Aave’s TVL on the line as whales trim their balances

- Aave tops the list of the leading polygon projects by market cap.

- Its token bounces back rapidly despite recent whale outflows.

Decentralized Finance (DeFi) protocols have maintained healthy activity despite taking a massive hit during the bear market. Top DeFi projects felt the impact in the form of liquidity outflows but many have survived.

Aave is currently the leading DeFi project within the Polygon ecosystem.

Is your portfolio green? Check out the AAVE Profit Calculator

According to the latest ranking conducted by the Twitter account Ben GCrypto, Aave’s total value locked (TVL) clocked in at $317 million.

Quickswap came in second with $166 million while Balancer had the third-highest TVL at $132 million.

Despite Aave being at the top of the Polygon table as far as TVL is concerned, its native token experienced increased sell pressure since the start of the week.

Top 10 Polygon Ecosystem Coins by Total Value Locked@0xPolygon $MATIC is a decentralised @ethereum scaling platform that enables developers to build scalable user-friendly dApps with low transaction fees.$AAVE $QUICK $BAL $UNI $CRV $BIFI $TETU $SUSHI $KLIMA $STG pic.twitter.com/arsBKoy1bi

— Ben GCrypto (@GCryptoBen) March 1, 2023

AAVE bears dominate until encounter support

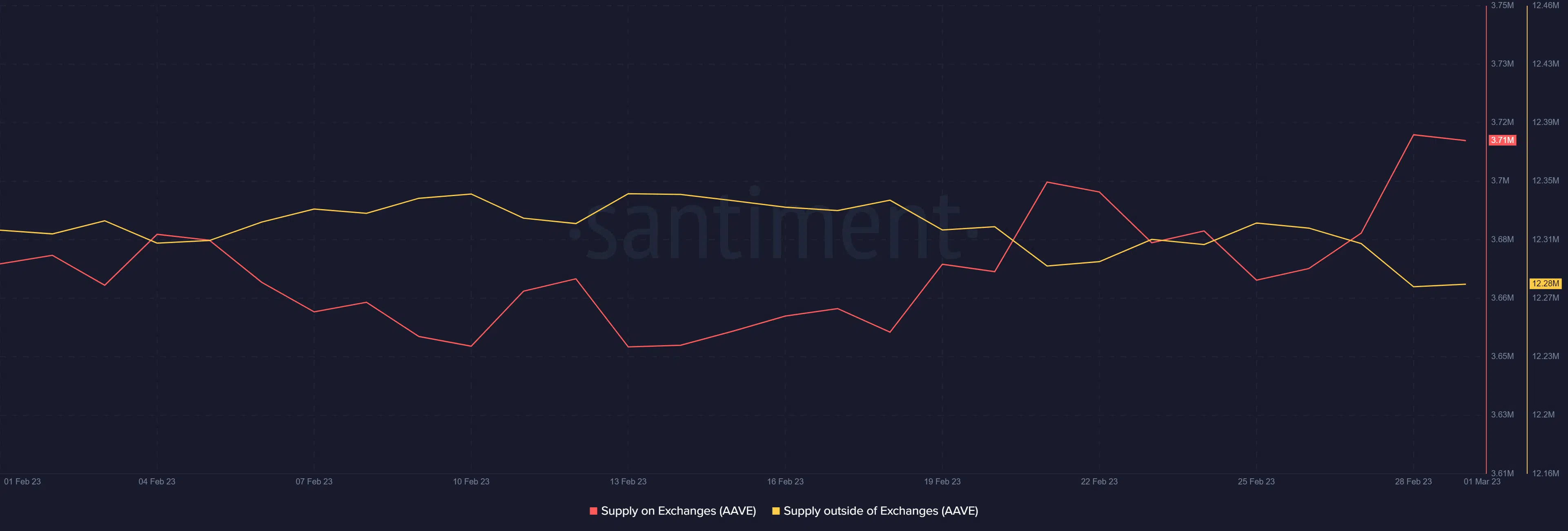

An analysis of AAVE’s supply dynamics reveals that AAVE’s supply on exchanges increased since the start of the week.

