Algorand: Range-bound extension depends on this

Disclaimer: The information presented does not constitute financial, investment, trading, or other types of advice and is solely the writer’s opinion.

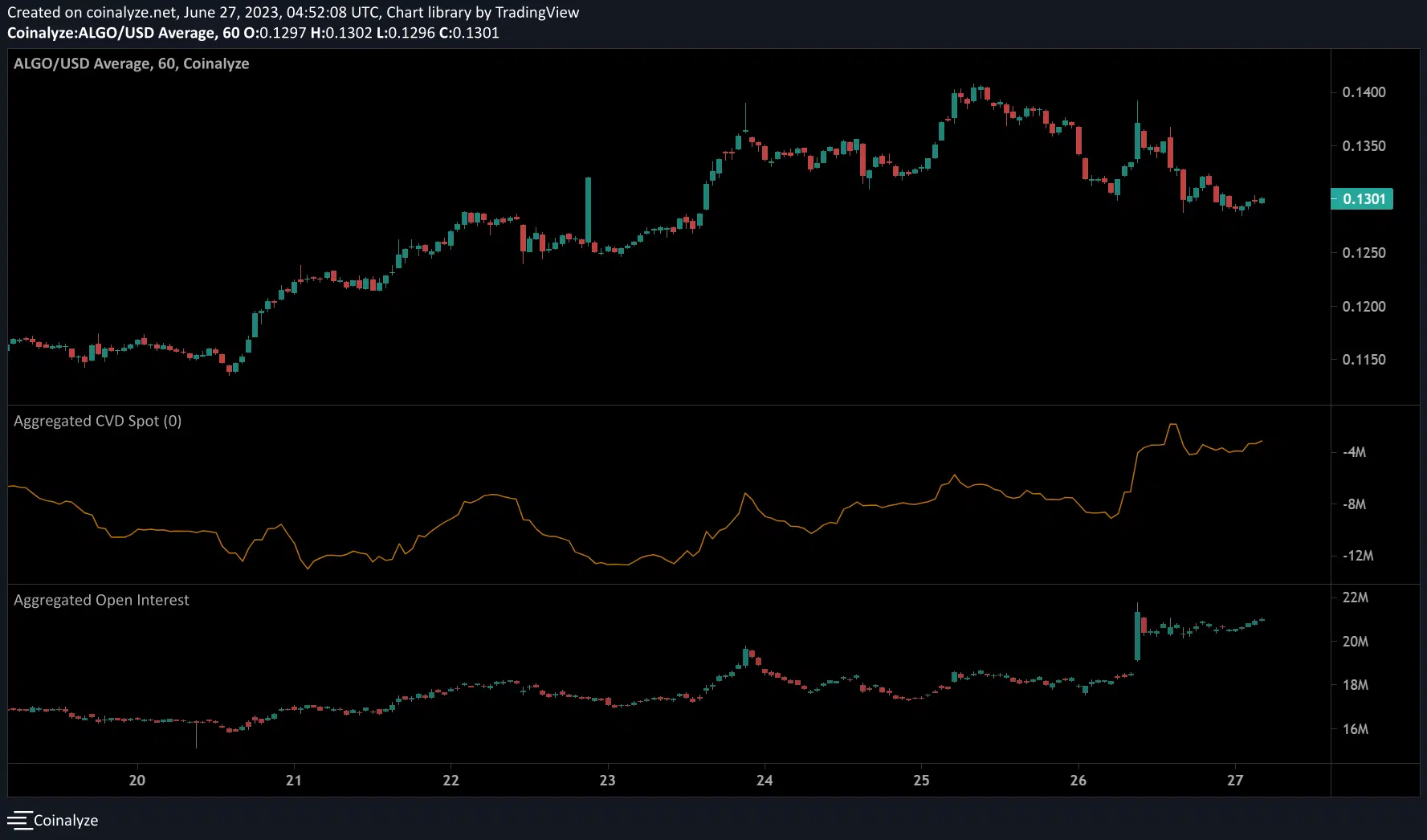

- ALGO’s recent uptrend morphed into a short-term, narrow consolidation.

- Buying volumes and Open Interest rates increased – a boost to bulls.

Algorand [ALGO] is riding on the prevailing bullish sentiment to recover recent losses. The token dropped from $0.15 to about $0.90 after being categorized as “security” during the SEC lawsuit against Binance [BNB] in early June. But it rebounded and traded at $0.13 at press time, up about 25% after edging above $0.10 on 10 June.

Is your portfolio green? Check out ALGO Profit Calculator

The Algorand ecosystem bagged a new partnership from DFW Labs, a global Web 3 investment firm, with an initial purchase of $50 million ALGO tokens for liquidity injection. But the lower timeframe price charts haven’t reacted to it as of press time.

ALGO enters range formation

After climbing above $0.10 on 10 June, ALGO has been making new higher highs and lower lows – defining an uptrend. But the rally faltered at $0.14, setting it up for a range formation within 61.8% ($0.13) – 78.6% ($0.14) Fib levels.

ALGO has been constricted in this range for the past four days, taking a cue from Bitcoin’s [BTC] fluctuations below $31k. If BTC’s consolidation persists, ALGO traders can target range extremes ($.13 & $0.14) for profits in the next few hours.

A breach below the range will invalidate the neutral bias. The drop could ease to the 50% Fib level of $0.13 but will further weaken the H4 structure, flipping it to bearish.

The RSI (Relative Strength Index) and CMF (Chaikin Money Flow) were below key neutral levels, denoting a slight dip in buying pressure and capital inflows.

However, the picture differed on higher timeframes, especially the weekly chart. Notably, Galaxy Trading, a crypto technical analyst on Twitter, believes that ALGO’s weekly chart is gold as it presents a massive accumulation opportunity.

Galaxy’s projection was based on the weekly chart retesting a critical demand zone in early 2022, with targets at $0.51 and $0.73, respectively.

How much is 1,10,100 ALGOs worth today?

Demand increased in the futures market

On the 1-hour chart, the CVD (Cumulative Volume Delta) and Open Interest (OI) increased in the past few days. It means buying volumes and contracts in the futures market increased – a bullish sentiment that could spell a potential upside, especially if BTC continues to rally.

But the metrics flattened in the past few hours. This reinforced the potential short-term range extension before a pump or a dump.