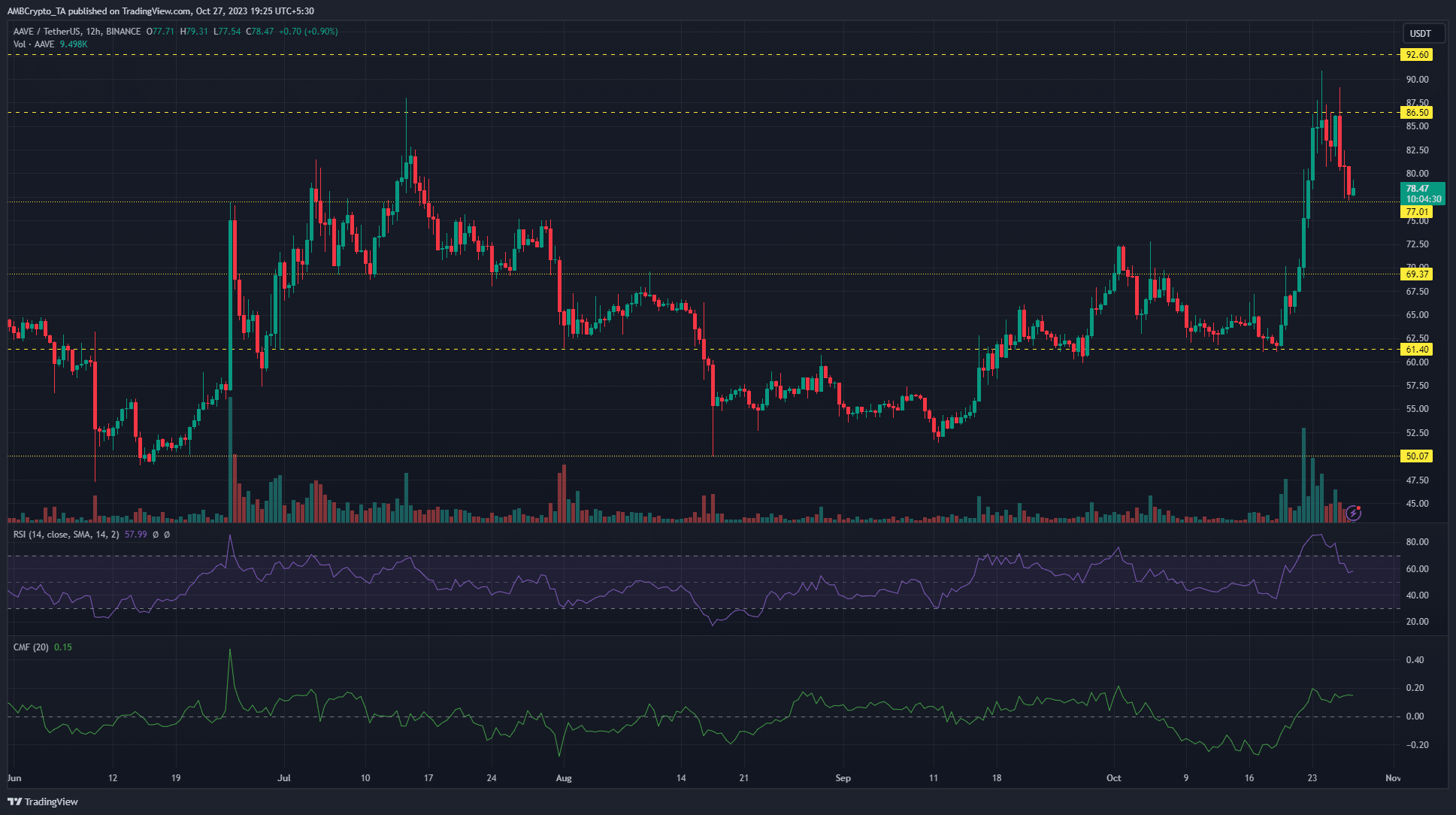

- AAVE’s bullish run faltered at the $86.5 resistance level

- Bulls looked to rebound from the $77 support level with funding rates staying positive

Aave [AAVE] bulls failed to consolidate the recent bullish gains with a price rejection at the $86.5 resistance forcing a sharp retracement. The 13% dip from the resistance level took AAVE to the near-term support at $77.

Read Aave’s [AAVE] Price Prediction 2023-24

However, as of the time of writing, bulls successfully defended the support level on the 12H timeframe and actively looking to rebound. Meanwhile, Bitcoin [BTC] consolidated its recent bullish run at the $34k price zone with buyers looking to scale the next hurdle at $35k.

AAVE retained bullish sentiment despite a sharp pullback

Source: AAVE/USDT on Trading View

Despite the retracement, AAVE was still bullish in the short term. This was highlighted by the Relative Strength Index (RSI) staying above the neutral 50, despite dipping out of the overbought zone. This reiterated the strong buying pressure still available on the higher timeframes.

Similarly, capital inflows stayed positive with the Chaikin Money Flow’s (CMF) reading of +0.15.

Based on the price action and on-chart indicators, buyers can anticipate a quick rebound with profit targets at $83 to $85. On the flip side, if the bullish defense at $77 falters, sellers could take advantage of further dips with targets at $70 to $72.

Mixed signals in the futures market

Source: Coinalyze

The positive funding rate showed that more speculators were willing to buy in highlighting decent demand for AAVE. This was according to data from Coinalyze.

Is your portfolio green? Check out the AAVE Profit Calculator

However, the Open Interest (OI) continued to decline which showed uncertainty in the current price rebound. Similarly, the spot CVD dipped to signal wavering demand.

As such, traders should wait for a bullish candle close at the $77 support on the higher timeframes before entering long positions.