Aave’s V3 deployment on Ethereum shows strong growth, thanks to…

- Aave V3 deployment on Ethereum has seen increased deposits and loans since it launched.

- AAVE’s price declines as investors show no interest in the alt.

Aave [AAVE] deployed its V3 iteration on the Ethereum network on 27 January, attracting $257.08 million in deposits and $139.14 million in loans, data from the decentralized lending and borrowing protocol showed.

The Ethereum version of AAVE V3 has something to offer

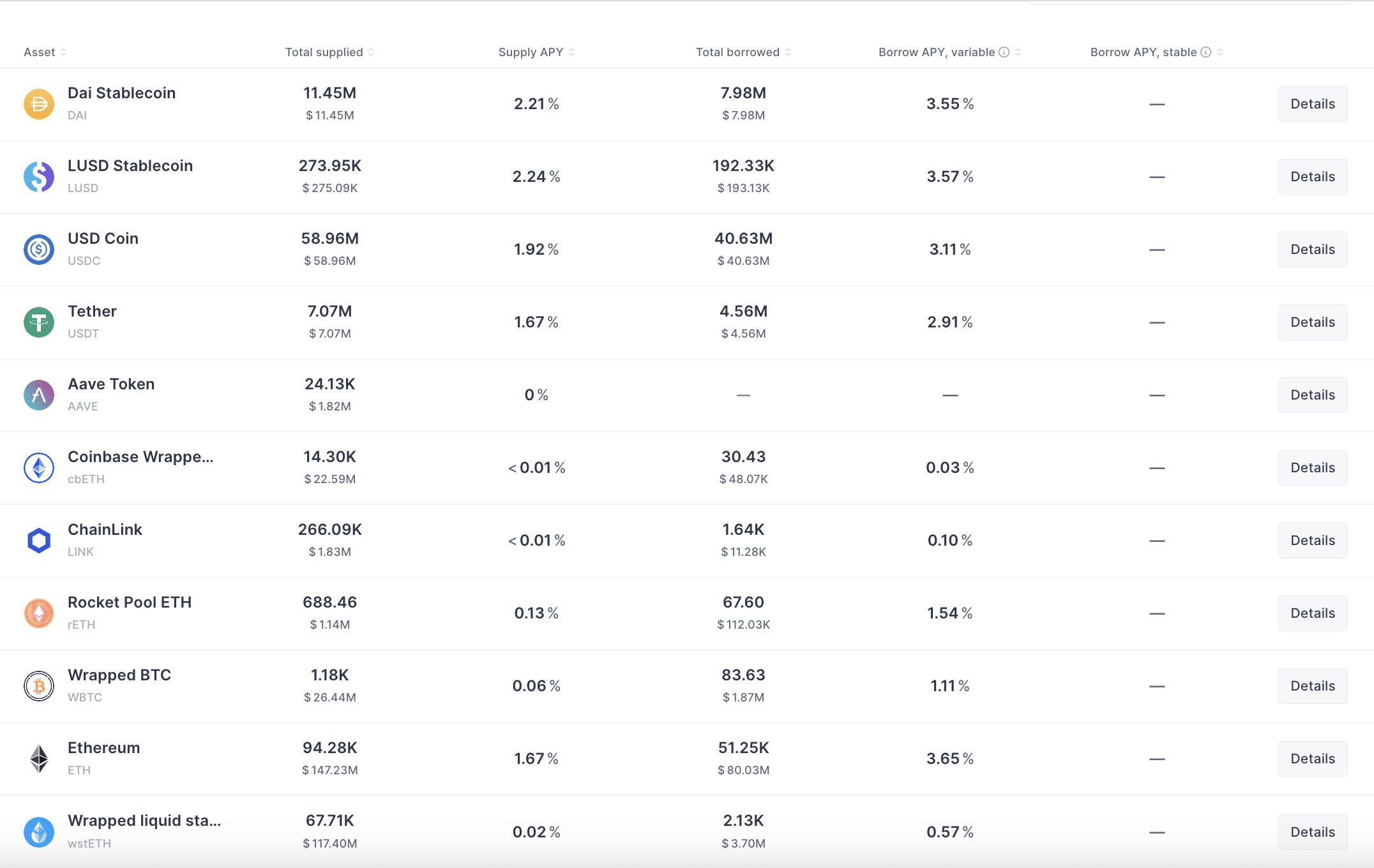

Upon launch on Ethereum, the V3 deployment consisted of only seven cryptocurrencies: DAI, USDC, AAVE, LINK, ETH, WBTC, and wsETH.

