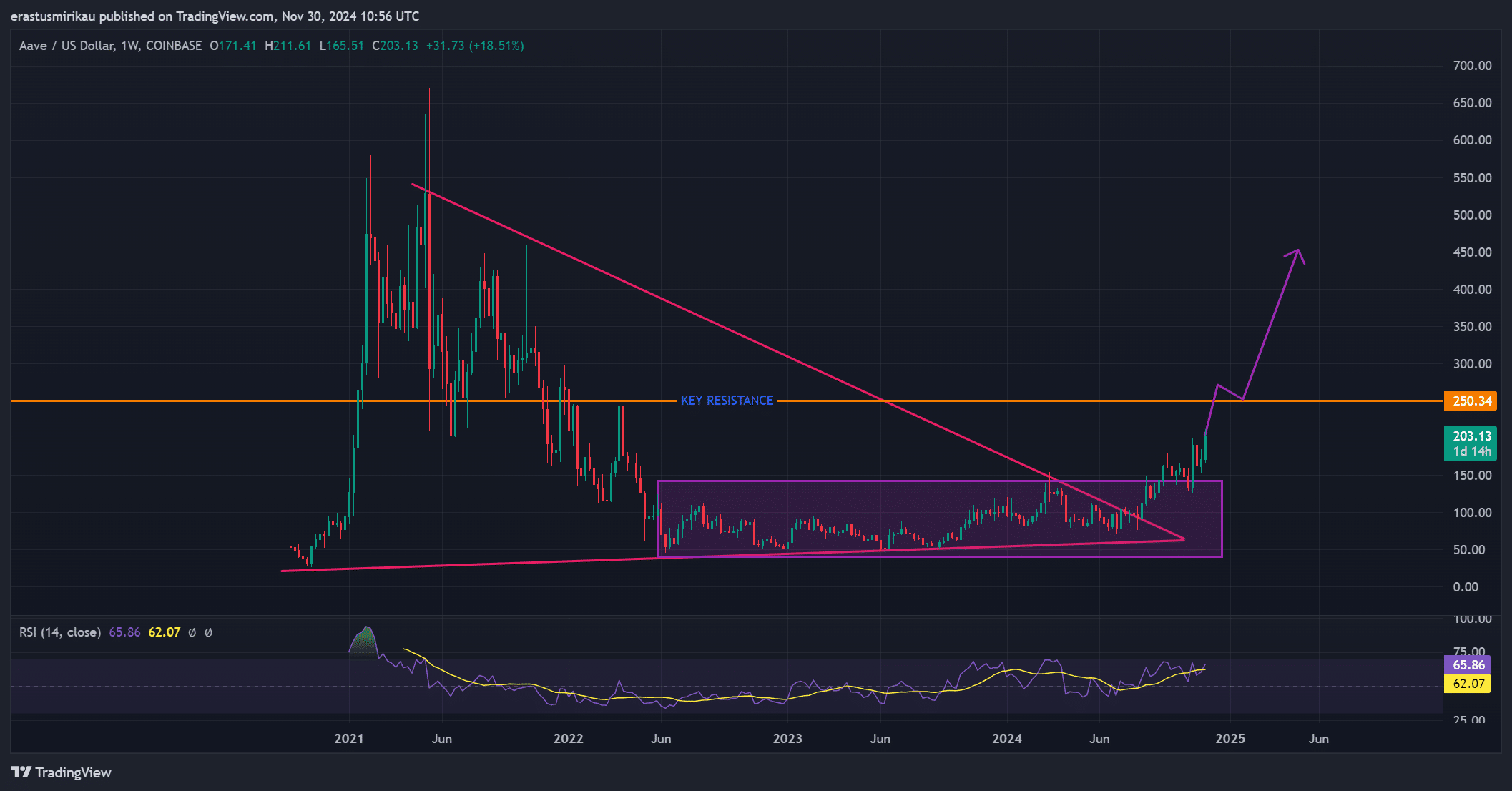

AAVE sets $250 price target, but here’s what must happen first

- AAVE broke out from accumulation, while approaching the key resistance at $250 with a strong RSI

- On-chain metrics, rising Open Interest, and liquidations pointed to sustained bullish momentum

Aave [AAVE] has emerged as one of the most bullish tokens in the market, recently breaking out from its accumulation box on the weekly timeframe. Trading at $202.53 at press time, up 2.06% in the last 24 hours, the token seemed to be showing strong price action and momentum.

