AI Coins in focus – Assessing NEAR, FET, and RNDR’s 2024 performances

- Despite outperforming many altcoins, NEAR’s price risked falling below $5

- On-chain data showed that FET and RNDR could be in line for a rebound

In contrast to what happened in the first quarter of 2024, the total market cap of AI coins has been falling lately. In fact, at press time, the value was “just” $28.86 billion.

While prices and market cap might have plunged, one cannot deny that these tokens have been a revelation this cycle. For example, cryptocurrencies like Render [RNDR], Bittensor [TAO], and Fetch.ai [FET] have outperformed many of the altcoins in the market.

And, the reason is glaring. Artificial Intelligence, popularly called its short-form AI, has had several developmental strides within the past year. Some of these range from growing demand for GPUs, ChatGPT Adoption, and the skyrocketing market cap of Nvidia.

Now, let’s look at how far some of these AI coins have fared in 2024, and what could be in store for the remainder of the year. For this article, AMBCrypto would focus on the three top AI coins – NEAR Protocol [NEAR], FET, and RNDR.

NEAR faces another round of decline

NEAR is a layer-one project operating in the intersection of blockchain and AI. By doing this, the protocol offers scaling solutions to applications while improving throughout on the network.

At press time, NEAR’s price was $5.06. Earlier in the year, the value of the token had climbed from $2.64 to $8.90 between January and March. However, a 30.02% decline within the last 30 days means that most of these gains have gone to dust.

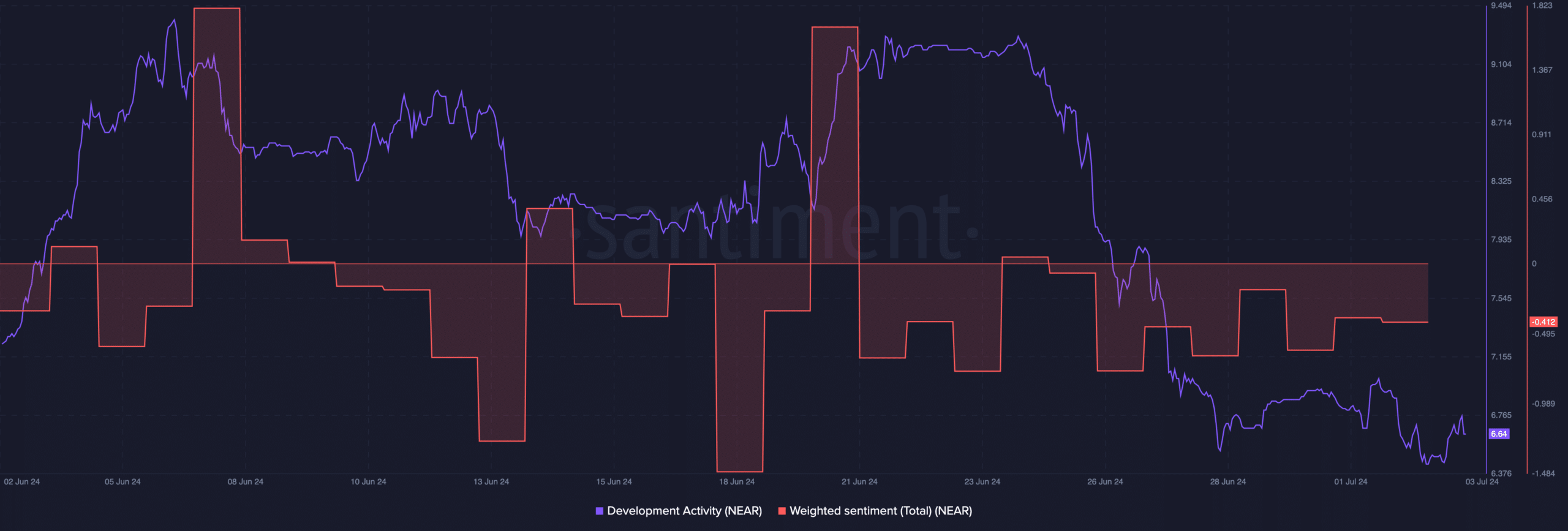

One particular factor that has helped NEAR’s price is the development activity. According to AMBCrypto’s analysis, the price of the token rises whenever development on the network is at a good level.