38 days later, the assets count has risen to 11 due to the addition of more assets, such as LUSD, cbETH, and rETH.

How much are 1,10,100 AAVEs worth today?

Of these assets, ETH’s supply remains the highest on Aave V3. As of this writing, 94,280 ETH coins worth over $147 million have been supplied to the protocol.

Out of the total ETH supplied by liquidity providers, 51,250 ETH has already been borrowed, making it the most popular asset borrowed on the protocol.

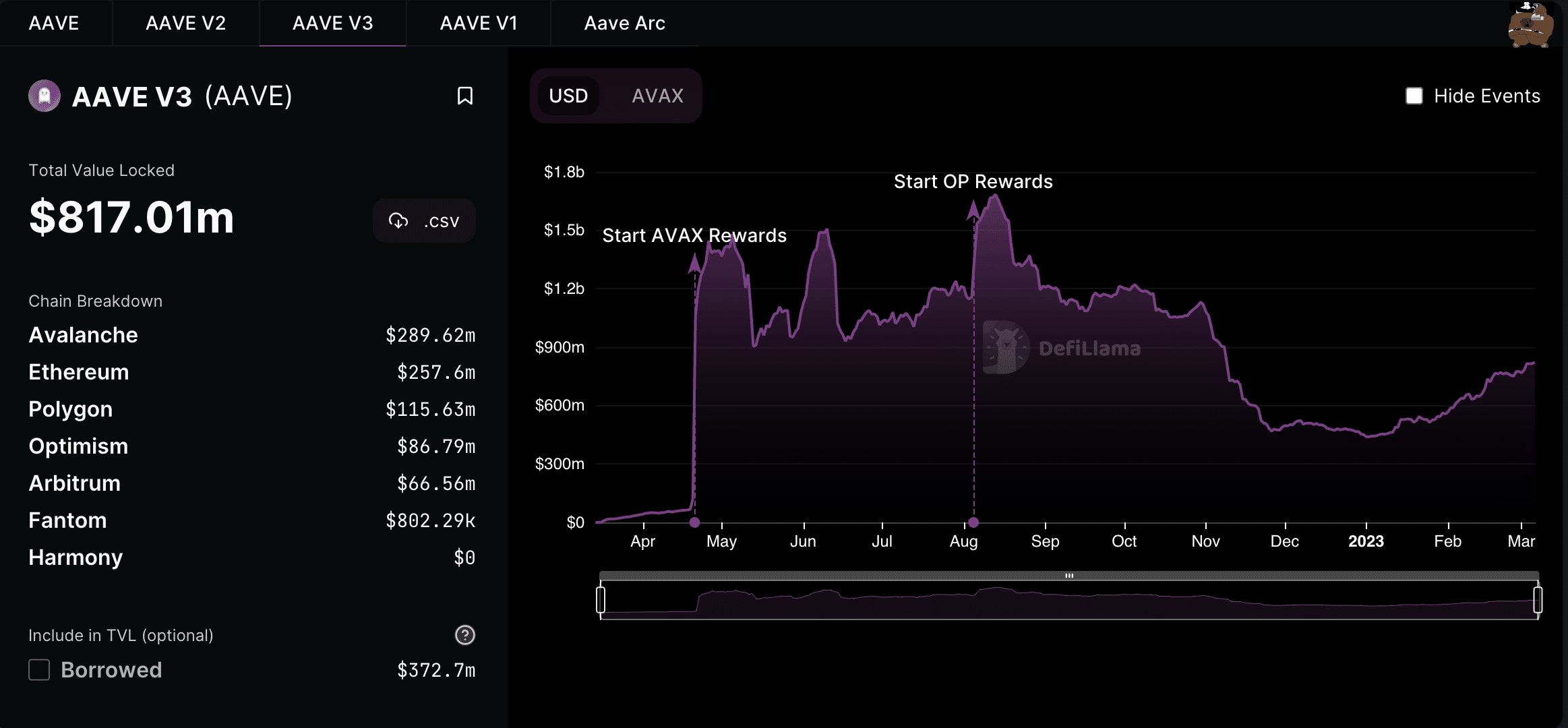

As of this writing, AAVE V3 on Ethereum had a total value locked (TVL) of $257 million, making Ethereum the second chain with the highest TVL for AAVE V3.