As AAVE continues to climb, the key question is whether it can maintain this bullish momentum or face resistance at this level.

Price action – Breakout and approaching resistance

AAVE’s price action has been impressive, breaking out from its accumulation phase with a solid surge in value. With a value of $202.53 at press time, the token seemed to be testing higher price levels on its chart. In fact, the price is now approaching the critical resistance zone at $250 – A level that has historically posed challenges for AAVE.

The Relative Strength Index (RSI) had a reading of 65.86, indicating strong bullish momentum while also suggesting that AAVE may be nearing overbought territory. Therefore, while the rally appears strong, the token may face some difficulty breaking through this key resistance.

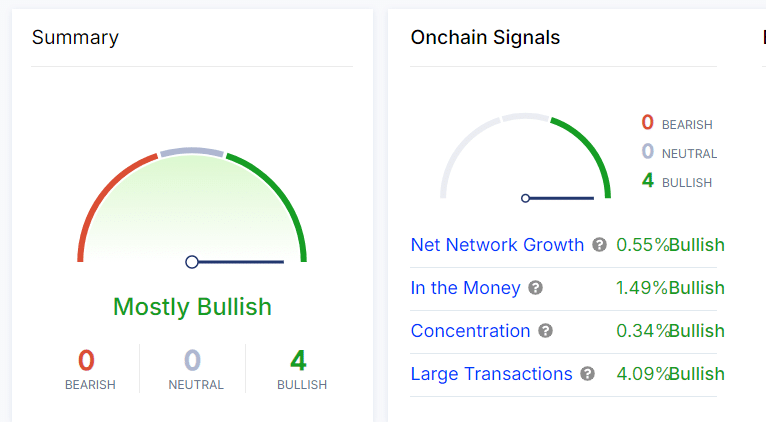

On-chain signals – Bullish metrics support the rally

The altcoin’s on-chain metrics offered additional evidence that the bullish momentum could continue. Network growth increased by 0.55%, reflecting rising activity and interest in the ecosystem. Furthermore, the “Into the Money” metric revealed a 1.49% hike, suggesting that more traders are entering profitable positions.

Additionally, the concentration metric climbed by 0.34% while large transactions rose by 4.09% – A sign of strong demand from both retail and institutional investors.

Consequently, these signals suggest that AAVE’s price hike has been being driven by genuine buying interest, further reinforcing the bullish outlook.