At the same time the supply outside of exchanges tanked by a sizable margin during the same period. These observations point toward an increase in sell pressure.

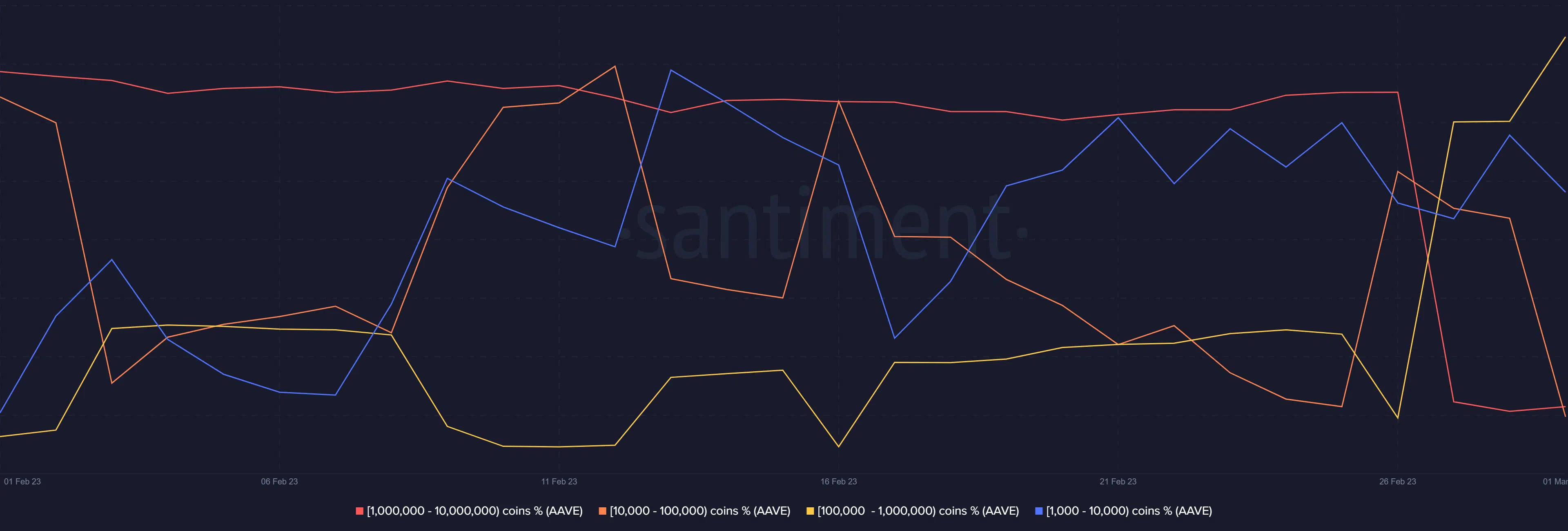

The exchange flows data reflects observations in AAVE’s supply distribution. The metric reveals a sharp drop in the balances of addresses holding the most tokens.

This includes addresses within the 10,000 to 10 million AAVE bracket. Addresses within this category controlled over 60% of AAVE’s current circulating supply.

These outflows from the top addresses confirm that whales have been selling. As a consequence, AAVE has been bearish for several days now. However, it did experience a 6.82% mid-week bounce to its $82.76 press time price.

There are multiple reasons for this bounce according to market observations. The price was already down by 19% which is a sizable retracement before the bulls start fighting back.

The second reason is that the downside pushed AAVE back into a support range that has prevailed since the second week of January. The 200-day Moving average underpins the same support range.

How many are 1,10,100 AAVEs worth today?

But the main reason for the mid-week bounce goes back to whale activity. The same supply distribution metric reveals that addresses holding over 1 million stopped selling at the end of February. As a result, the selling pressure quickly died down, paving the way for demand.

Addresses holding between 100,000 and 1 million AAVE contributed the most to buying pressure. This category of whales represented 24% of AAVE’s circulating supply.

Notably, the same category has been heavily accumulating for the last five days. This alignment of factors including the support retest made for a strong bounce.