Despite Ethereum being the latest chain with the AAVE V3 iteration, its TVL has exceeded that of Polygon, Optimism, Arbitrum, Fantom, and Harmony, data from DefiLlama showed.

The V3 deployment on Ethereum has helped Aave grow its protocol TVL in the last month, further data from DefiLlama revealed. At $4.76 billion at press time, Aave’s TVL has risen by 3% since 27 January.

Read Aave’s [AAVE] Price Prediction 2023-2024

No gain, more pain

Impacted by the sideways movement of the general market in the last month, AAVE’s price has fallen by 15% in the last 30 days.

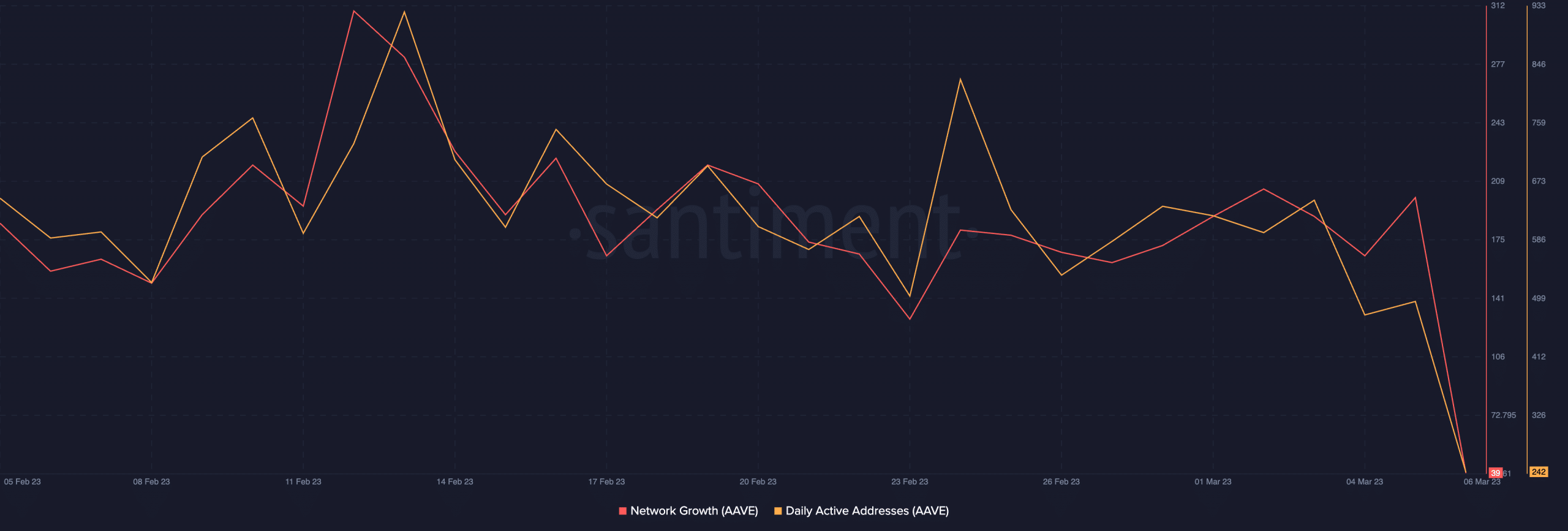

The on-chain assessment revealed a decline in network activity during that period. According to data from Santiment, the count of daily active and new addresses engaged in AAVE transactions has been on a downtrend in the last month.

As the alt’s price fell, investors’ confidence quickly turned negative. At press time, AAVE’s weighted sentiment was -0.237.

With very few anticipating any price growth in the interim, AAVE’s supply on exchanges has climbed as many investors have taken to distributing their AAVE holdings.

Conversely, within the same period, AAVE’s supply outside exchanges has fallen, indicating that more investors have been selling than they have been holding.