Bitcoin

Altcoins crash harder than Bitcoin – When will the rebound start?

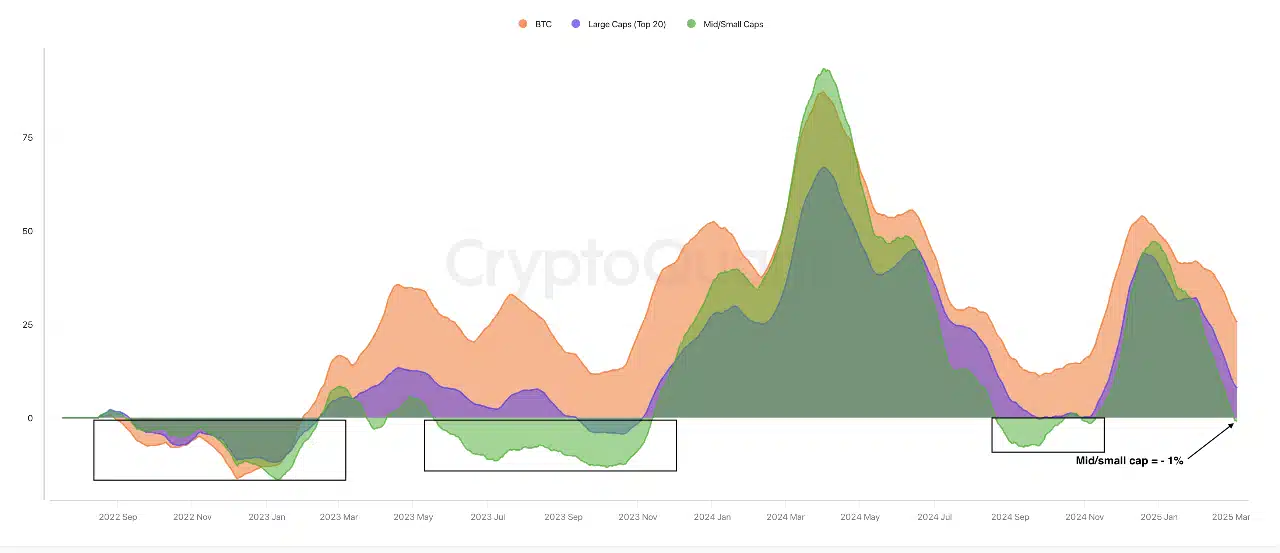

Struggles of mid and small-cap altcoins

Mid and small-cap altcoins are bearing the brunt of Bitcoin’s correction, with their market cap growth rate now turning negative at -1%.

This underperformance is largely driven by capital rotating into Bitcoin and large-cap assets — a common trend during risk-off environments.

The gap between the 365-day and 30-day moving averages further highlights this divergence, with small caps struggling to sustain any momentum.

Historically, such conditions have led to extended stagnation in this segment, delaying recovery relative to Bitcoin.

This poses challenges for short-term traders, but presents opportunities for long-term investors willing to accumulate undervalued assets ahead of the next expansion phase.