Analyst claims this is the way you can retire early thanks to Bitcoin, cryptos

It’s no surprise that anyone would want to escape the rat race or maybe retire early. No, no advertisements here promoting insurance companies with their schemes and returns as in the traditional finance world. But, how about retiring early using cryptocurrencies? While the cumulative crypto-market capitalization, at press time, stood at $1.29T, given the current headwinds in the market, is it even feasible?

Well, one crypto-analyst certainly thinks so, with popular YouTuber Lark Davis recently laying out a practical guide for the same.

Before jumping right into it, it’s worth discussing the elephant in the room – How much money is required, irrespective of the age to get financial freedom? Here’s what this New Zealand-based crypto bull had to say about this,

“Classic calculation is 25 X your annual expenses based on withdrawing 4% annually. IE your expenses are $50,000 a year then you’ll need 1.25 million. Just 1.25 million.”

It’s worth highlighting that Davis was also quick to clarify by stating that “the total amount saved could be a lot less since rates of return are so high in crypto.”

“IE 250k in Anchor would give your 50k a year passive. Still though the more the better.”

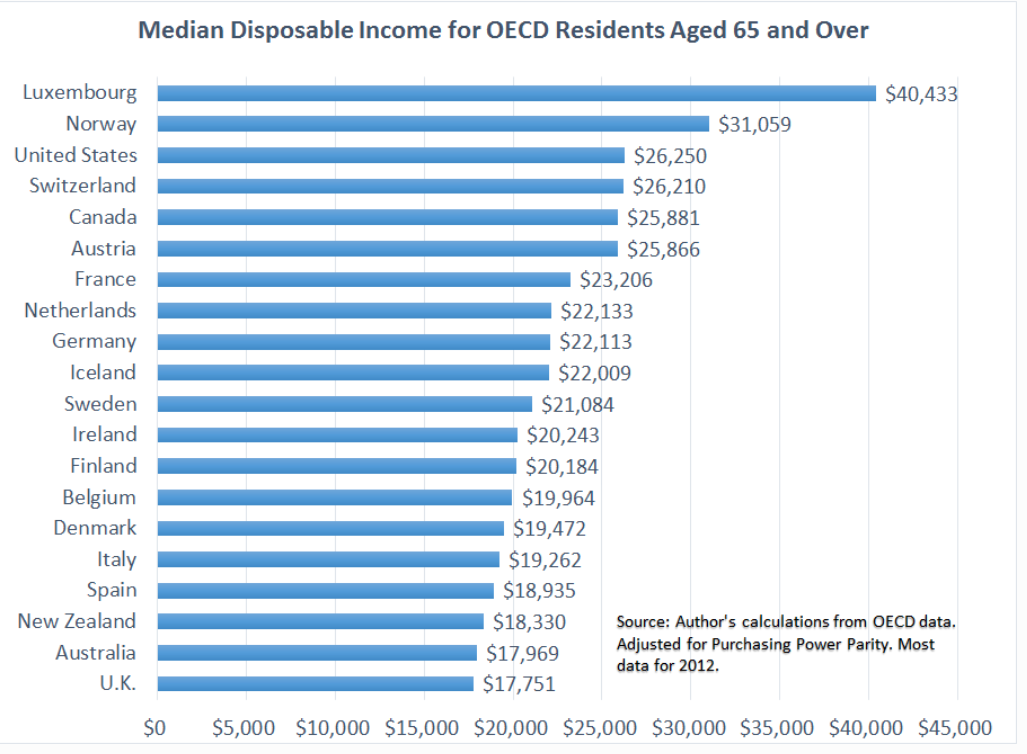

For a deeper perspective on expenses and savings, here’s how the median disposable income for residents aged 65 and over across the world look like,

Source: OECD data

Countries such as the USA, with a median retiree income of $26,250, are ranked third in the world, on par with Switzerland, Canada, and Austria. The point is, these figures will vary based on which country one is based in.

Now comes the hard bit, how to get the money?

Getting enough for retirement, whether early or not, is not an overnight endeavor. It requires a lot of patience and time, with “the most common way” being by “cutting the fat,” according to Davis.

In addition to this, consider the spending optimization attribute as well. He reiterated,

“Review your budget and ask yourself the hard questions. The more you can invest and sooner, the more likely it will be that you can retire early.”

Post the saving stage comes the investing part. As covered previously, Davis has always highlighted the importance of dollar-cost average into safer cryptocurrencies like Bitcoin, Ethereum, Chainlink, Aave. This time is no different.

Ergo, he hinted at the time in the market versus timing the market approach. What’s more, the analyst repeated that “the younger you are the more risk you can take,” with Davis cautioning his followers of the potential risks by adding,

“You can flush a year of home-brewed coffee savings down the drain in minutes on leverage trading, meme coins, and degen DeFi.”

Having said that, Davis has in the past stated that altcoins have the best shot at massive returns on investments. He tweeted,

3.3 Quick tips.

1 – Keep position sizing low on high risk plays. 1 to 5% of your crypto portfolio is enough.

2 – Take profits when high risk plays pump. Get your capital out. Move high risk money into low risk plays like BTC.

3 – Keep a moon bag, just in case 😉— Lark Davis (@TheCryptoLark) July 13, 2021

Consider this – At the time of writing, BTC was noting YTD returns of 18.23%. On the other hand, the likes of ETH, LINK, DOT, and ADA were registering figures of 155%, 44%, 27%, and 562%.

Ethereum, Chainlink, Polkadot, and Cardano, at press time, had all appreciated significantly when compared to the world’s largest cryptocurrency, despite recent market corrections being accounted for. Ergo, altcoins might not be a bad idea if one is looking to save up money for retirement.

It’s also worth noting that like in the past, Davis again shared his optimism with respect to earning passive income and staking.

The analyst concluded the aforementioned video by stating,

“…retiring on crypto in your 20’s or 30’s or 40’s or whenever is indeed possible. And you can do it, just be aware that risks remain and you need to keep a calm rational investor-focused mindset to make it happen.”

Now, that might be difficult these days, especially since it has faced a lot of scrutiny from different regulators as well as individuals lately. Here, it should be pointed out that despite such skepticism, the market has come a long way. The fact that analysts are discussing crypto as a retirement option is a big deal, especially since mainstream reports a few years ago were saying that early retirees won’t EVER touch Bitcoin and other cryptos.