In non-technical terms, development activity refers to the work done in keeping a blockchain functioning at the highest level. When it rises, it means that developers are shipping out new features.

However, as one of the top AI coins, a decline in the metric causes bearish cues for the price. At press time, the metric had dropped and was not anywhere near the peaks it reached previously.

Should this continue, NEAR’s price could fall below $5 in the short term. Furthermore, the Weighted Sentiment around the token was negative, indicating that there were more negative comments about it than positive ones.

If this remains the case, demand for NEAR could be difficult to come by. As such, the price might fall. However, this prediction will be invalidated if a major development occurs in the AI sector or buying pressure increases.

Activity on Fetch.ai’s network soars

FET, now known as a part of the Artificial Superintelligence [ASI] Alliance, was one of the AI coins that hit a new all-time high in 2024. Specifically, FET touched $3.47 on 28 March this year.

Despite the integration with other AI tokens, the hype around FET has fizzled, and this has affected the token’s value. At press time, FET was changing hands at $1.24, representing a 29.76% fall in the last seven days.

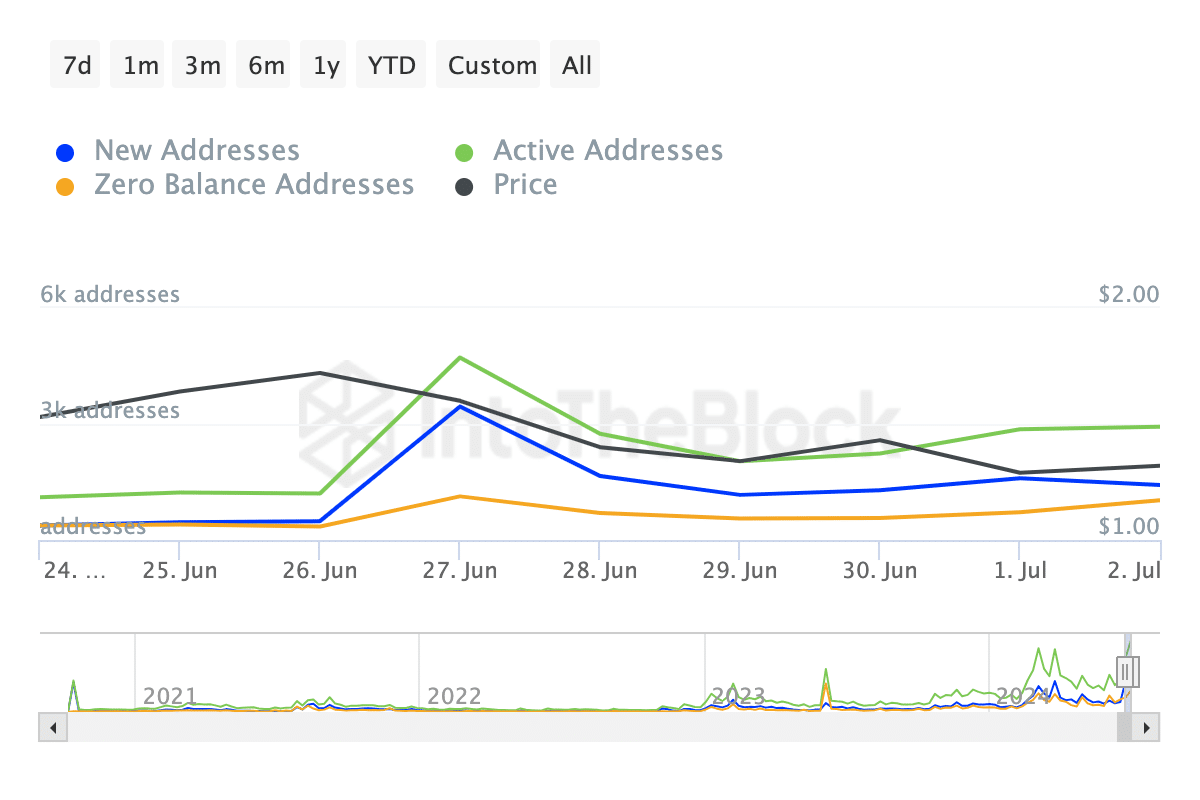

Alas, going forward, the price of the cryptocurrency might hike again. AMBCrypto found evidence of this potential after a look at Fetch.ai’s network activity. According to IntoTheBlock, FET’s new, active, and zero-balance addresses have been increasing over the last few days.

