After 375% hike, here’s where LUNA stands against its fellow alts

It’s true that the cryptocurrency market is an unpredictable space. When altcoins such as LUNA, barely 2 years old, perform better than 4 to 7-year-old coins, it simply underlines the aforementioned aspect about the markets. In fact, many of these altcoins have risen exponentially, rather than gradually.

LUNA beats ETC and BCH

LUNA is one such crypto. In the last one month alone, LUNA rose by 375%, up from $5.8 to trade at $27.8 at press time. Since its launch, the altcoin has gained by a solid 2,167%

LUNA rallies by 375% | Source: TradingView – AMBCrypto

Interestingly, in comparison, Ethereum Classic and Bitcoin Cash have not been keeping up with the alt’s market. Their rallies are yet to cover the losses noted over the last 2 months. While BCH gained by only 71%, ETC was up by 73%.

Metrics tell the same story

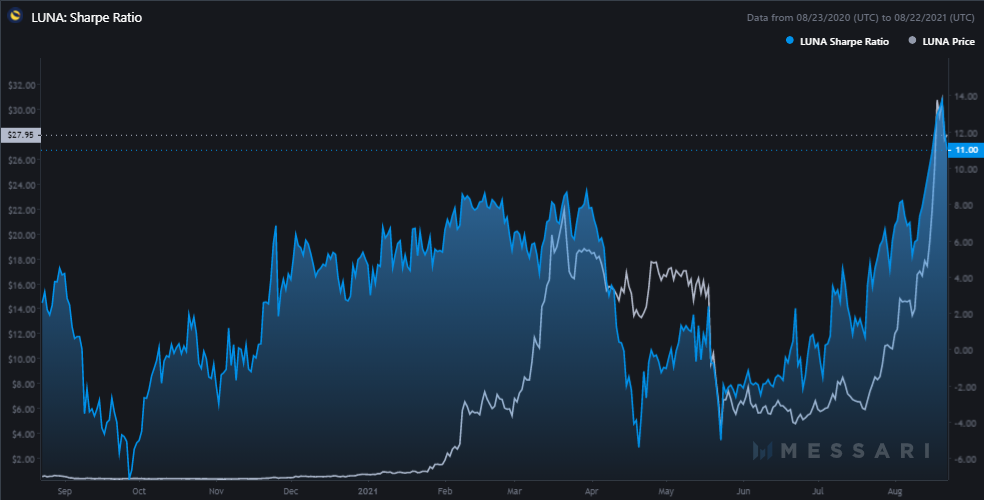

The Sharpe Ratio underlines the degree of strong returns for an asset based on market movement. Right now, LUNA is soaring, with the indicator touching 10.0 today.

ETC and BCH have been lagging behind, at 6 and 8, respectively, however.

Secondly, LUNA’s circulating market cap is also higher than BCH and barely $1 billion behind ETC.

LUNA’s Sharpe Ratio | Source: Messari – AMBCrypto

Furthermore, real volumes of this newer altcoin were $194 million higher than Bitcoin Cash’s $50 million and Ethereum Classic’s $60 million.

Another aspect where LUNA trumps these bigger altcoins is that LUNA is a trader’s coin. When traders operate the market for a crypto, prices have room to rise at a quicker pace.

The opposite of that is reflected on BCH as it is primarily a HODLer’s coin. In fact, the average duration that it is held for was sitting at 3.3 years, at the time of writing.

Bitcoin Cash’s average holding time | Source: Intotheblock – AMBCrypto

Finally, as far as the network is concerned, news of Terra beating Polygon to become the third-highest TVL blockchain (locked value worth $6.2 billion) also possibly impacted LUNA’s rally.

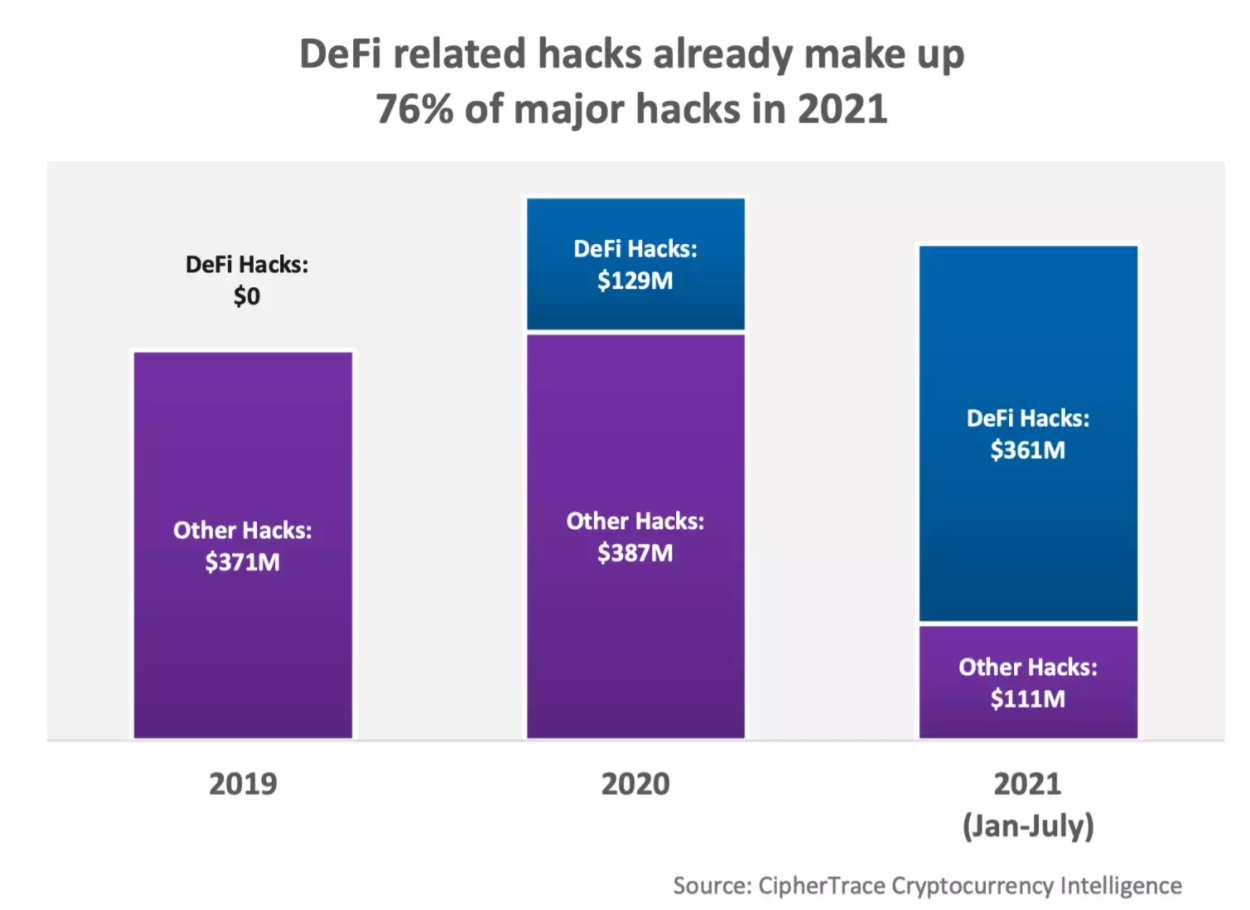

Even so, investors must remain vigilant before investing since the fear of DeFi hacks still looms over Terra. This year alone more than $361 million has been stolen out of DeFi projects.