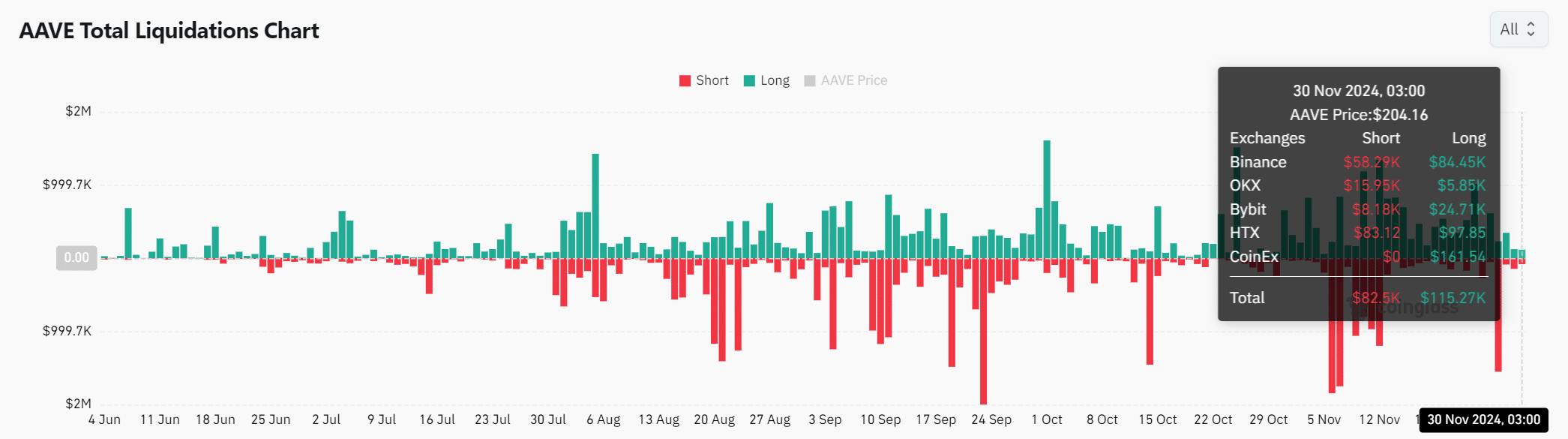

Liquidations – Shorts and longs in play

The token has also seen notable liquidations, with shorts totaling $82.5k and longs at $115.27k. This uptick in liquidation activity is a sign of the heightened volatility surrounding the token.

As both long and short positions are actively being liquidated, AAVE is likely to see amplified price movements in the short term. These liquidations could potentially fuel more upside if bullish positions dominate, or cause a retracement if bears take control.

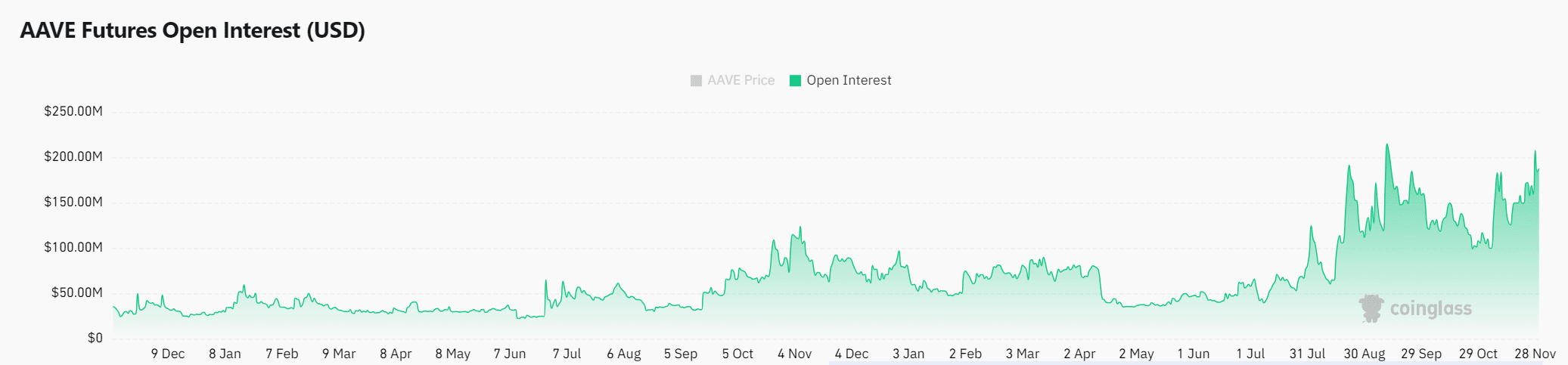

Open interest – Rising confidence in AAVE

Open Interest surged by 10.35%, hitting $186.22 million. This hike can be interpreted to mean growing market confidence, while implying that traders are increasingly betting on AAVE’s price continuing to rise.

With higher Open interest, there is a greater likelihood of significant price movement. Especially as the token tests key resistance levels.

Read Aave’s [AAVE] Price Prediction 2024-25

Can AAVE break through $250?

AAVE’s bullish breakout, backed by strong price action and positive on-chain signals, suggest that the token may be on track to test higher levels. However, the resistance at $250 remains a significant hurdle.

If it can break through this level, it could see a sharp rally towards its new highs. Consequently, traders should monitor the token’s price closely to determine whether AAVE can sustain its momentum and overcome this resistance.