Growth like this implies that the network has been getting good traction and adoption is at a healthy level. Should the addresses continue to rise, FET’s price might also follow as it is a sign of demand for the token.

If sustained, FET could evade dropping below $1. Instead, the cryptocurrency could begin a move that sends it closer to $2 in the coming weeks.

Is it time to buy Render [RNDR]?

RNDR was one of the breakout stars of this cycle. As a GPU rendering network built on the Ethereum blockchain, positive developments around the thriving GPU market helped RNDR’s price rise.

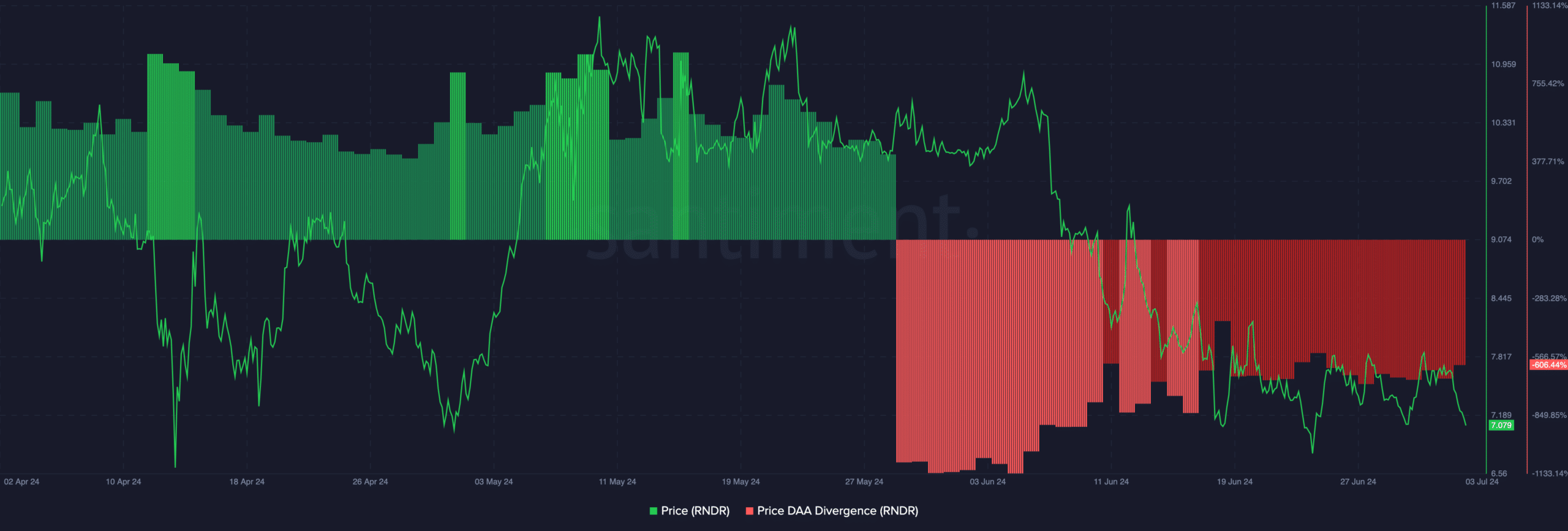

Like FET, RNDR tapped a new all-time high in March. However, the price has since fallen from $13.60 to $7.08 — almost half the value. Meanwhile, AMBCrypto checked if the decline offers a buying opportunity.

To do this, we looked at the price-DAA divergence. DAA stands for Daily Active Addresses, and it measures user activity on a blockchain. As a whole, the price-DAA divergence compares if the value of a token is growing faster than activity on the network or not.

If the reading is positive, it means that price is growing faster than activity. When this happens, and the reading is extremely high, it is a sell signal.

In this case, at press time, the price-DAA was -606.44%. This implied that participation rate on Render’s network was higher than the level of price growth. Simply put, the negative reading implied that RNDR might have provided a buy signal not seen in a long time.

Realistic or not, here’s NEAR’s market cap in RNDR terms

If sustained, this could bring about a higher value and RNDR’s price could jump past $9. Meanwhile, other AI coins that have been in the spotlight include Injective [INJ] and The Graph [GRT].